The U.S. advertising market is expected to explode this year as businesses spend more on advertisements to recover from the coronavirus pandemic, bolstering telecommunication sector exchange traded funds that track some of the largest internet advertising venues.

According to ad agency GroupM, as stimulus measures and an economic recovery help fuel spending, businesses could spend more on ads ahead, Reuters reports. GroupM upwardly revised its projections and believed that the ad market could expand by 15% this year (excluding political advertising) when compared to 2020.

In 2020, the U.S. ad market plunged as struggling businesses tightened their belts and cut marketing budgets to weather the coronavirus pandemic.

Even when compared to the relatively “normal” year of 2019, the ad market for 2021 is still expected to grow 6%, reflecting a “more-than-full recovery” in advertising.

GroupM based its more optimistic outlook to the trillion dollar fiscal aid package that is expected to trickle through the economy this year.

Consequently, businesses are buying digital ads, particularly on Facebook and Alphabet Inc.’s Google.

ETF investors can look to the communication services sector to capitalize on increased advertising spending on online platforms like Facebook and Alphabet.

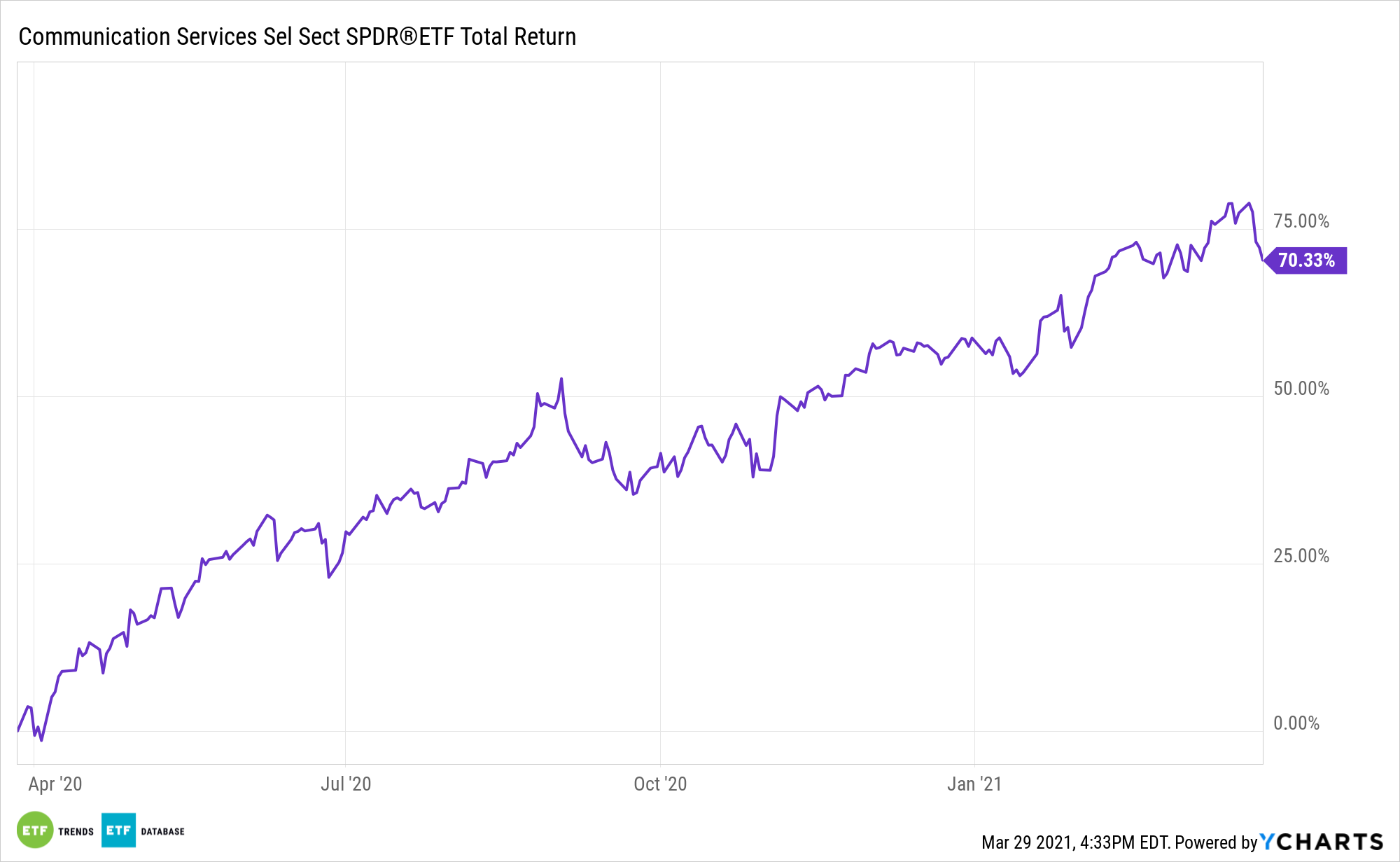

For example, the Communication Services Select Sector SPDR Fund (XLC) seeks to correspond generally to the price and yield performance of publicly traded equity securities of companies in the Communication Services Select Sector Index. The index includes companies that have been identified as Communication Services companies by the GICS, including securities of companies from the following industries: diversified telecommunication services; wireless telecommunication services; media; entertainment; and interactive media & services.

