By Chris Konstantinos, CFA

Why RiverFront is not yet concerned about recent rise in rates

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

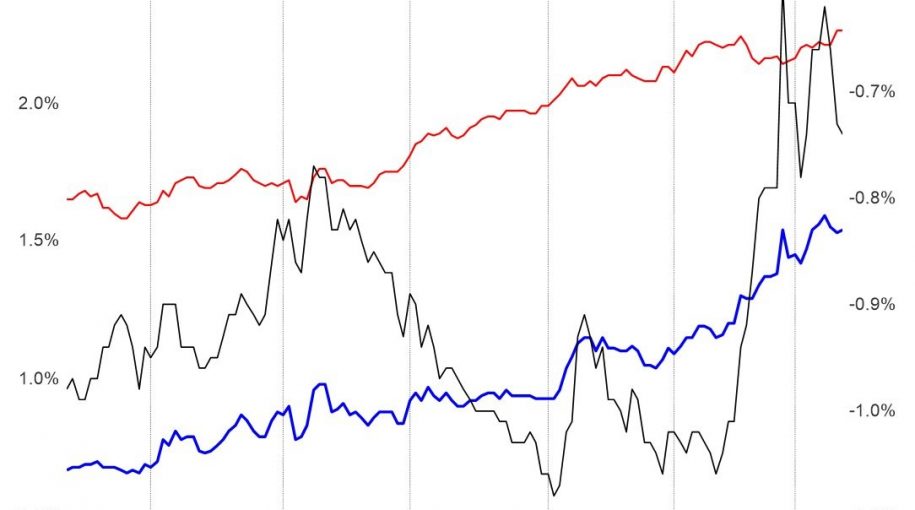

After a prolonged period of hovering near all-time lows, the US 10-year Treasury yield has been on the move lately (see chart). This is not wholly unexpected, nor it is necessarily something for the stock market to be concerned about, in our view. In RiverFront’s 2021 Outlook, both our base case and bull case scenarios for stocks predicted rates rising this year; at the upper end, we predicted a range as high as ~1.80% on the US 10-year Treasury.

However, the speed with which rates have risen recently– from a low of just over 1% at the end of January to currently over 1.6% – has some market participants spooked, contributing to recent stock and bond market volatility.

The reason for the market’s concern is that quick, significant rate increases can suggest that inflation expectations are rapidly rising. The specter of inflation tends to have an adverse effect on stock market valuations, as inflation concerns generally cause the Federal Reserve to tighten financial conditions and raise their target rates, slowing economic growth.

Federal Reserve Not Likely to Raise Target Rates Anytime Soon, In Our Opinion

Should the stock market be concerned today about the Federal Reserve tightening conditions? We do not believe so. In previous Weekly Views, we have put forth why we believe that high inflation is likely to be transient in 2021. Importantly, we believe rates are rising right now mainly because economic growth potential is improving – a positive for stocks – not because of a dangerous increase in the inflation impulse. The consensus forecast for US and global GDP growth for 2021 has been revised higher in the last several months, a function of higher stimulus and a rebound in economies affected by the pandemic shutdown in 2020. Despite these higher GDP forecasts, we are not observing a large propensity to raise wages among employers or significant increases in pricing power at US retailers in the various survey data we track – suggesting core inflation remains in check.

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

We would argue the bond market agrees with our sanguine view on inflation, despite the recent uptick in yields. One way to we try to interpret inflation expectations is to compare the yields on Treasury Inflation-Protected Securities (TIPS) to the yields on regular treasuries of the same tenor. Because TIPS principal payments are adjusted to reflect the change in inflation as calculated by the Consumer Price Index (CPI), the difference in yields between the two bonds theoretically should equal the market’s inflation expectations over that time horizon. The TIPS analysis suggests to us that the recent rise in rates is imputing a level of inflation approximately equal to 2.3% over the next seven to ten years (see red line in right chart). This is close to the Fed’s official goal and hardly a 1970s scenario, when inflation averaged over 7% annually across the decade. These inflation expectations are low enough, in our opinion to keep the Fed on the sidelines for quite some time with regard to target rate hikes.

We also believe that the Fed not likely to start verbally talking up expectations for rate hikes in the near-term, because the jobs market in the US is still highly dislocated in industries such as entertainment and hospitality. In a meeting with Congress towards the end of February, Fed Chairman Jay Powell suggested that the Fed has no intention of raising target interest rates until it thinks its dual mandate of maximum employment and inflation containment have been reached. He noted in the same meeting that he believes the actual unemployment rate in the US is closer to 10% than the official 6.2% statistic, due to workers giving up and dropping out of the job-seeking population altogether. In a more recent interview last week with the Wall Street Journal, Powell said the Fed sees the current inflationary impulse as only ‘transient’ versus persistent. With the two-day Federal Open Market Committee (FOMC) policy meeting starting Tuesday March 16th, we will get another update into Fed thinking with regards to inflation.

Treasuries’ Recent Rise May Be Capped in Near-Term

In addition, note that foreign investors may be increasingly interested in buying treasuries, providing large demand and thus a potential ceiling for US yields in the near-term. Even after adjusting for the cost of currency hedging, US treasuries now have higher yields than European or Japanese bonds, according to a recent Wall Street Journal article. This is a departure from much for 2020, when foreign bonds offered superior yields to US ones when factoring in hedging costs.

Conclusion: Stocks Should Not Yet Fear Rising Rates

Because we see the move up in interest rates as primarily driven by better economic growth prospects rather than fears of sustained inflation, we remain positive on stocks. Across our balanced asset allocation portfolios, we continue to be positioned overweight stocks relative to bonds versus our baseline benchmarks. We will continue to monitor rates and the message of markets closely and will adjust our portfolios accordingly should our view of potential inflation meaningfully change.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Gross Domestic Product (GDP) is the monetary value of all finished goods and services made within a country during a specific period. GDP provides an economic snapshot of a country, used to estimate the size of an economy and growth rate.

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. Changes in the CPI are used to assess price changes associated with the cost of living. The CPI is one of the most frequently used statistics for identifying periods of inflation or deflation

Treasury Inflation Protected Securities (TIPS) are Treasury securities that are indexed to inflation in an effort to protect investors from the negative effects of inflation. The principal value of TIPS is periodically adjusted according to the rate of inflation as measured by the Consumer Price Index (CPI), while the interest rate remains fixed. TIPS will decline in value when real interest rates rise. Portfolios that invest in TIPS are not guaranteed and will fluctuate in value.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1564339