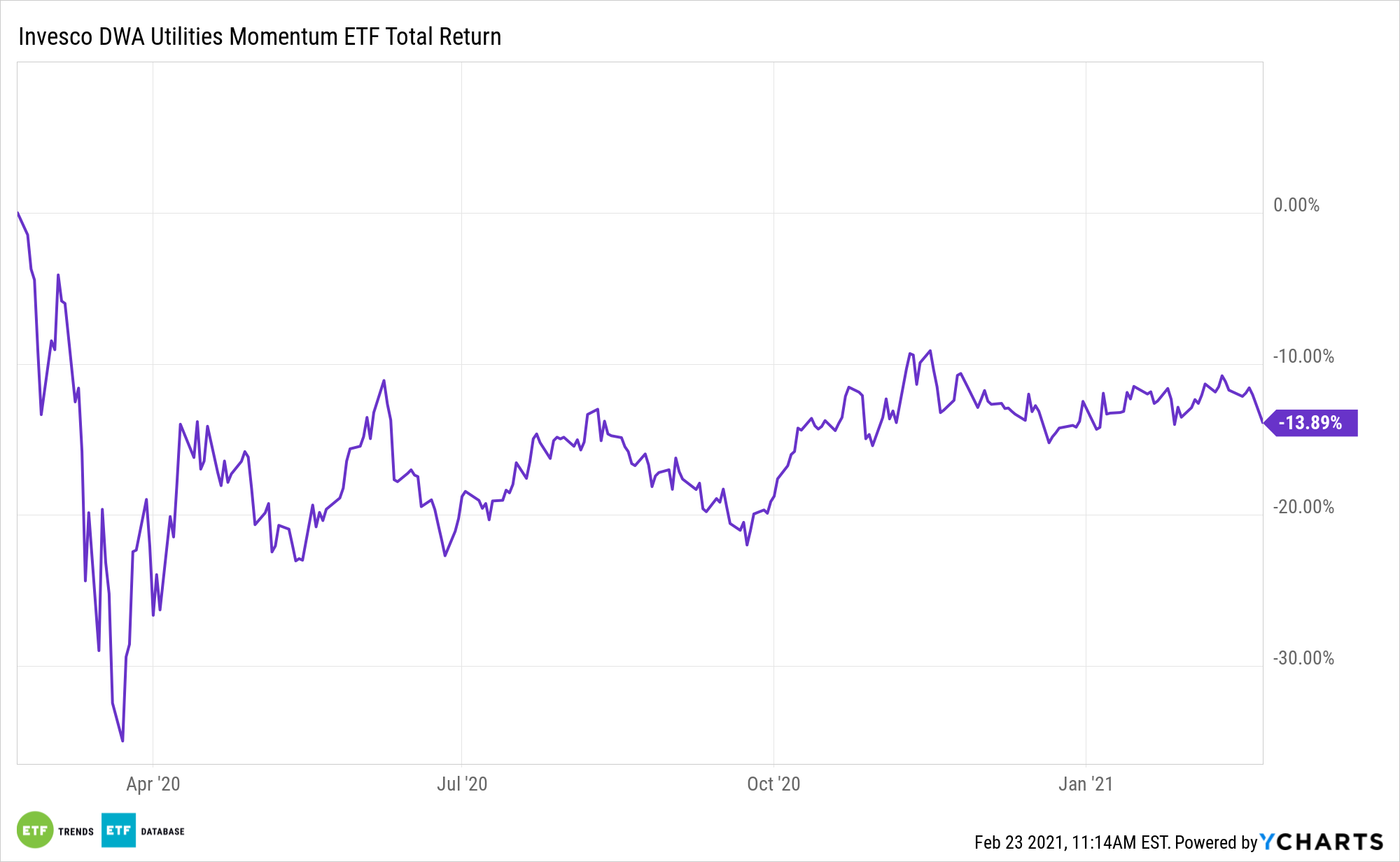

The utilities sector was a 2020 laggard, but the group looks attractive today with exchange traded funds such as the Invesco DWA Utilities Momentum Portfolio (NASDAQ: PUI).

PUI tracks the DWA Utilities Technical Leaders Index. That index “is designed to identify companies that are showing relative strength (momentum), and is composed of at least 30 securities from the NASDAQ US Benchmark Index. Relative strength is the measurement of a security’s performance in a given universe over time as compared to the performance of all other securities in that universe,” according to Invesco.

While 2020 was a rough year for the normally stable sector, the group appears poised for better things in 2021.

“Like many of us, utilities were happy to say goodbye to 2020. They lost all of their early-year momentum when the pandemic hit and have yet to recover,” according to Morningstar. “Utilities closed 2020 as the second-worst-performing sector behind energy and remain down 10% from their peak last February. After record-high valuations in early 2020, the sector pullback means more attractive valuations going into this year. Healthy balance sheets, secure dividends, and growing earnings should give investors comfort that utilities can play their traditional defensive, income-producing role in 2021.”

Lots of Reasons to Like Utilities, PUI

Utilities are typically more stable stocks since the demand for their services, notably electricity and gas, is steady from both consumers and businesses. Moreover, in a lower-for-longer yield environment, utilities come with more attractive above-average dividends.

“Utilities’ dividend yields and growth outlook have rarely been so attractive. The 220-basis-point spread between the sector’s 3.5% dividend yield and the 1.3% 10-year U.S. Treasury yield is near a 30-year high,” adds Morningstar. “The current spread is also well above the average 140-basis-point spread since interest rates began their secular decline during the last two decades.”

Adding to the allure of PUI is the utilities sector’s increasing footprint in the fast-growing renewable energy arena.

“Utilities will be leading investors in renewable energy and supporting infrastructure like transmission and smart grids,” continues Morningstar. “The U.S. is set to add nearly 50 gigawatts of solar and wind generation capacity in 2021-23 based on planned or under-construction projects. That would bring U.S. solar and wind capacity nearly equal to coal generation capacity.”

After recent bouts with volatility, investors are still looking at the bond-esque sector as a safe way to remain the game and generate some extra dividends on the side. Lastly, investors can take comfort in the positive impact disruptive technologies and emerging industries will have on the industry.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.