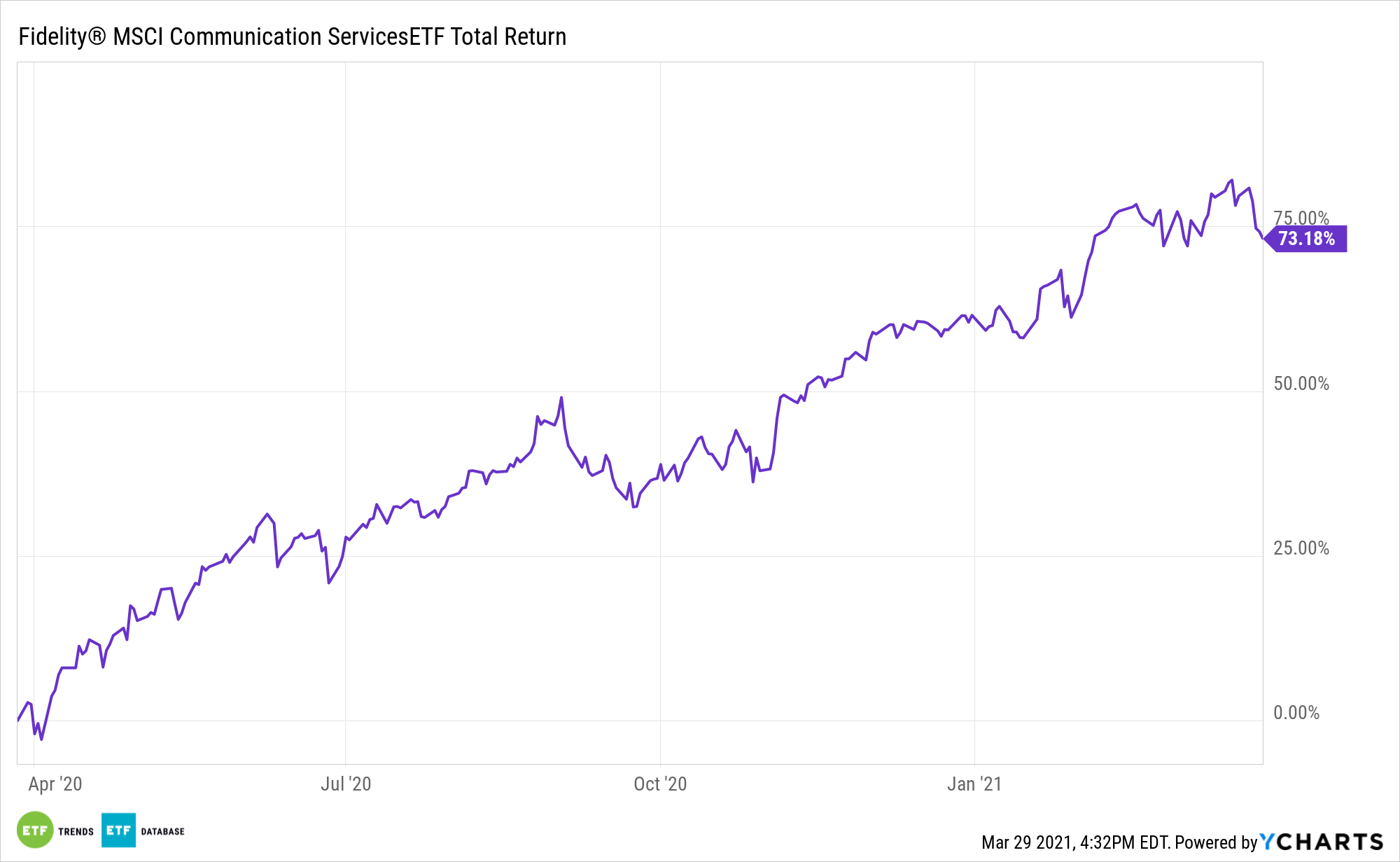

The Fidelity MSCI Communication Services Index ETF (NYSEArca: FCOM) seeks to provide investment returns that correspond generally to the performance of the MSCI USA IMI Communication Services 25/50 Index. The index represents the performance of the communication services sector in the U.S. equity market. It may or may not hold all of the securities in the MSCI USA IMI Communication Services 25/50 Index.

