With the dynamic ability to capture upside or to mute the effects of a downturn, active management is all the rage in the ETF world. Here are three actively managed iShares funds to consider.

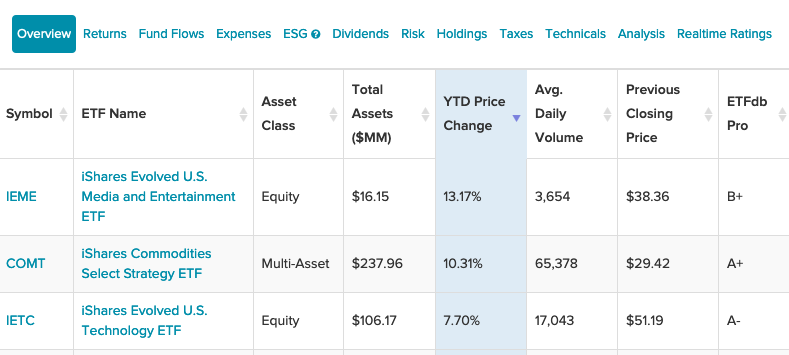

iShares Evolved U.S. Media and Entertainment ETF (IEME): seeks to provide access to U.S. companies with media and entertainment exposure, as classified using a proprietary classification system. It will hold common stock of those companies that fall into the Media and Entertainment Evolved Sector which have economic characteristics that have been historically correlated with companies traditionally defined as media and entertainment companies.

iShares Commodities Select Strategy ETF (COMT): seeks total return by providing investors with broad commodity exposure. The fund seeks to achieve its investment objective by investing in a combination of exchange-traded commodity futures contracts, exchange-traded options on commodity-related futures contracts, and exchange-cleared commodity-related swaps (together, “Commodity-Linked Investments”), thereby obtaining exposure to the commodities markets. It is an actively managed fund that does not seek to replicate the performance of a specified index.

iShares Evolved US Technology ETF (IETC): seeks to provide access to U.S. companies with technology exposure, as classified using a proprietary classification system. It will hold common stock of those companies that fall into the Technology Evolved Sector.

Retirement Plan Sponsors Could Also Get More Active

Per a PlanSponsor article, the shift to active management in retirement plans is becoming more prevalent. As active management turns to a lower-cost structure to compete with passive options, this trend could continue.

One of the advantages of an active management style is strategic diversification.

“[Asset managers] can use quantitative approaches to determine securities that have worse or better expected returns, and what’s called fundamental analysis, which is doing an analysis on individual securities,” said Josh Cohen, head of institutional defined contribution at PGIM.

Active management gives managers the ability to adjust exposure to the ebbs and flows of markets. Per the article, “active strategies are intentionally built by their managers to be different, with the intention of adding excess return or reducing risk relative to the benchmark.”

“This allows the potential for, but not the guarantee of, higher growth in assets over time compared to a passive strategy,” said Sarah Abernathy, a senior investment analyst from Envestnet.

For more news and information, visit the Equity ETF Channel.