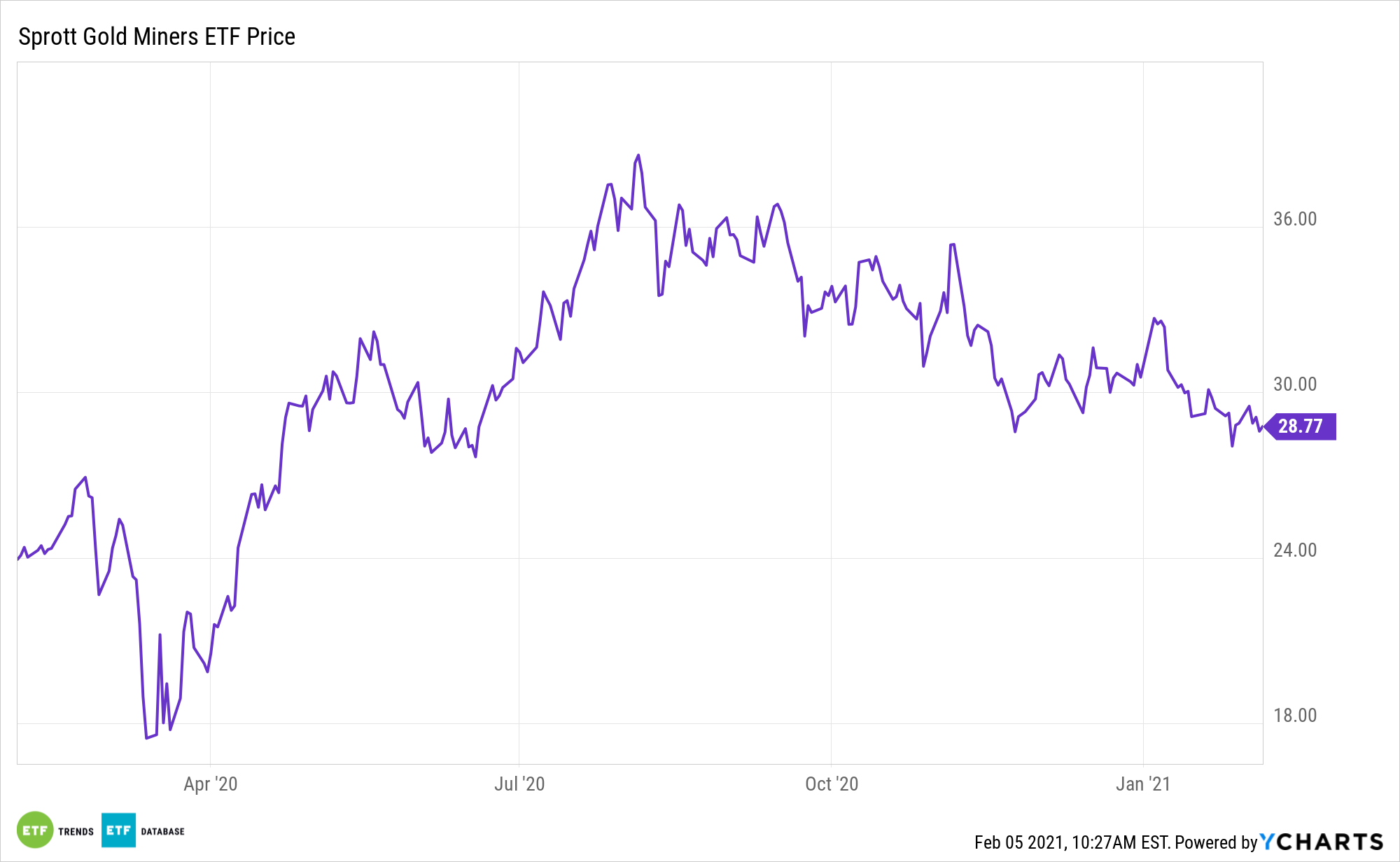

Gold prices pulled back Thursday, but help could be on the way for bullion and exchange traded funds such as the Sprott Gold Miners ETF (NYSEArca: SGDM).

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

“What is worth doing is looking at what were the main drivers of gold’s performance in 2020, and how are they shaping up in 2021,” reports Frik Els for Mining.com. “There is little doubt that buying into exchange-traded funds (ETFs) were the major factor in gold’s strong 2020, with World Gold Council (WGC) data showing a massive 120% surge in inflows to 877.1 tonnes in 2020, up from 398.3 tonnes in 2019.”

Sizing Up the SGDM ETF

It’s no secret that gold has been a major beneficiary during the coronavirus pandemic as a viable safe haven asset amid all the uncertainty in the capital markets. But investors don’t actually have to get pure-play gold exposure in order to reap the benefits of the precious metal. Gold miners offer gold upside with minimal risk.

Adding to the case for SGDM is improving cash flow for many gold miners, the result of not rising gold prices and prudent balance sheet management.

“The pandemic also ensured that interest rates across the world will remain extremely low for an extended period, a factor that traditionally supports gold,” according to Mining.com. “However, it’s also worth noting that the inflows into ETFs, which were strong in the first three quarters, reversed in the fourth, with the WGC numbers showing an outflow of 130 tonnes after a cumulative inflow of 1,007.1 tonnes in the first nine months of the year.”

If jewelry demand bounces back in China and India, SGDM has room for upside as 2021 moves along.

“China’s fourth-quarter jewellery demand was 145.1 tonnes, the most since the fourth quarter of 2019 and up 22.4% from the prior quarter,” concludes Mining.com. “India’s jewellery demand was 137.3 tonnes in the fourth quarter, also the most since the fourth quarter of 2019 and 125.8% up from the prior quarter. If physical demand returns as the global economy improves, and ETF flows and central bank buying remain more or less constant, it’s possible gold will resume a bullish trend in 2021.”

For more on precious metals, visit our Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.