There are more and more reasons for advisors to help clients understand the benefits of international equities, including attractive multiples.

The WisdomTree Developed International Multi-Factor Model Portfolio offers advisors an effective way to position client portfolios for more upside in international developed markets.

“This model portfolio is designed for investors with a long-term horizon looking for exposure to a broad universe of Developed International equities primarily using factor focused ETFs,” according to WisdomTree. “The selected ETFs provide certain factor tilts that have the potential to generate excess return relative to comparable cap-weighted benchmarks over longer-term holding periods. The strategies may use both WisdomTree and non-WisdomTree ETFs.”

This model portfolio is a right place/right time concept.

“Stocks outside the United States have shown some signs of strength lately. In the fourth quarter of 2020, for example, the Morningstar Global Markets ex-US Index gained 17.4% compared with a 14.2% return for the Morningstar US Market Index,” noted Morningstar analyst Amy Arnott. “That quarter was a rare glimmer of hope amid an unusually long performance slump. Over the past 10 years, annualized returns from international stocks have lagged those of their domestic counterparts by more than 7 percentage points per year, on average. The bright side of this long and painful performance slump: While few markets qualify as cheap, non-U.S. markets offer more attractive valuations in relative terms.”

The Big Benefits of Traveling Abroad

Getting international exposure is a great way to pull in uncorrelated market movements. But at a time when a pandemic has the whole world in its grasp, it becomes quite the challenge.

The WisdomTree portfolio offers quality/value tilts with several of its components holdings.

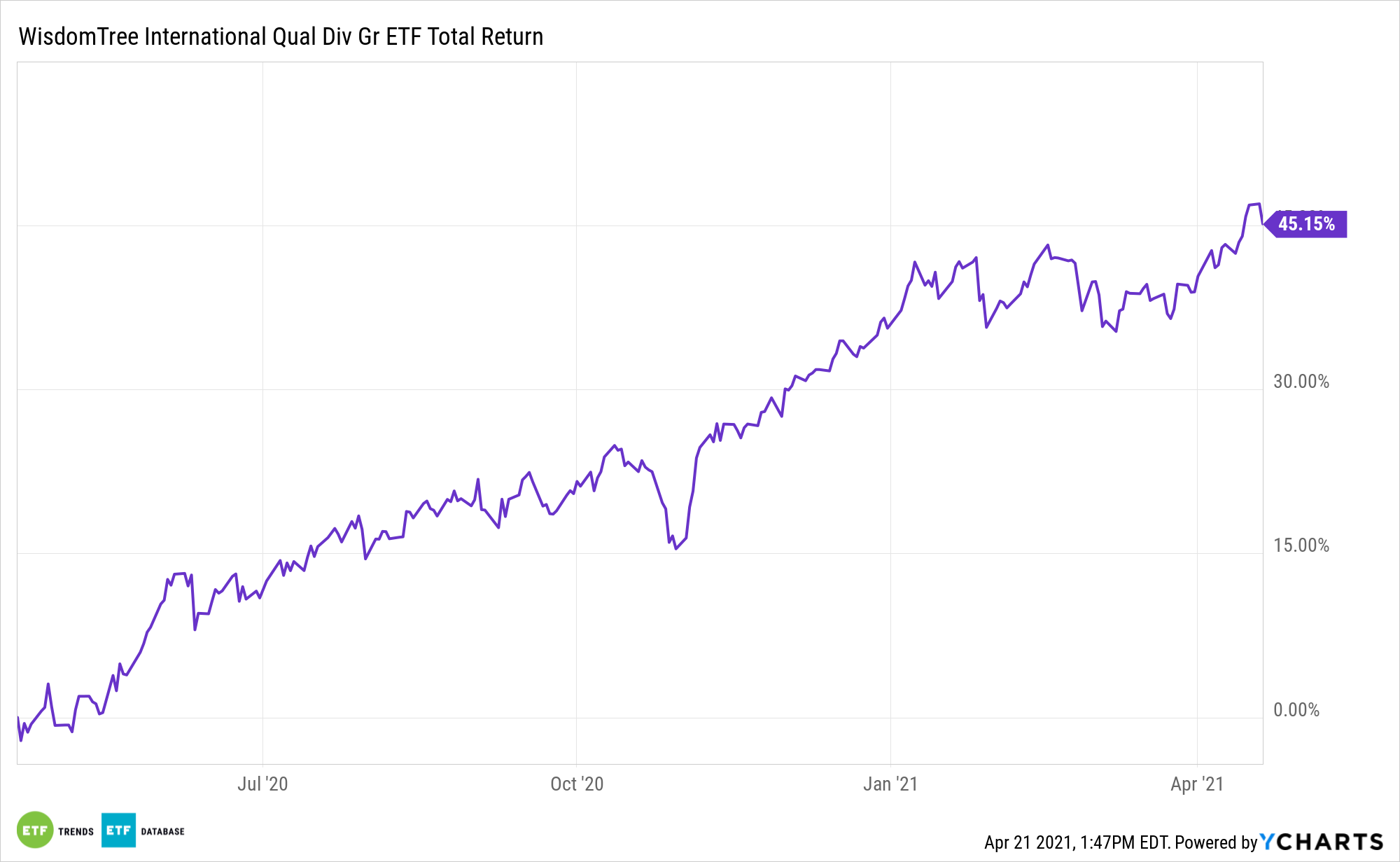

The WisdomTree International Quality Dividend Growth Fund (CBOE: IQDG) and the WisdomTree International Hedged Quality Dividend Growth Fund (NYSEArca: IHDG) represent two quality avenues for advisors seeking ex-U.S. developed markets exposure.

Ex-U.S. developed market dividend payers often feature larger yields than their U.S. counterparts, an assertion proven by comparing large- and mega-cap dividend stocks from familiar dividend sectors such as consumer staples, energy, financial services, and telecommunications.

“On the positive side, the long dry spell for international stocks makes for more attractive valuations. As shown in the chart below, traditional valuation metrics such as price/earnings, price/book, and price/sales are all significantly lower for non-U.S. stocks compared with the domestic market. Japan, some parts of Europe, and the United Kingdom look particularly cheap based on traditional valuation metrics,” continues Arnott.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.