By Scott Welch, CIMA ®, Chief Investment Officer – Model Portfolios

In part I of this two-part blog series, we focused on personal sentiment and confidence indicators, as well as income and consumption metrics. We concluded that, in general, individuals, families and small businesses are exhibiting a sense of “cautious optimism” as the COVID-19 vaccinations continue apace, massive fiscal stimulus has been passed and the economy continues to recover from its pandemic-induced recession of last year.

How is that general optimism translating into actual investor behavior?

Investor Behavior

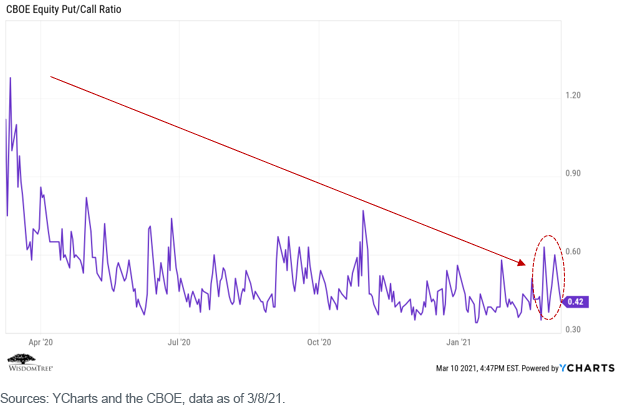

First up is the put/call ratio. This measures the degree to which investors are buying protection against the market (buying put options—a bearish indicator) versus buying leveraged access to the market (buying call options—a bullish indicator). The lower this ratio (i.e., the fewer put options purchased than call options), the more bullish investors are behaving.

Note the bouncy but steady decline in this ratio over the course of 2020, suggesting increased optimism. But what is most noticeable is the volatility over the past 2–3 months, as interest rates spiked, and investors seemingly expressed renewed concerns over potential inflation (driving the ratio upward). This was followed quickly, however, by a sharp decline as good news about COVID-19 vaccinations increased, and Congress passed a massive $1.9 trillion fiscal stimulus package.

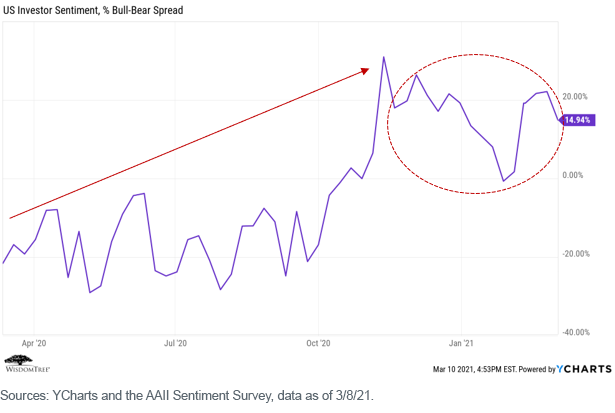

The inverse of the put/call ratio is the bull/bear spread, which measures the ratio of investors indicating they are bullish versus bearish on the market.

We see similar results to the put/call ratio—a steady increase in bullishness over the course of 2020, followed by increased volatility over the past few months—perhaps an indication of investor concerns over frothy equity market valuations and rising interest rates.

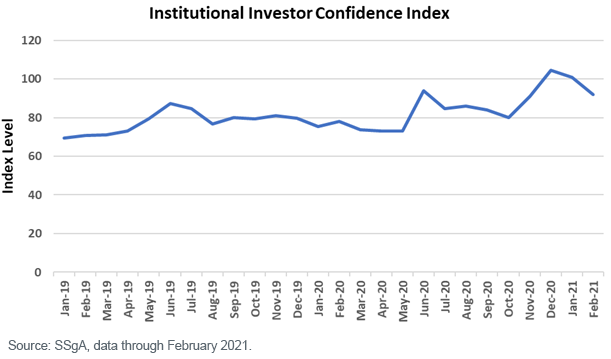

While retail investor behavior is interesting, most market trading still takes place with institutional investors (Reddit/Robinhood speculators aside), so let’s examine that next.

What we see (not surprisingly) is more consistent behavior and a generally bullish trend over the past 12–24 months (but, again, with a slight decline over the past month or two).

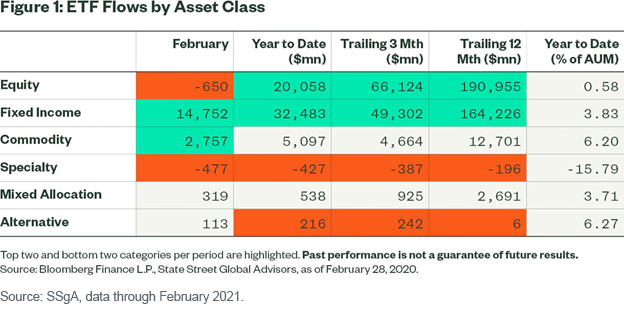

Finally, let’s look at actual fund flows, focusing on ETFs. What we see is a small majority of flows into equity ETFs over the previous 12 months (a bullish indicator), but a reversal into bond ETFs so far in 2021. Given current interest rate and credit spread levels, this is a fairly bearish indicator.

Conclusions

What can we conclude from examining the various individual, consumer and investor indicators discussed in these two blog posts?

In our opinion, it is a mixed bag. Individuals and investors seem generally optimistic about the current and future state of the economy and the stock market, but there are signs that some level of caution is creeping into the market “mood.”

This may be the result of any number of issues—uncertainty over the potential impacts of the newly passed fiscal stimulus package and/or the effectiveness of the COVID-19 vaccination program, inflation and valuation concerns, or perhaps just “fatigue” over continuing lockdowns and school closings.

Given human emotions, most of these sentiment and behavior indicators tend to be volatile, and they can and do reverse course and back again quickly. So, it is wise to view them with some level of detachment and a longer-term time horizon.

But they are worth paying attention to. I participated in a market outlook webinar in late December and was asked: “What’s the one thing that maybe people aren’t paying enough attention to that could have an impact on the market?”

My response was as follows, and I stand by it today. We need to maintain our vigilance “all along the watchtower”:

Investor sentiment currently is in a euphoria stage. If you look at various investor sentiment indicators, there is a lot of optimism priced in. So, at the retail level, we are in a “risk-on” environment, and I agree with much of that optimism.

But a potential shock might be that there is too much optimism built into the market. If we get an event that turns sentiment around, and people begin to de-risk, it could happen quickly and dramatically.

Originally published by WisdomTree, 3/23/21

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.