By Jun Zhu, The Leuthold Group

We’ve noticed a small segment of equity ETFs, designated as “thematic,” that is increasingly gaining popularity. Thematic ETFs invest in baskets of stocks that share narrowly defined business enterprises outside of the standardized GICS methodology.

These baskets are collections of stocks that may differ as far as traditional industry representation but have commonalities that may similarly benefit from an emerging trend, technological developments, or evolving political/economic landscape, among others. Nearly all thematic ETFs track a custom-made benchmark.

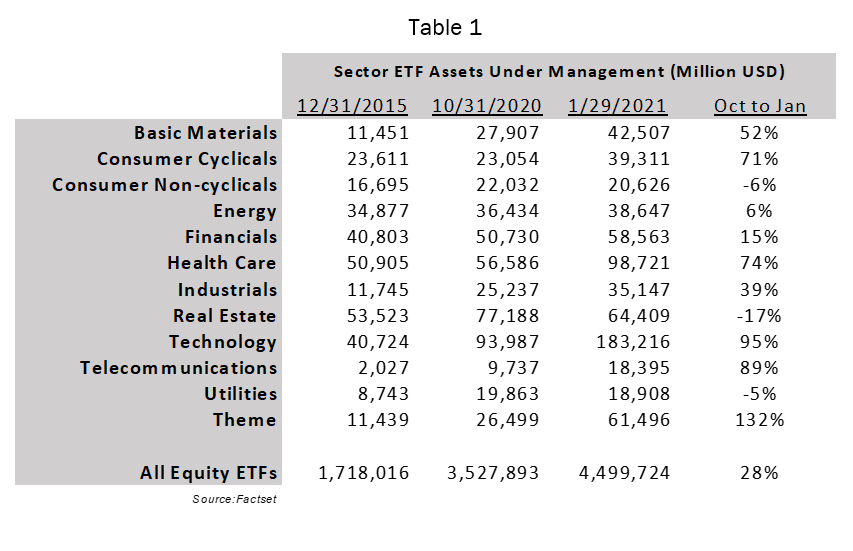

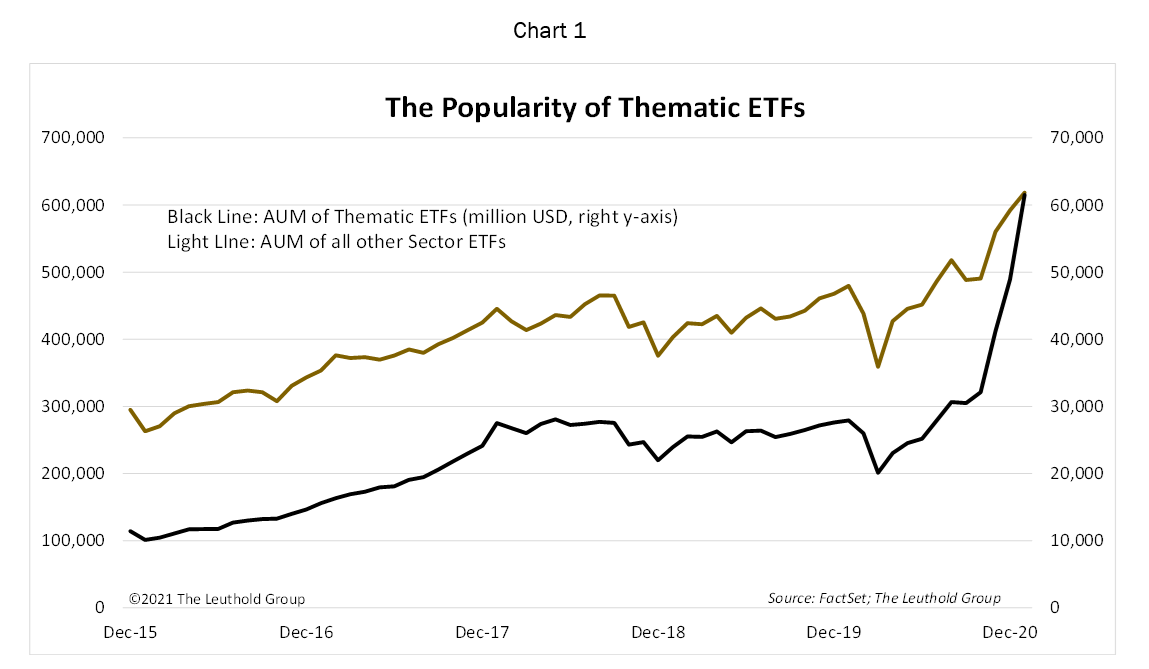

Although the sector division has lost assets, the thematic subset has taken center stage, particularly in just the last four months. Since October 2020, AUM for thematic ETFs have grown by 132% and they now comprise more than $61 billion (Table 1).

In general, equity ETFs can be broadly grouped into three categories based on FactSet definitions: sector, factor/style, and high yield. Thematic ETFs fall under the sector grouping. Among the three segments, sector ETFs are on the decline in terms of percentage of total assets under management. At the end of 2015, sector ETFs accounted for 17.8% of all equity ETF AUM; it has declined to 15.1% as of the end of January 2021.