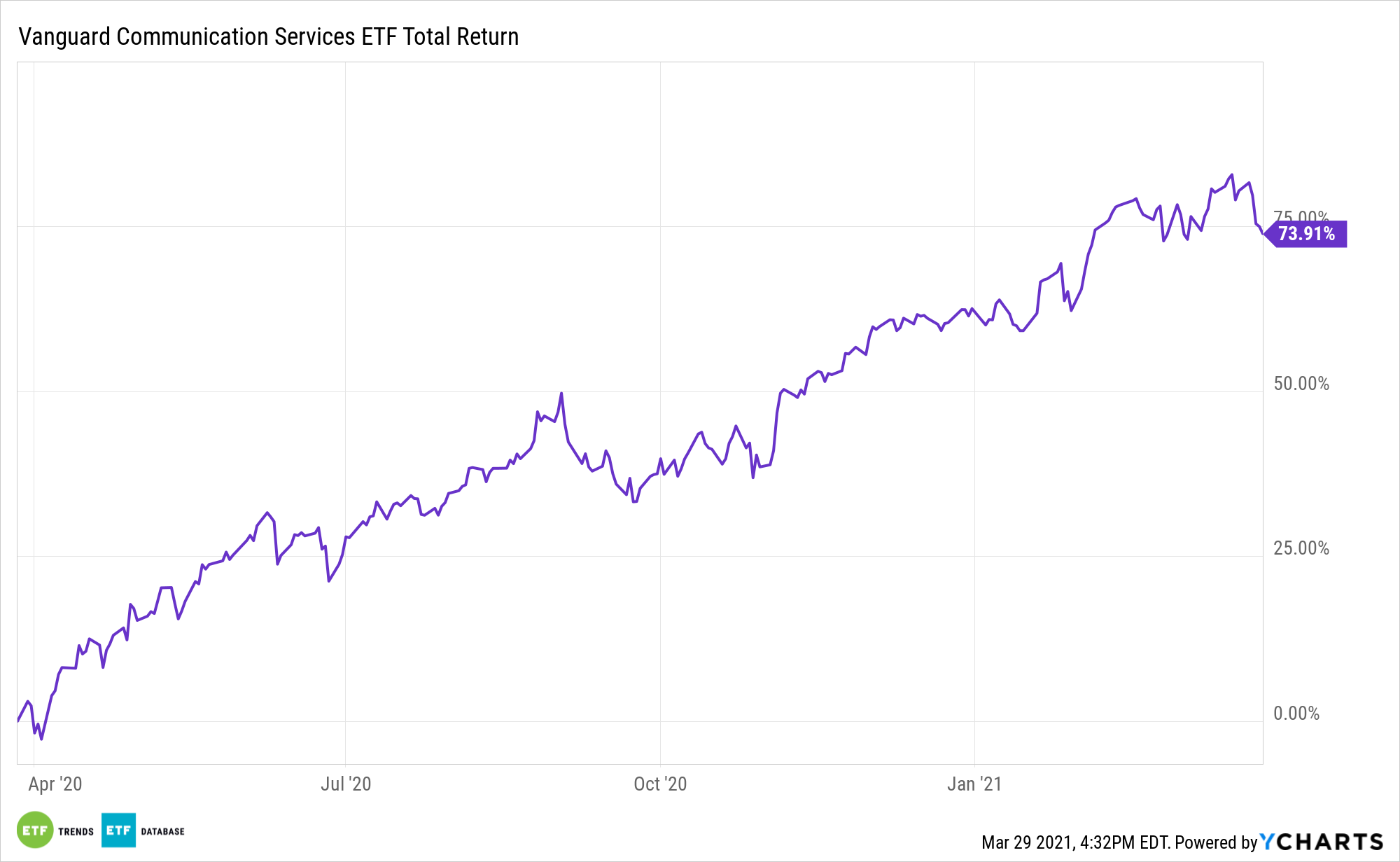

Additionally, the Vanguard Communication Services Index Fund ETF Shares (VOX) employs an indexing investment approach designed to track the performance of the MSCI US Investable Market Index (IMI)/Communication Services 25/50. The index itself is made up of stocks of large, mid-size, and small U.S. companies within the communication services sector, as classified under the GICS. The Advisor attempts to replicate the target index by seeking to invest all, or substantially all, of its assets in the stocks that make up the index, in order to hold each stock in approximately the same proportion as its weighting in the index.

Facebook shares makes up 19.7% of XLC’s underlying portfolio, 15.2% of VOX, and 14.3% of FCOM. Google’s parent company, Alphabet Class A shares, makes up 12.7% of XLC, 11.6% of FCOM, and 11.4% of VOX.

For more news, information, and strategy, visit the Innovative ETFs Channel.