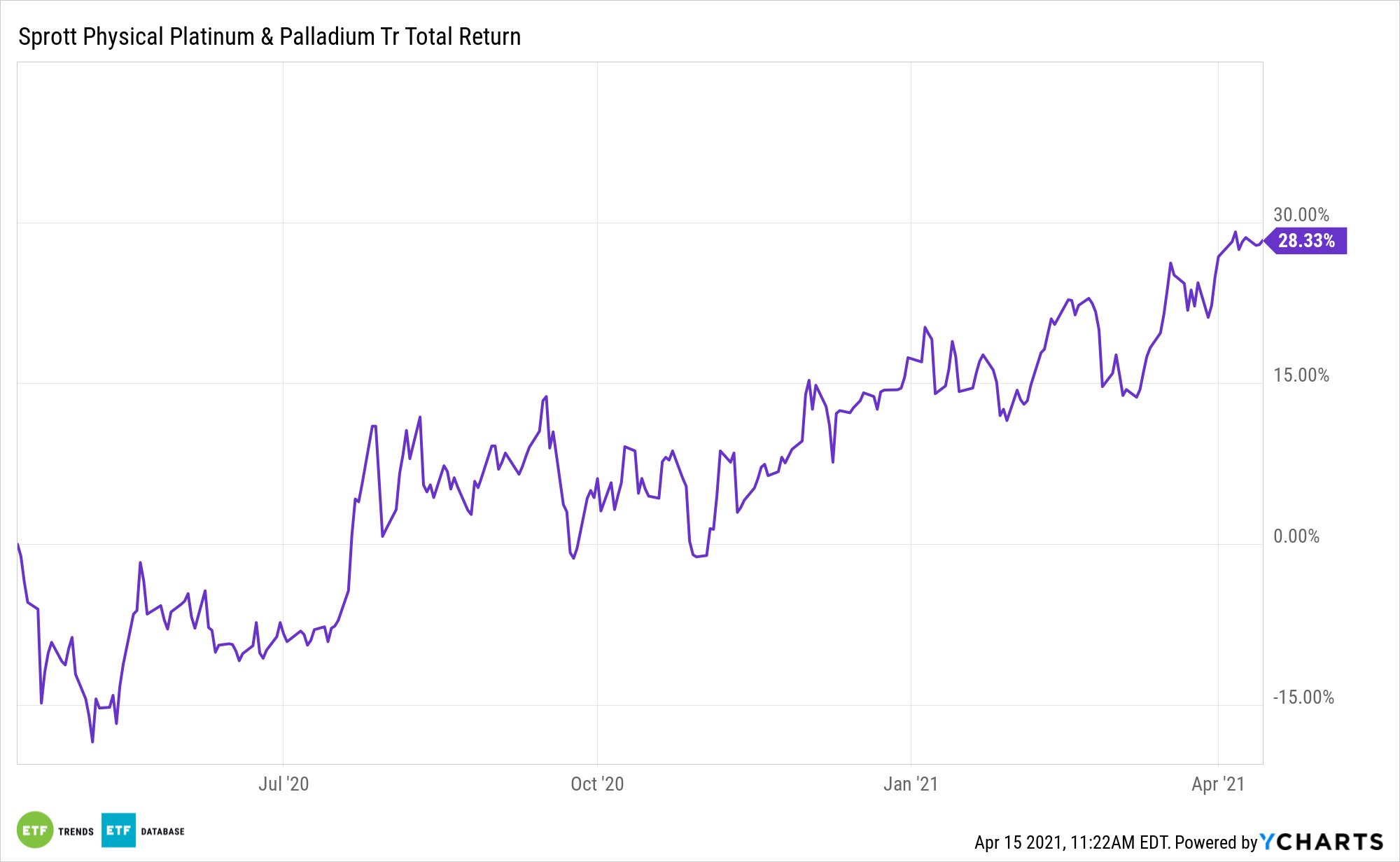

Palladium and platinum shouldn’t be overlooked in the precious metals conversation as both could be poised for substantial upside in the back half of 2021. Enter the Sprott Physical Platinum and Palladium Trust (NYSEArca: SPPP).

SPPP provides “a secure, convenient and exchange-traded investment alternative for investors who want to hold physical platinum and palladium. The Trust offers a number of compelling advantages over traditional exchange-traded platinum and palladium funds,” according to the issuer.

In the ongoing push toward sustainable energy sources to combat climate change, developments in hydrogen fuel cell technologies could support platinum and related exchange traded funds.

Mining executives and industry analysts argue that increased efforts around the world to cut down on carbon-dioxide emissions are strengthening demand for the metals from the car industry, the Wall Street Journal reports.

Demand for platinum, which is a key component in catalytic converters that scrub pollutants from diesel engine fumes, waned in recent years as carmakers transitioned to electric vehicles from internal combustion engines. These battery-powered electric cars don’t utilize platinum group metals.

Economists and market analysts argue that a Biden administration will contribute to tighter environmental regulations and a focus on green energy technology, which may mean tighter regulation on car emissions and increased demand for palladium and platinum in catalytic converters. That adds to the case for SPPP.

The return to lower interest rates around the world has also continued to support demand for physical assets, which tend to exhibit an inverse relationship to interest rates since investors are less apt to hold raw materials when bonds offer higher yields in a rising rate environment. Though it’s not an exchange traded fund, SPPP offers tax benefits too.

SPPP “offers a potential tax advantage for certain non-corporate U.S. investors. Gains realized on the sale of the Trust’s units can be taxed at a capital gains rate of 15%/20% versus the 28% collectibles rate applied to most precious metals ETFs, coins and bars,” notes Sprott.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.