This growth is greater than fund flow of overall equity ETFs. For comparison, between October 2020 and January 2021, AUM for all equity ETFs grew by 28%.

At the end of 2015, about 3.7% of all sector ETFs were considered “thematic,” they now encompass more than 9% (Chart 1).

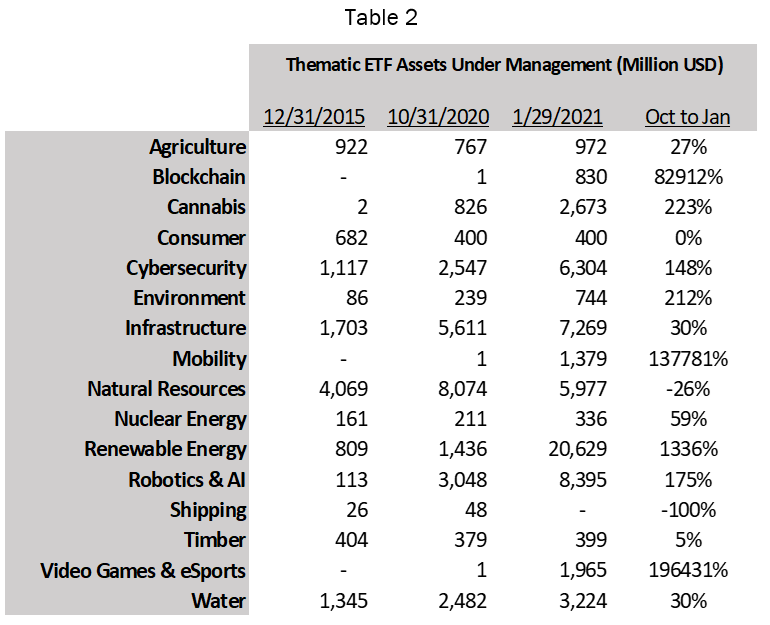

Table 2 breaks down some specific themes these ETFs are tracking. There are sixteen themes at present, although one does not have any stock constituents (“Shipping”). Three of the concepts are more recent phenomena and are characterized by new technology developments: Blockchain, Mobility (think EV), and Video Games & eSports.

Other notions that have attracted investor interest are based on changes in the political landscape, including Cannabis, Environmental, Nuclear, and Renewable Energy.

On the other side of the coin are Natural Resources and Timber, which could face future political headwinds. These styles of ETFs have not benefited from the recent growth boom.

Hot investments always come with elevated risk. We take a look at three potential risks for these thematic ETFs and their underlying portfolio constituents.

ETF Fund Flows And Future Returns

Naturally, the first question is whether we will see a reversal of investor enthusiasm for these hot themes, and in turn, negative trends for fund flow and performance.

