By Bob Smith, Sage President & CIO

According to a recent letter written to the Texas Public Utility Commission (PUC) by Potomac Economics, the Electric Reliability Council of Texas (ERCOT) made a $16 billion error in pricing during the week of Winter Storm Uri. This reportedly occurred because the PUC directed the grid operator to set wholesale power prices at $9,000 per megawatt hour for two days during the storm — the maximum market price allowed. Retail power providers then bought power from the wholesale market to deliver to consumers, because they were contractually obligated to do so. Because ERCOT failed to bring prices back down on time, those companies had to buy power in the market at extremely inflated prices.

Retail power providers have been in financial distress across Texas since the storm, and some, such as Brazos Electric Co-Op, have already begun to file for bankruptcy. This pricing error will likely result in higher levels of defaults, wrote Carrie Bivens, a vice president of Potomac Economics, the firm that monitors the PUC (1). This extraordinary pricing failure “has pushed the entire market to the brink of collapse,” according to Patrick Woodson, CEO of ATG Clean Energy Holdings, a retail power provider based in Austin (1).

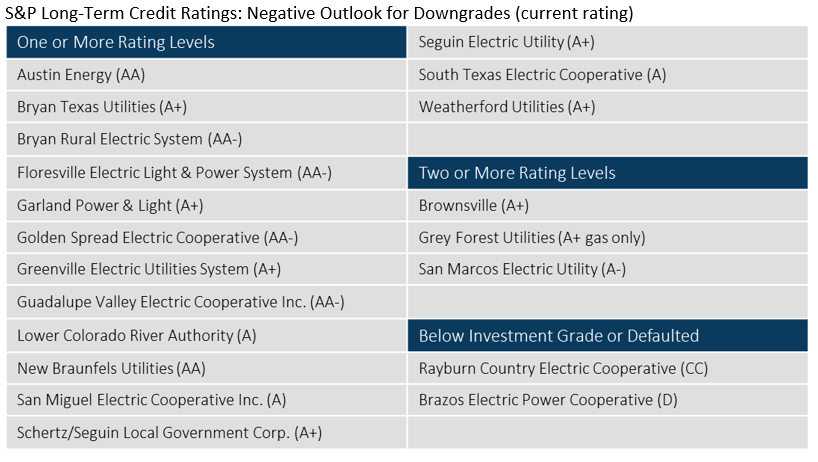

The significant financial implications of Winter Storm Uri became even more evident for municipal bond investors when Standard & Poor’s released a ratings action report on March 3rd citing it had placed 19 Texas-based municipal power generation organizations under review for possible credit rating downgrades. These actions were extraordinary and reflected the agency’s view that the utilities that participated in the ERCOT power grid may experience substantial near-term financial stress from the effects of the surge in demand and prices for both power and natural gas. This caused exceptionally high generating costs and potential liabilities for those utilities that were short or insufficiently hedged.

To exacerbate the situation, due to the “joint and several” nature of the ERCOT agreements signed by the participants, several participants may be subject to sharing the ERCOT costs associated with those former participants that defaulted on their respective payment obligations following the winter storm. This “uplift” mechanism applies when one or more ERCOT market participants fails pay for their power purchases from the system. Under the agreement, those defaulted payments are spread pro-rata to other participants so that ERCOT can reimburse its electricity suppliers. This payment agreement has not been tested previously, particularly under such extreme circumstances, and has raised many legal questions over the extent to which the non-defaulting participants may be subject to potential uplift payments.

The adverse impact this may have on the cash flows, future fixed-charge coverage ratios, liquidity measures, power rate competitiveness, and balance sheet leverage are all major concerns shared by the affected participants. S&P has said that over the next 90 days it will assess the extent to which these new storm-related costs and additional liabilities will impair each entity’s financial strength and need for external liquidity to meet their respective power purchase obligations.

In our view, it is possible that a few of the affected utilities will be able to pursue alternatives to cover their anticipated share of new ERCOT charges, but this will likely require substantial future rate increases for consumers if utilities are to sustain their internal liquidity levels as well as maintain appropriate debt and cash flow coverage metrics. Undoubtedly, the most adversely affected utilities will be those that were caught short or were unhedged on their natural gas supplies and had to buy power and gas at peak market prices to meet consumer demand.

Originally published by Sage Advisory

Sources:

1. Douglas, Erin, and Mitchell Ferman. “ERCOT Overcharged Power Companies $16 Billion for Electricity during Winter Freeze, Firm Says.” The Texas Tribune, The Texas Tribune, 4 Mar. 2021.

Disclosures

This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.