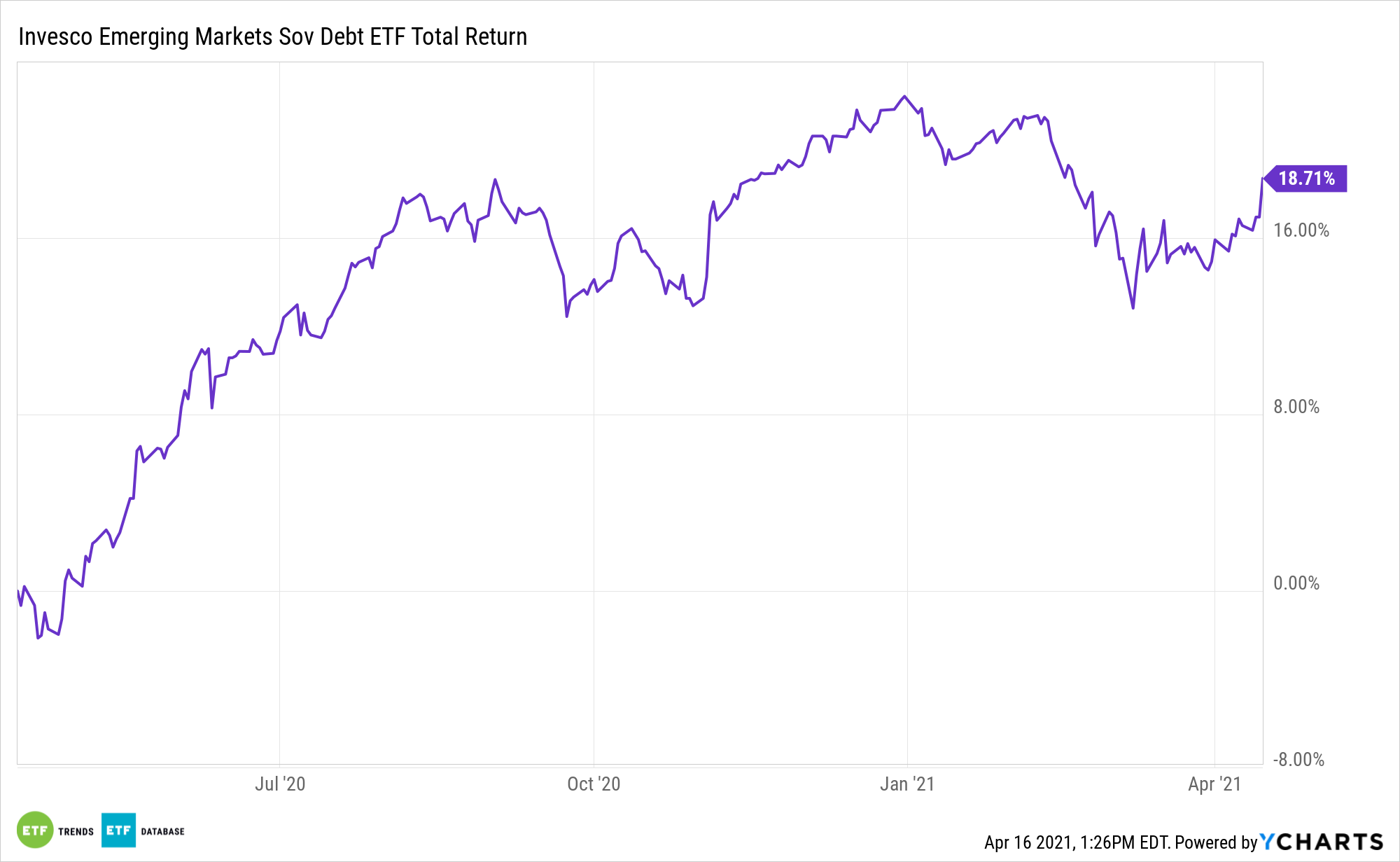

Historically, low domestic rates and accommodative central bank policy have highlighted international assets like the Invesco Emerging Markets Sovereign Debt ETF (PCY).

