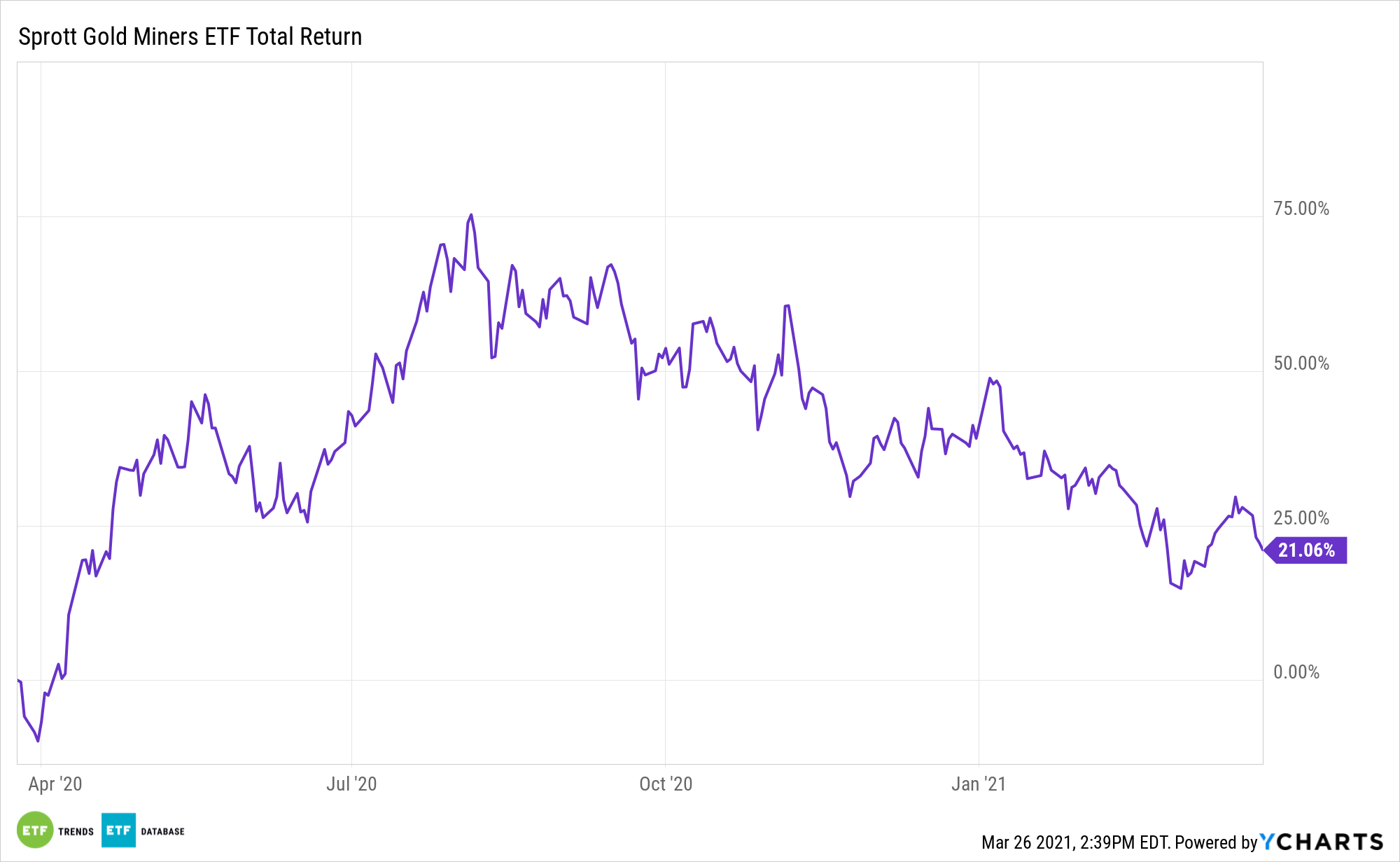

The effects of rising Treasury yields on bullion and assets like the Sprott Gold Miners ETF (NYSEArca: SGDM) is getting ample attention of late, but there’s still much more to the story.

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

“The reasons for holding gold or other precious metals are often misunderstood and lead many to the wrong conclusions,” reports Seeking Alpha. “While real interest rates are the key driver of gold prices, there is a far more important reason to have an exposure to the metal.”

Reasons ‘SGDM’ Can Rebound

ETFs have been stockpiling gold as more coronavirus news continues to invade the financial markets.

With the federal government stepping in to help shore up the economy, it might seem like gold gains could be tamped down. However, some market experts predict that the U.S. economy will be tested in the coming months, potentially further boosting bullion and ETFs.

“It is perhaps, the sheer and ever-growing amount of negative-yielding debt that provides the strongest evidence that the current monetary system is not functioning as it should,” according to Seeking Alpha. “It is just one of the consequences from the level of government & monetary interventions that changed from mostly regulating the markets and fine-tuning the economy to essentially nationalizing the fixed income market.”

Ominous as that scenario may be, it’s constructive for gold, and that could prove beneficial to SGDM.

Analysts see a bright future for the shiny metal, especially in the ETF domain, where a flight to safety may soon take center stage once again.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.