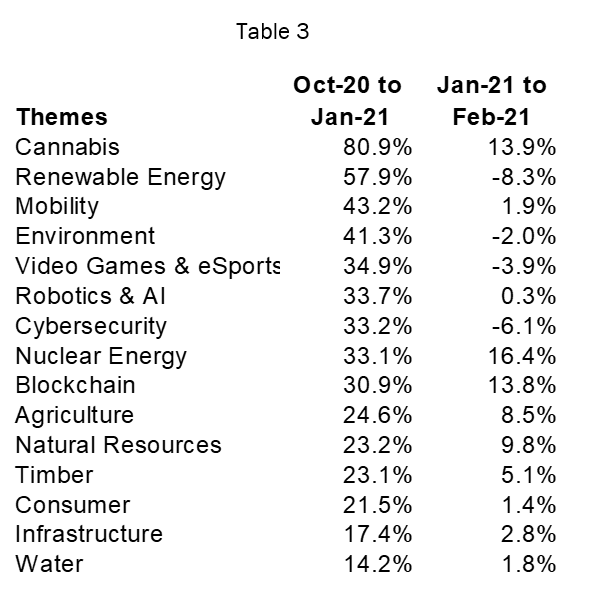

Table 3 ranks ETF average returns within each theme based on results from October 31st through January 31st—the recent three-month period thematic ETFs received noteworthy fund inflow. During that time, all 16 themes beat the S&P 500, with nine doubling that of the broader benchmark. This performance correlates with fund-flow data shown in Table 2—those with the best returns attracted the most assets.

We’ve already seen a reversal in this space during February. Except for the continued strength of the #1 performer, Cannabis, the next six-best performing themes trailed the S&P 500 for the month.