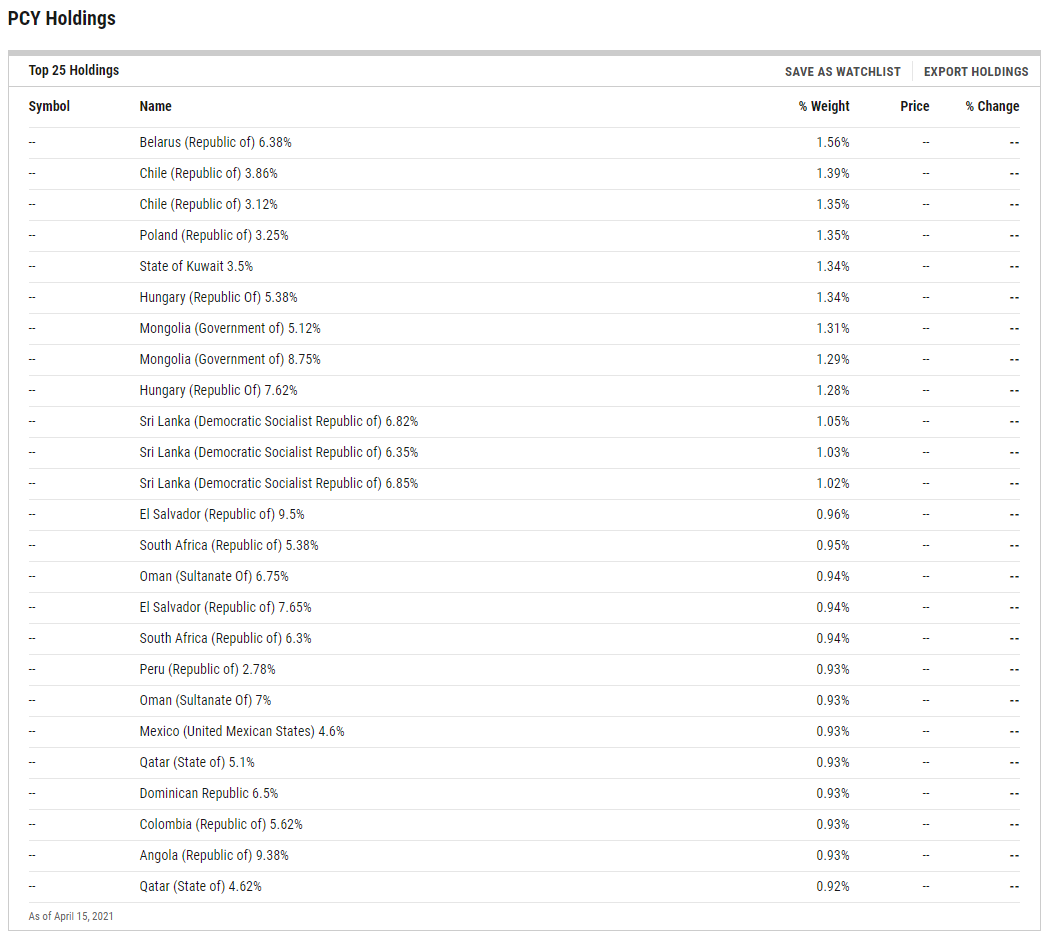

PCY is based on the DBIQ Emerging Market USD Liquid Balanced Index. The Fund will normally invest at least 80% of its total assets in securities that comprise the Index (the ‘Index’). The Index tracks the potential returns of a theoretical portfolio of liquid emerging markets US dollar-denominated government bonds issued by more than 20 emerging-market countries. The countries in the Index are selected annually pursuant to a proprietary index methodology, and the fund as well as the index are re-balanced and reconstituted quarterly.

“Several emerging market central banks have launched quantitative easing (QE) programs at the height of the coronavirus pandemic,” said Moody’s Investors Service. “We focus on 11 markets where central banks have embarked on the largest programs in their regions — Chile, Colombia, Croatia, Ghana, Hungary, India, Indonesia, the Philippines, Poland, South Africa and Turkey. Improved policy frameworks and institutional arrangements have underpinned these actions and the programs’ effects have been largely positive.”

PCY: A Powerful Pecuniary Plan

The combination of emerging markets and junk bonds may appear to be too risky for many income investors, but with the right methodology, investors can dial back some of that risk while grabbing access to higher levels of income.

Amid low interest rates in the United States and inklings of the reflation trade taking shape, PCY is a credible near-term consideration for income-starved investors.

“In most markets, QE launched at the height of the pandemic has helped offset the effect of capital outflows and brought down long term bond yields as governments’ financing needs have increased,” added Moody’s.

Ten-year Treasury yields have also been volatile. Emerging markets bonds, particularly those denominated in local currencies, are often levered inversely to Fed action because lower U.S. rates can depress the dollar, thereby bolstering emerging markets currencies and assets denominated in those currencies.

Certain areas overseas may also be earlier in their market cycles compared to the U.S., so issues like rate risk are not yet a concern. While many emerging markets bonds focus on China, PCY provides broad international exposure.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.