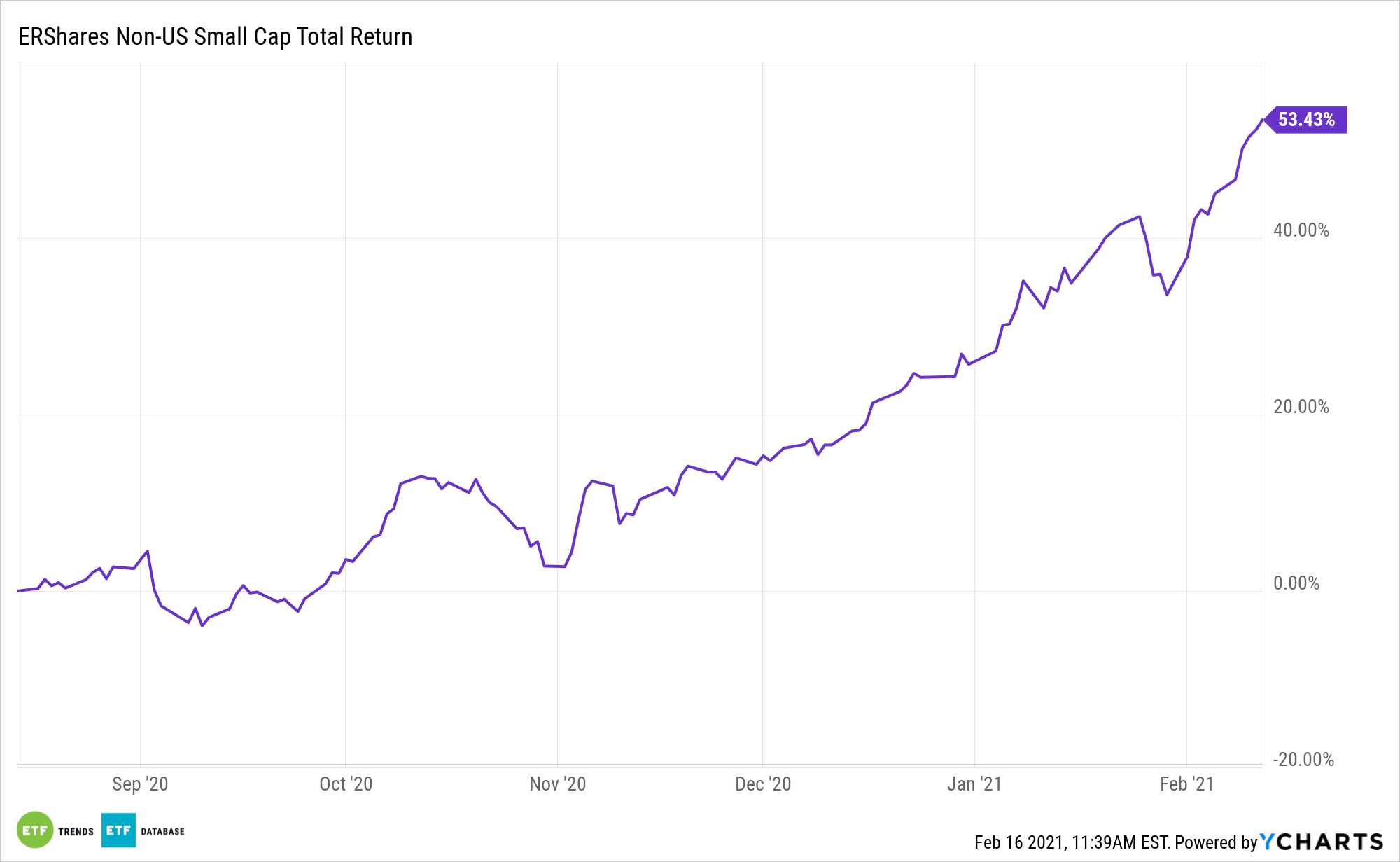

There are often scenarios when investors bid up assets with little regard for fundamentals. The opposite is true of the recent small cap rally and for exchange traded funds such as the ERShares NextGen Entrepreneurs ETF (ERSX).

ERSX selects the most entrepreneurial, primarily Non-US Small Cap companies, that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers compelling performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

“A popular spot targeted by retail investors may deliver the year’s biggest gains. Wells Fargo Securities’ Chris Harvey said he believes the affinity for small caps has merit because growth stocks have gotten so expensive,” reports Stephanie Landsman for CNBC.

Get Good Value with ERSX

Valuations on international equities in both developed and emerging markets are more attractive than what investors find in the U.S., and that’s true of both large- and small-cap stocks. Investors don’t have to pay up for growth with ERSX.

ERSX tracks a fundamental-selected index of global small cap ex-US equities weighted by market capitalization. The fund’s index is benchmarked against the FTSE All-World Ex-US Small Cap Index, a market-capitalization weighted index representing small cap stocks’ performance in developed and emerging markets excluding the United States. The index is derived from the FTSE Global Equity Index Series (GEIS), which covers 98% of the world’s investable market capitalization.

“Harvey, who came into the year bullish on small caps, notes there has been a significant amount of short covering in the group for a while,” according to CNBC.

Small cap shares have made impressive gains on hopes that millions of people will step out from lockdowns, along with bets on a broad pickup in economic growth. As investors look for ways to position their portfolios for the start of the next bull market run, they can look to small-capitalization stocks and related exchange traded funds to get in on the start of the new economic cycle.

For more investing ideas, visit our Entrepreneur ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.