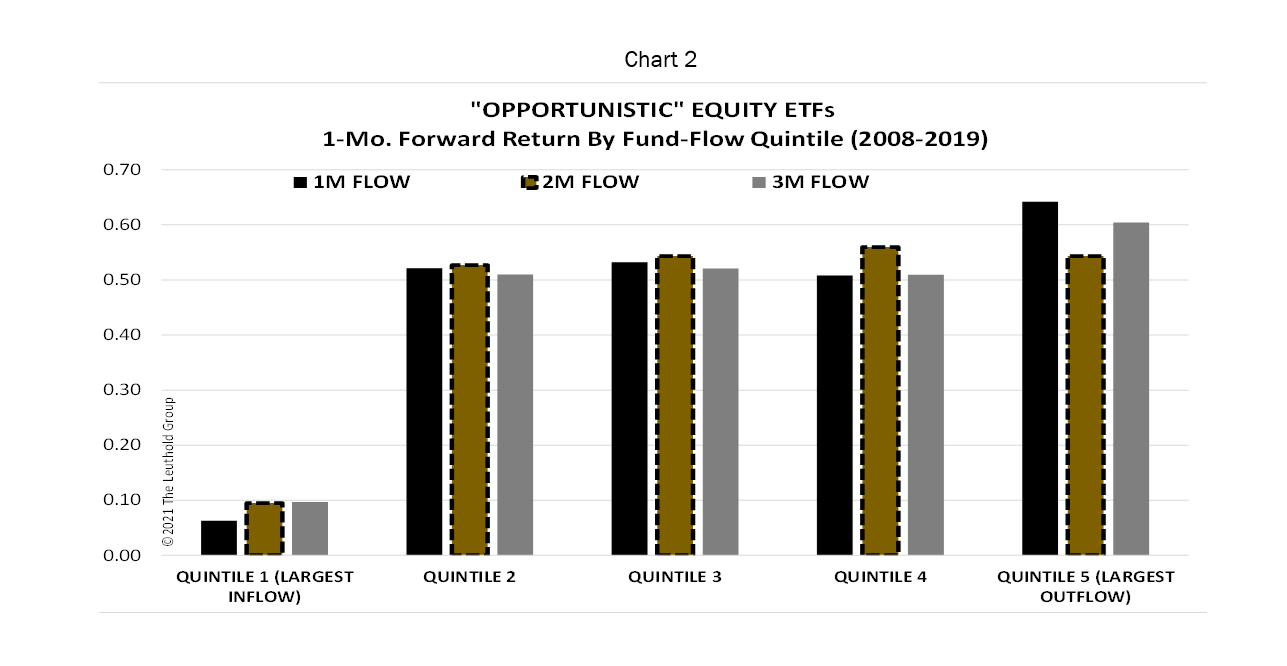

In the past, we found the inverse relationship between ETF fund flow and future performance existed both in the core and opportunistic equity ETFs (Chart 2). We classify FactSet’s equity ETF segments of high-dividend yield, sector, and small cap as “opportunistic,” which investors tend to trade in-and-out, rather than treating them as mainstay holdings.

The year of 2020 broke this historical relationship. ETFs with the highest inflow outperformed. We suspect a lot of that is due to the performance of the thematic ETFs. However, it’s hard to imagine the flow-fueled outperformance can persist, and reversion to the historical relationship might not bode well for these high-flyers.

The Effect Of Thematic ETFs’ Concentrated Holdings On Individual Positions

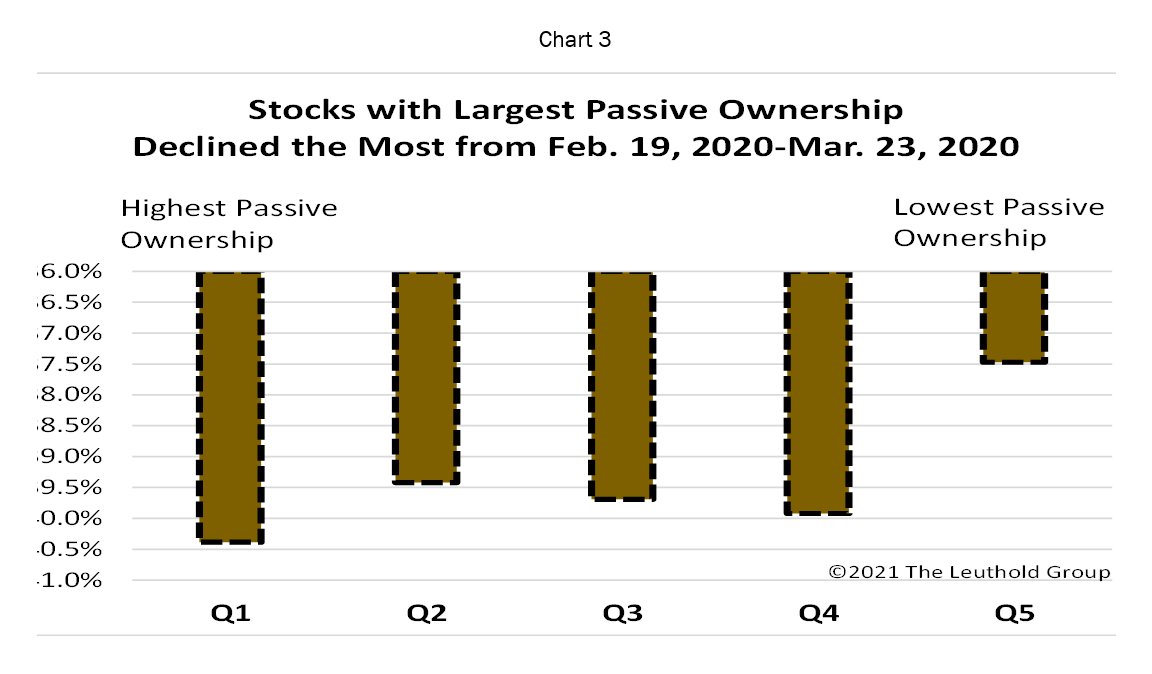

We wonder if the performance of individual stocks that are widely held by the trendy ETF themes are additionally subject to the impact of fund flows. Last year, when the pandemic intensified the market rout, we found that stocks with the largest passive ownership fared worse than those with the lowest (Chart 3).

