By BCM Investment Team

The manufacturing resurgence continued in February as the sector climbed to a 15-year high, and phenomenon isn’t just limited to the U.S. Climbing costs though could ultimately put pressure on margins and/or make their way through consumers and add yet another inflationary pressure. Meanwhile, with such a massive—and growing—divergence between tax revenue and spending, it stings to see the percentage of stimulus funds being directed toward investments and savings over their intended purpose. Is a lower income cap the answer? Yields jumped yet again this week, prompting a response from equities, but how have stocks typically performed in the long-term following a yield spike? And should we expect the same this time around or will context have something to say on the matter? 2020’s near-zero interest rates have more than one consequence after all… Over in China, manufacturing has lost some momentum and the renminbi impressive appreciation has continued; how will these developments affect the future of their economic recovery?

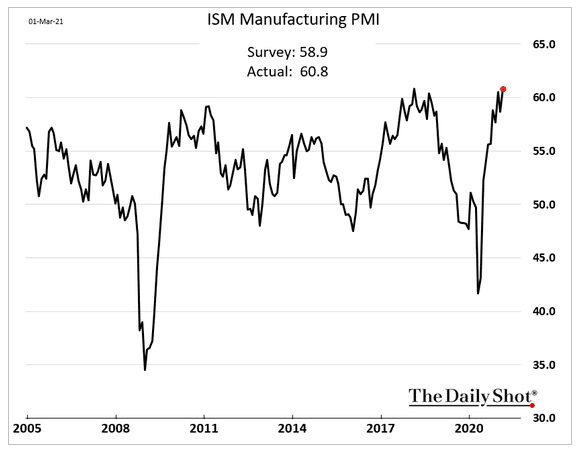

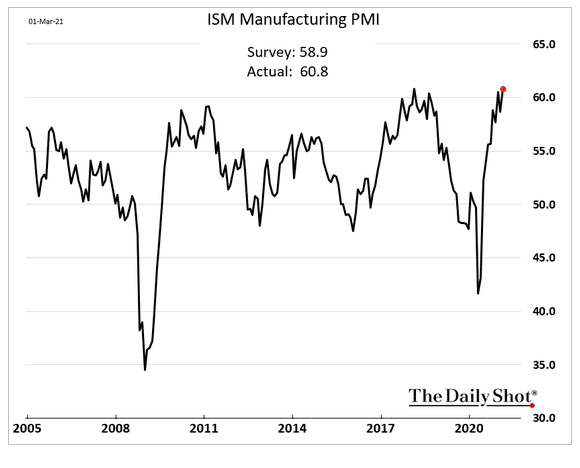

1. The manufacturing sector, ~11.4% of total GDP, is at a 15-year high:

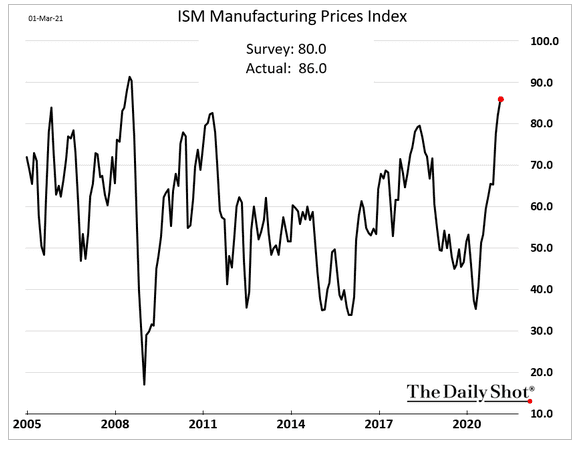

2. Commodity price increases are certainly affecting manufacturer’s cost of goods sold; will these costs get passed through to consumers, lessen profits, or a little of both?

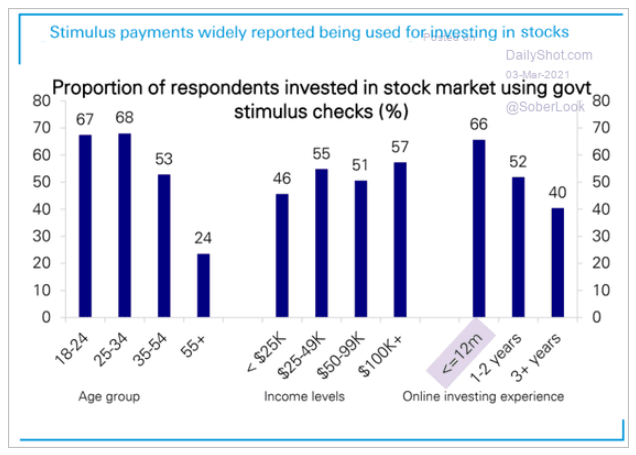

3. The “joy” of receiving free money is going to be replaced by the “pain” of paying it back with higher taxes…

4. More evidence that the stimulus packages are missing their intended mark. Washington, please focus on those truly in need!

