Growth stocks remain a compelling market segment and there opportunities abound for active managers to deliver alpha in this arena. The newly minted Cabot Growth ETF (CBOE:CBTG) brings a fresh approach to the growth factor.

“Cabot ETF Partners is a coalition formed by financial professionals affiliated with Cabot Wealth Network, SkyOak Wealth, and Edge Strategy Group, who combined, have over 50 years of experience advising clients on their investment needs. Each of the owners brings a distinct set of skills to the new company and are excited to provide institutional-quality ETFs to investors and investment advisors,” according to a statement.

Growth stocks are often associated with high-quality, prosperous companies whose earnings are expected to continue increasing at an above-average rate relative to the market. Growth stocks generally have high price-to-earnings (P/E) ratios and high price-to-book ratios. Still, data suggest the growth/value premium isn’t overly elevated relative to historical norms.

More on the New CBTG ETF

Actively managed, CBTG’s portfolio “aims to identify top performers in research & development, next wave technologies, burgeoning consumer, and business trends areas; each deemed capable of experiencing high and sustainable growth,” according to the issuer.

Growth stocks may be seen as exorbitant and overvalued, which may cause some investors to favor value stocks. Yet while they generally have solid fundamentals, value stocks have lost popularity in the market and are considered bargain priced compared with their competitors.

“A distinct feature of CBTG is its implementation of Cabot Wealth’s proprietary Market Timing Indicators, which take an internal assessment of market health and pressures on individual stocks. Within favorable market environments, most of the Fund’s assets will focus on equity securities; however, when indicators point toward a protracted market sell-off, Cabot Growth ETF is able and prepared to increase cash or cash equivalents as a way of managing downside risk,” adds Cabot.

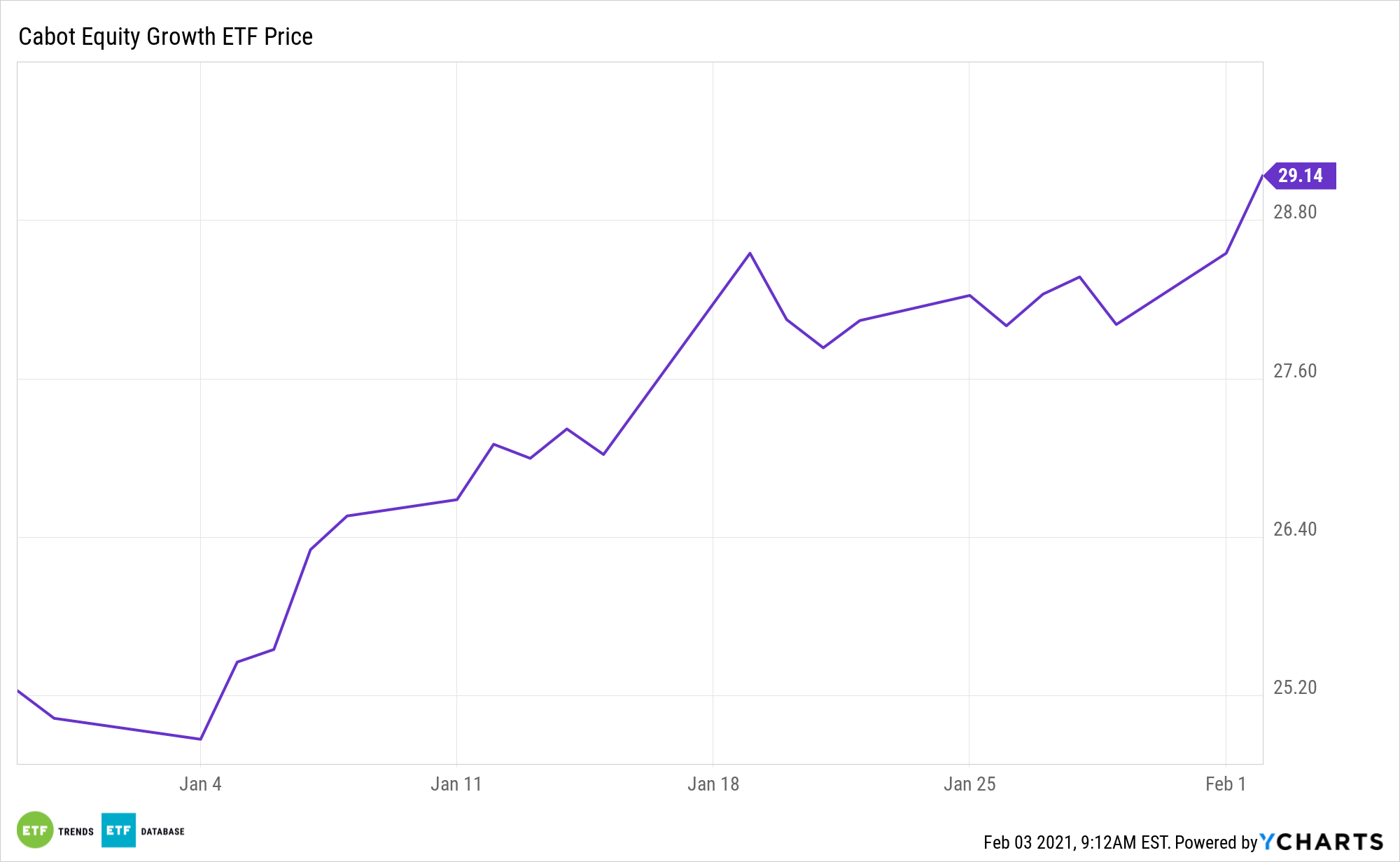

CBTG, which debuted at the end of December, already has $30 million in assets under management. The fund charges 0.77% per year, or $77 on a $10,000 investment.

For more on active strategies, visit our Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.