That analysis was based on the largest 500 stocks, and we suspect that the effect might be even more prevalent among smaller companies.

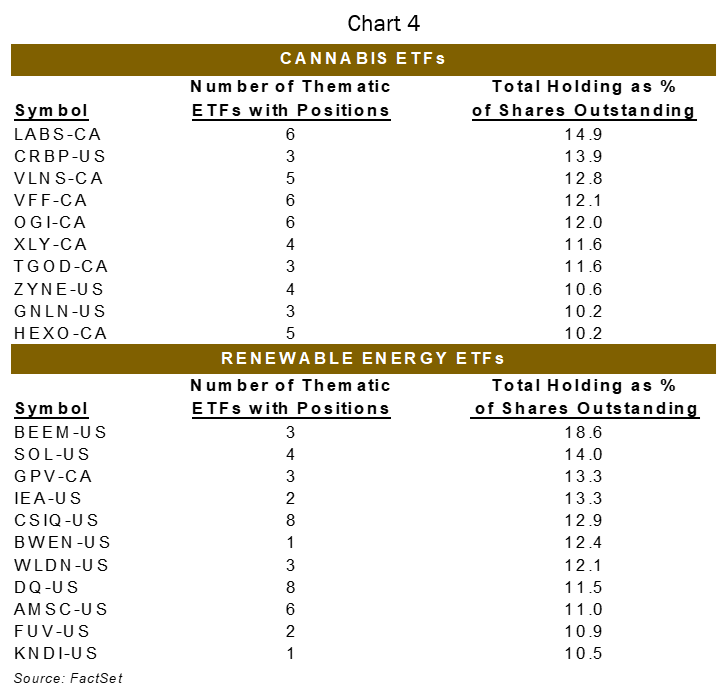

Here we look more closely at the top-three performing thematic ETFs since last October (Cannabis, Renewable Energy, and Mobility) to identify the stocks with considerable shares outstanding being held by these ETFs.

Cannabis and Renewable subsets have extremely concentrated holdings. ETF positions represent more than 10% of shares outstanding for ten different Cannabis stocks, and for eleven positions held by Renewable Energy ETFs (Chart 4).

These stocks certainly benefit from new investors buying the thematic ETFs. However, with such a large chunk of shares outstanding being held by these thematic ETFs, it will be a detriment when the market sells off or the theme loses appeal.

Are Thematic ETFs Pure Plays?

A closer look at the holdings leads to another potential risk or pitfall for investors.

We found that most Mobility and Blockchain ETFs primarily hold large technology companies, like Google, Baidu, Microsoft, and Apple, for example. Their performance is closely correlated with traditional ETFs that track these same firms, such as QQQ.

In other words, investors might think they are buying into a hot theme but end up getting the traditional mega-caps through higher-fee ETFs, as the thematic variety typically charge two- to three times that of traditional ETFs. With close to 3,000 ETFs now available, the names of strategies may be misleading.

Takeaways

Steve Leuthold was a pioneer with “thematic” style equity investing. He first designed the industry-group sphere and thought process nearly 60-years ago and we’ve practiced that approach to equity investing at The Leuthold Group since Steve founded the firm over 40 years ago. As we’ve found in our extensive experience with industry-group concentrations and sector rotation, thematic investing can be an exceptional tactical tool to gain exposure to very specifically targeted and narrowly-defined ideas.

As thematic ETFs now gain a foothold in popularity, there are hurdles to consider. This includes significant asset inflow/outflow that can destabilize underlying stock positions where an ETF holds a large percentage of shares outstanding. Another serious drawback is that ETFs may diversify beyond the niche concept, either to mute the effect of asset flows or because there is a lack of eligible pure-plays to construct a meaningful basket of stocks for investing, which, of course, results in a dilution of the intended exposure. In those cases, it becomes a matter of whether the hefty fees are justified.

Based our studies, we advise not chasing a hot ETF, understand exactly which stocks the ETFs holds, and watch out if you have investments in stocks that happen to be major holdings of the hot thematic ETFs.

Originally published by The Leuthold Group