By Brian Manby, Senior Analyst, Research

By now, many investors can probably recite most investment strategists’ expectations for 2021 in their sleep. The common theme is an anticipated economic recovery.

Although forecasts are inherently limited, after a tumultuous 2020, this sanguine consensus is certainly encouraging. One sector on many investors’ minds is U.S. small caps. However, we think there’s a prevalent risk that is dangerously overlooked: historically high valuations and deteriorating fundamentals.

- The Russell 2000 Index is currently trading at a P/E ratio of 496x earnings, a multiple so high it’s practically meaningless. Its forward P/E multiple is more mundane by its own standard (clocking in at 53x estimated earnings), but still nearly twice its historical average.

- Moreover, the health of the small-cap market, as measured by Russell 2000, has continued to deteriorate, all while investors have become comfortable throwing money at it with little regard for price.

We think WisdomTree has a compelling alternative that can provide small-cap access without paying astronomical valuations or sacrificing the quality of its underlying company exposures: the WisdomTree U.S. SmallCap Fund (EES).

It’s Simple: Profitability

Launched in 2007, EES uses an earnings-weighted methodology to access small-cap U.S. equities. It’s a key differentiator from market cap-weighted alternatives. Selecting and weighting by a company’s contribution to the overall Earnings Stream® (using trailing 12-month earnings) gives the Fund an inherent emphasis: profitability.

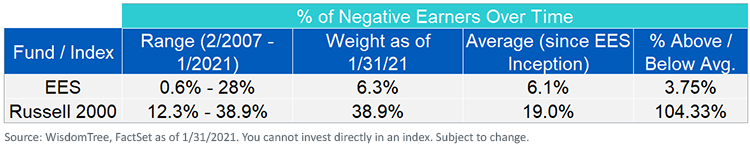

The profitability focus is significant, and its value is evident. The weight of unprofitable companies in the Russell 2000 is nearing 40%, more than twice its average weight since EES’s inception in early 2007. This percentage has also been above its average since mid-2017, signaling that while valuations have gone stratospheric, so has the junk that investors are unknowingly paying for.

On the other hand, the weight of unprofitable companies in EES is sitting right at its long-term average of 6%. Moreover, at the Fund’s annual rebalance, the earnings-weighted methodology systematically reduces the weight to unprofitable companies so that valuations and junk don’t grow unabated.

But How Bad Is Bad?

Despite this, negative earnings are not always an irrefutable sign of a bad investment. For small companies, especially those in their infancy or in nascent markets, it’s common to have negative earnings as the industry grows, operations improve, and consumer recognition and demand for their product or service increases.

That means it’s prudent to examine another metric to discern the health of the small-cap market. We think interest coverage ratios are informative and especially helpful in identifying “zombie companies.”

While there are varying definitions for zombies, the essence is the same: zombie companies barely generate enough cash to service the interest on their debt, instead relying on loans from creditors and external sources to stay afloat.

There’s cause for concern since the interest coverage ratio for the Russell 2000 is a measly 1.5x interest expense, meaning operating earnings (measured by EBIT) are barely enough to service their debts. Furthermore, interest coverage has been on a steady downtrend since about 2011, save for a few brief periods of improvement. The current multiplier is also more than a full point less than its long-term average of 2.7x interest expense.

The underlying companies in EES have much more breathing room, another benefit of the emphasis on positive trailing earnings. Despite the pandemic’s afflictions in 2020, interest coverage has steadily recovered since economic activity cratered, settling in at 3.6x interest expense as of January. This is still slightly below the long-term average of 4.2x interest expense, but the upward trend is encouraging.

Interest Coverage Ratios

Back to the Basics

Now that we know what to be concerned by, we can recognize the attractive opportunities as well. Once again, the story for EES is compelling.

P/E and forward P/E valuations are not even on the same planet, which is reassuring. But profitability measurements such as return-on-equity (ROE) and return-on-assets (ROA) are intriguing as well. EES delivers 10x more ROE and 2% ROA, compared to virtually none for the Russell 2000. That results in about half as much leverage the broader index as well.

Time to Reassess Small-Cap Allocations

Small caps are in a precarious position. Market cap-weighted approaches are forcing investors to pay more than ever for lower quality and inefficient companies.

We believe in the benefits of a long-term allocation to small caps, but what you own is more important than just owning an allocation.

EES has historically delivered healthy underlying companies with controlled valuations, and can be a beneficial way to access an otherwise speculative market.

Originally published by WisdomTree, 2/19/21

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

It is the opinion of WisdomTree that all funds are managed differently and do not react the same to economic or market events. The investment objectives, strategies, policies or restrictions of other funds may differ, and more information can be found in their respective prospectuses. Therefore, we generally do not believe it is possible to make direct fund-to-fund comparisons in an effort to highlight the benefits of a fund versus another similarly managed fund. The information included in this material is based upon data obtained from Facewhich is believed to be accurate. This material is not considered an offer to sell or a solicitation to buy shares of any other funds mentioned herein.