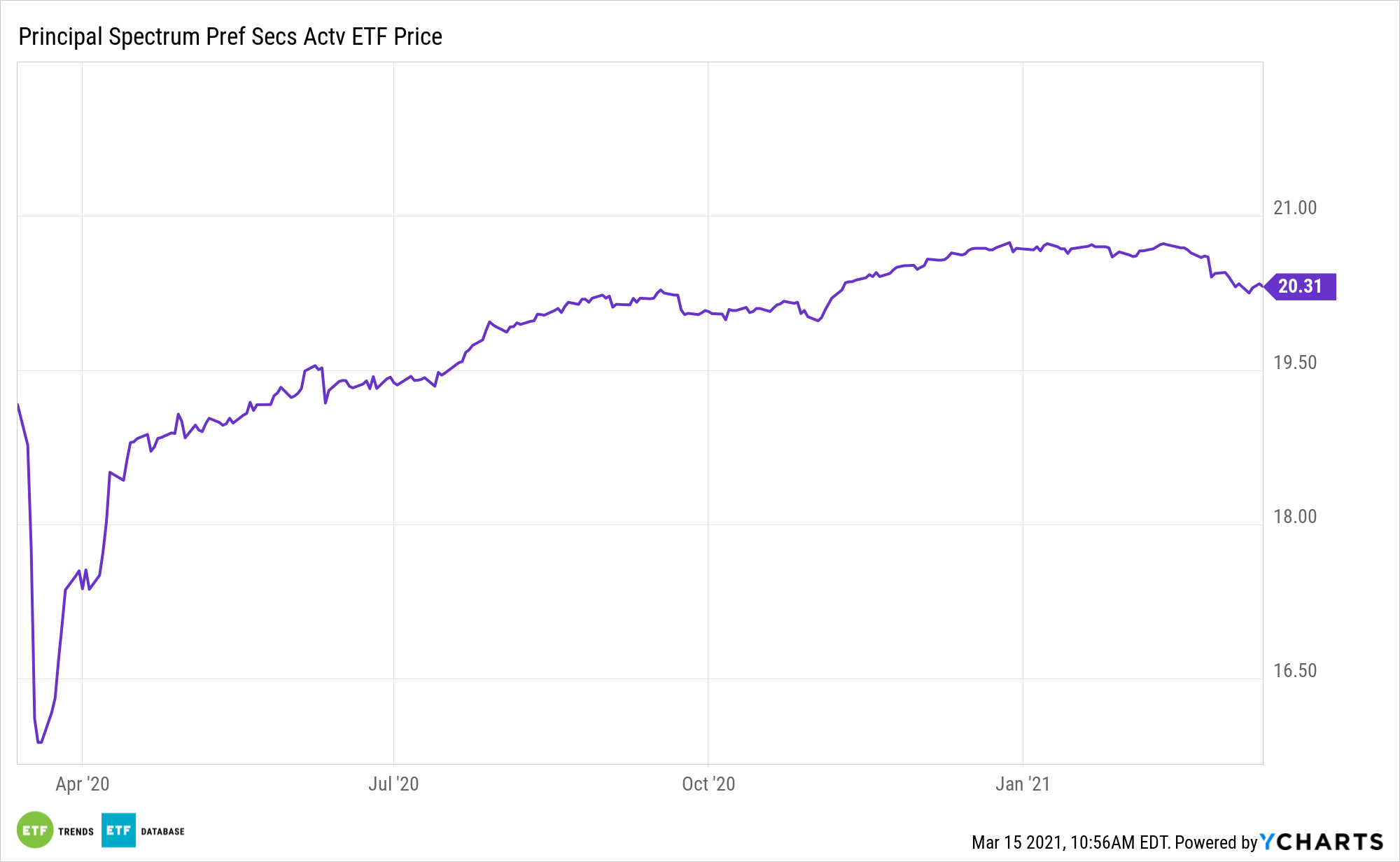

Interest rates are likely to remain low in 2021, meaning investors need to be selective with income-generating asset classes. The Principal Spectrum Preferred Securities Active ETF (NYSEArca: PREF) is a great starting point.

PREF can act as a portfolio diversification tool and reducer of correlations. Another advantage of PREF’s active management is that the manager’s can look for value in an asset class that has been expensive for much of this year.

“Although stocks and bonds have been negatively correlated over the past 20 years, Bank of America noted that this is a recent phenomenon and one that may change in the near term,” reports Forbes. “Derek Harris and Jared Woodard, portfolio strategists at BofA, note that the 60/40 portfolio is built on the premise that stocks and bonds are negatively correlated with bonds hedging against risks to growth and stocks hedging against inflation.”

Turn to ‘PREF’ for Income

Preferred stocks are a type of hybrid security that shows bond- and equity-like characteristics. The shares are issued by financial institutions, utilities, and telecom companies, among others. Within the securities hierarchy, preferreds are senior to common stocks but junior to corporate bonds. Additionally, preferred stocks issue dividends on a regular basis, but investors don’t usually enjoy capital appreciation on par with common shares.

Preferreds are considered alternative investments and one of the better income generators in that group.

“A third option is alternative investments. Alternatives offer several benefits: They are generally uncorrelated with stocks and bonds, which improves portfolio diversification; they tend to be less volatile than publicly traded assets; they have the potential to provide more attractive returns; and many alternatives offer other benefits, such as passive income,” adds Forbes.

Lack of constraint to an index is also a relevant advantage, because PREF’s managers can eschew issuers with shaky financial profiles while focusing on those most likely to make good on dividend payments.

Income investors have looked to preferred stock ETFs in their portfolios for a number of reasons. The asset class offers stable dividends, does not come with taxes on qualified dividends for those that fall into the 15% tax bracket or lower, is senior to common stocks in the event liquidation occurs, is less volatile than bonds, and provides dividend payments before common shareholders.

For more on active strategies, visit our Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.