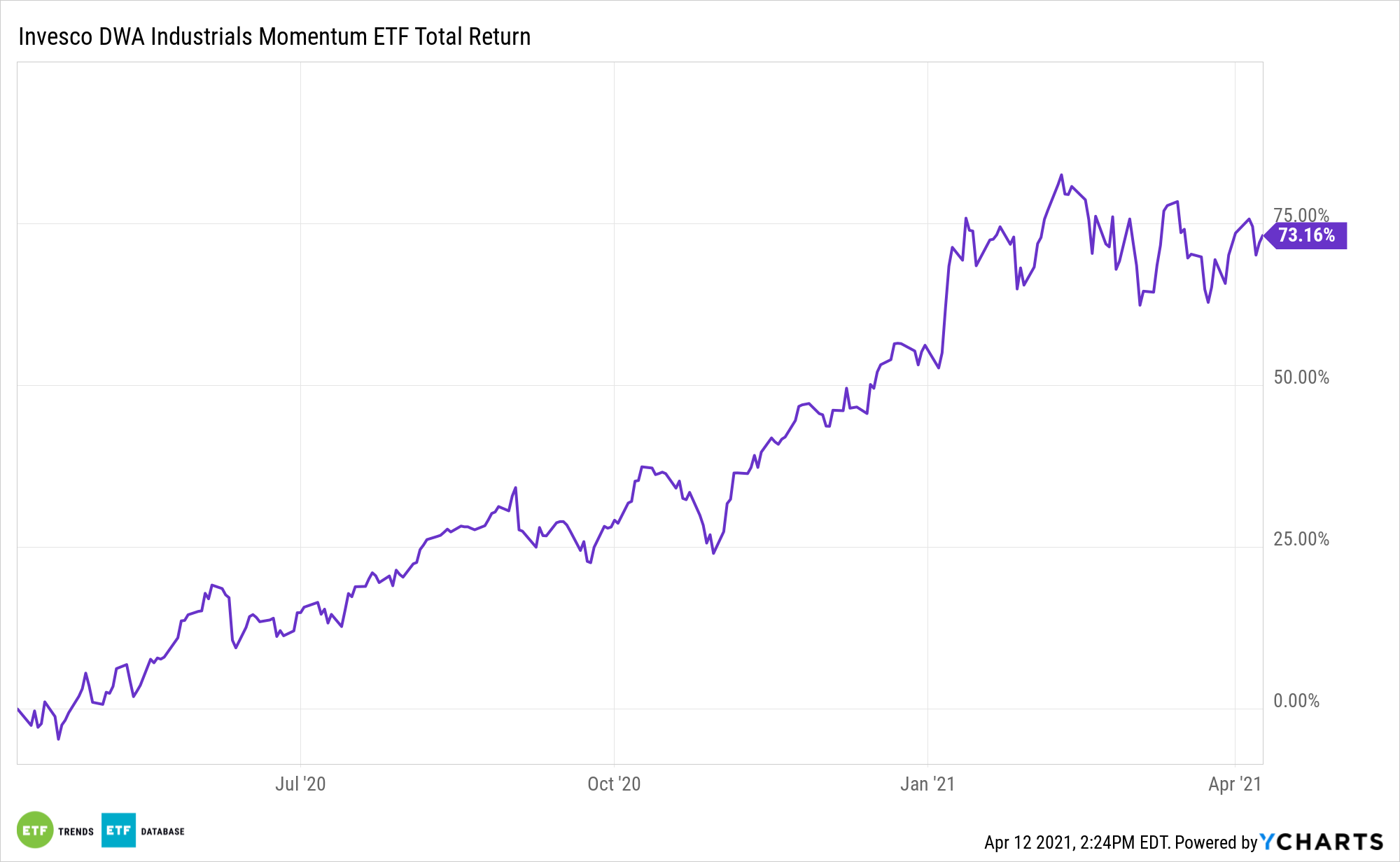

The cyclical/value resurgence is lifting the industrial sector. The Biden Administration’s infrastructure efforts could bring even more upside for exchange traded funds like the Invesco DWA Industrials Momentum ETF (PRN).

PRN tracks the Dorsey Wright Industrials Technical Leaders Index, which is designed to identify companies that are showing relative strength (momentum), and is composed of at least 30 securities from the NASDAQ US Benchmark Index. Relative strength is the measurement of a security’s performance in a given universe over time as compared to the performance of all other securities in that universe.

“President Joe Biden’s proposed $2 trillion infrastructure plan will result in another shot in the arm for companies across the industrials sector if Democrats are able to garner enough support for once-in-a-generation spending on roads, bridges and broadband access,” reports Thomas Franck for CNBC. “Industrials stocks, which have handily outperformed the broader S&P 500 over the last three months, could be set for even more gains, according to top industry analyst Nick Heymann.”

Infrastructure Interest Building with ‘PRN’

The industrial sector includes companies that create machinery, equipment, and supplies that take part in construction and manufacturing, as well as those that offer related services. Interestingly, these companies are closely connected with the economy, and their business volume often declines steeply in a recession.

As the global economy shakes off the effects of the coronavirus pandemic, PRN and industrial equities could be among the leaders.

“Aerospace and defense, capital goods, industrial technology and building products subsectors could all be due for another wave of buying if the American Jobs Plan is passed, Heymann told clients in a note earlier this week,” according to CNBC. “Heymann, the co-head of William Blair’s Global Industrial Infrastructure research, narrowed down a list of equities the firm believes could see the most additional upside thanks to big infrastructure spending in the months ahead.”

Infrastructure exposure can also help protect against long-term inflationary risks since most infrastructure operators pass through the cost increases of inflation to users through the long-term contracts that typically underpin the infrastructure business models.

As President Joe Biden looks to update and upgrade the nation’s aging infrastructure, ETF investors can turn to targeted sector plays to capitalize on the spending spree.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.