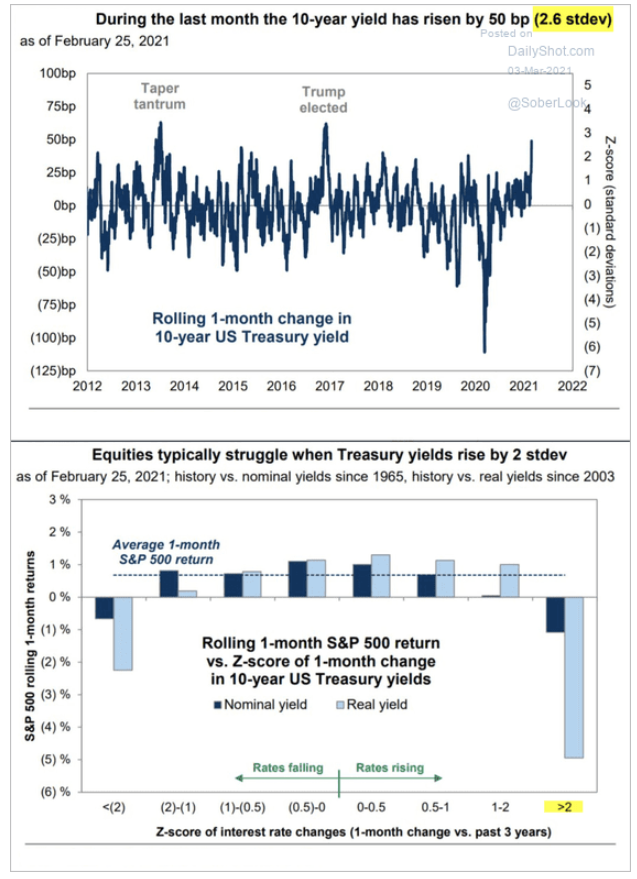

5. The reflation crowd brought some new leadership in February:

6. Historically, yield increases like we saw in February have had a negative effect on stock returns. Yet, given the near-zero start and a pandemic recovery with unprecedented stimulus, will this relationship hold?

7. Ultra-low coupon bonds are harder to sell when rates rise. Remember the 10-year UST had a record-low yield of 0.052% It is almost triple this now…

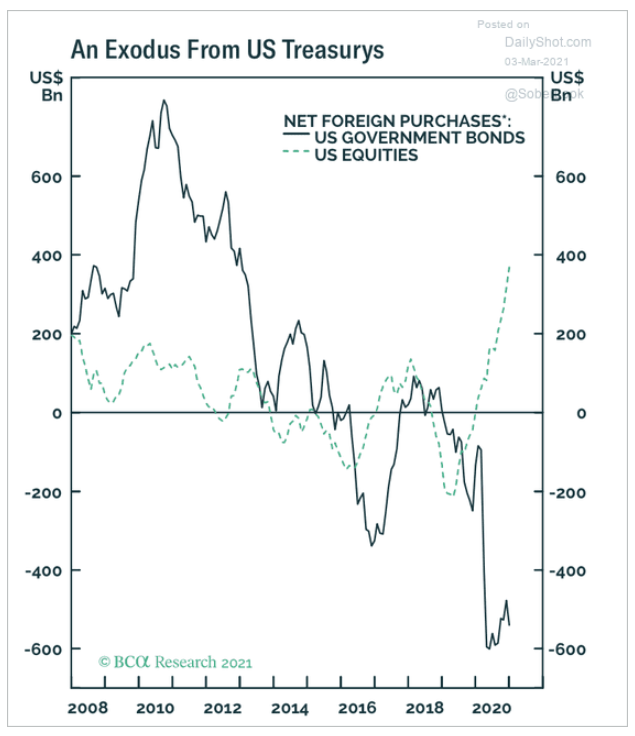

8. The near-zero rate policy had an unintended consequence: Treasury yields were too low to attract foreign buyers…

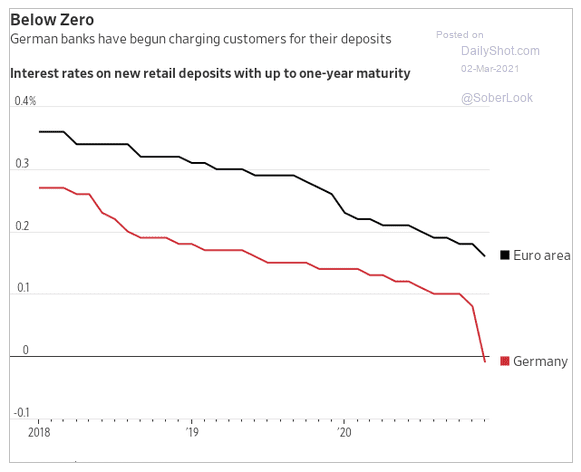

9. Negative rates are not rational over the long term. Here is one result:

10. The manufacturing resurgence is not confined to the U.S. Here is Europe:

11. Now that the rest of the world has “caught up”, China’s manufacturing sector is cooling off:

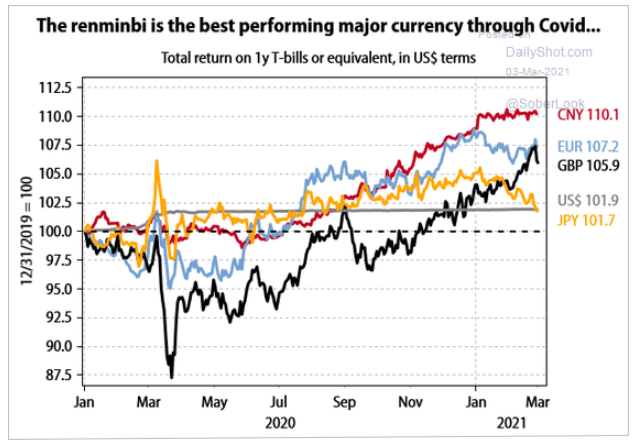

12. The Yuan’s appreciation has not helped Chinese competitiveness…

13. Children get Covid just like adults, albeit usually with much less severity, but we rarely tested them. Now that schools have started large scale testing:

14. We could all add a few more humorous responses…

This article was contributed by Beaumont Capital Management Investment Team, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.