By Kevin Nicholson, CFA

With another round of fiscal stimulus likely, interest rates are moving higher and the equity markets have stalled. The obvious question becomes: what is RiverFront doing from a tactical perspective? As children most of us played the game ‘Red Light Green Light’, a game where everyone would line up on the starting line and move forward when green light was called out. However, when red light was called out, we would have to stop immediately, or risk being caught continuing to move forward and having to return to the starting line. The first one to cross the finish line wins. Red Light Green Light taught us self-discipline just like the “Three Tactical Rules” have created an investment discipline for us at RiverFront. In keeping with the Red Light Green Light theme, the three rules combine to form a “Flashing Yellow Light” currently. Below we will highlight how we reached this conclusion.

Don’t Fight the Fed: Green Light

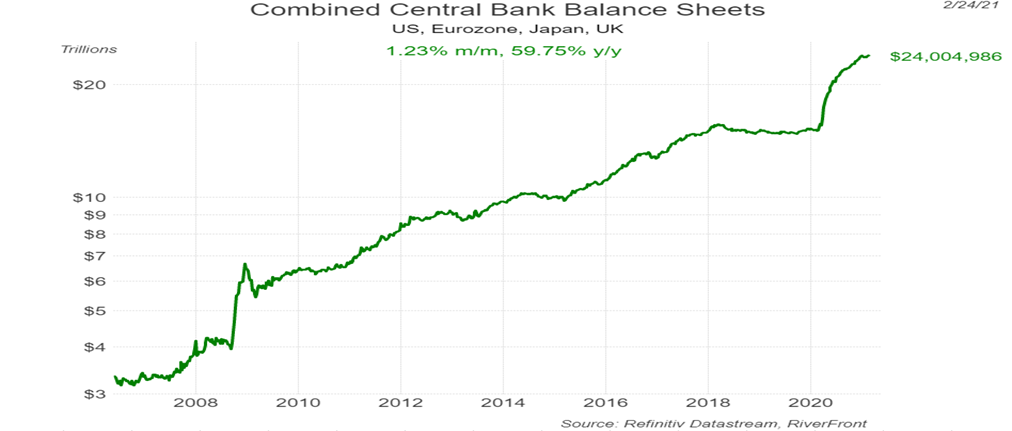

Currently, the Federal Reserve is on the investor’s side as they have provided tremendous monetary support since the onset of the pandemic. The Fed’s balance sheet is at an all-time high at $7.59 trillion, up $3.43 trillion in the last year. The Fed stated last week that they intend to keep interest rates low until 2023 to jumpstart the economy. In conjunction with fiscal support from the US government, financial conditions are loose and supportive for lending and investing into financial assets.

Internationally, the European Central Bank (ECB), Bank of Japan (BOJ) and the Bank of England (BOE) continue to provide support to their respective economies as their balance sheets are also at all-time highs. For instance, the ECB established a €1.85 trillion Pandemic Emergency Purchase Program, the BOJ has become the nation’s biggest stockholder through its ETF purchases, and the BOE increased its quantitative easing (QE) program late in 2020 buying £150 billion of government bonds. The combined balance sheets of the four central banks currently stands at $24 trillion. Conclusion: Central Banks around the world are supportive, giving investors the Green Light.

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

Don’t Fight the Trend: Yellow Light

We define the trend as the 200-day moving average (DMA) of the S&P 500. History has shown that a positive trend tends to lead to positive returns over our tactical investment horizon of 3 to 6 months. Broadly speaking, a positive trend is good for equity markets; however, there are times when the trend rises too quickly. In those instances, we proceed with caution and now is one of those times. We believe the trend is currently rising at an unsustainable rate of 47% annualized. In our view, the S&P 500 will have to digest the strong gains before the trend returns to a more sustainable level.

Internationally we also use the 200-DMA, this time with the MSCI All Country World ex-US Index. We believe that the international trend is also rising at an unsustainable rate. Currently the trend is rising at a rate of 55% annualized but is has recently peaked and is decelerating as well. Like the US, the international trend will be largely driven by the reopening of the economy. Conclusion: Equity trends both domestically and internationally are neutral and will be flashing Yellow Lights until they cool-off.

Beware of the Crowd at Extremes: Red Light

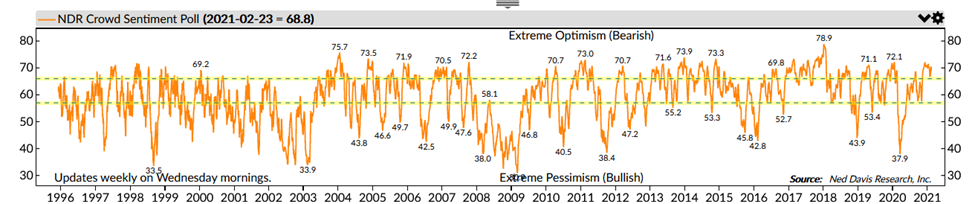

The Ned Davis Weekly Crowd Sentiment remains elevated as investors have reacted positively towards a better-than-expected S&P earnings season, accelerating vaccine distribution, and additional fiscal stimulus. This combination along with improving economic data has left investors feeling euphoric and has contributed to Crowd Sentiment staying in the extreme optimism zone. We believe that sentiment could cool if market participants begin to view inflation as a problem. However, we do not believe this will be the case in the next 3-6 months. Conclusion: Crowd Sentiment will remain elevated in extreme optimism, in our view due to the positive catalysts discussed and therefore is flashing a Red Light for investors.

NDR Crowd Sentiment Poll

Copyright 2021 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/.

In conclusion, the Fed is ‘green’, the Trend is ‘yellow’, and the Crowd is ‘red’, which translates into a flashing yellow and to proceed with caution, in our view. Since our portfolios remain overweight equities, we are watching risk management levels where we may take action to reduce risk in our short-horizon portfolios. In our longer-horizon portfolios, we may not act as tactically, given that the fundamentals and positive primary trend suggest to us that any market correction will be temporary.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 developed markets (DM) countries (excluding the US) and 23 emerging markets (EM) countries.

Definitions:

Don’t Fight the Fed – ‘Supportive’ means the Fed’s monetary policy regarding inflation and employment is in what we believe based on our analysis to be the investors’ best interest; ‘Against’ means the Fed’s monetary policy, in our view, is going against the investors’ best interest; ‘Neutral’ means the Fed’s monetary policy is neither supportive or against the investors’ best interest in our view. Don’t Fight the Trend – Terms correlate to the 200-day moving average as it relates to the equity indexes: ‘Positive’ means that the trend is rising, ‘Flat’ means the trend is flat, ‘Negative’ means the trend is falling. Beware the Crowd at Extremes – Terms correlate to the NDR Crowd Sentiment Poll and its measurement of Extreme Optimism (Bearish), Neutral, or Extreme Pessimism (Bullish).

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1544442