By Andy Poreda, ESG Research Analyst

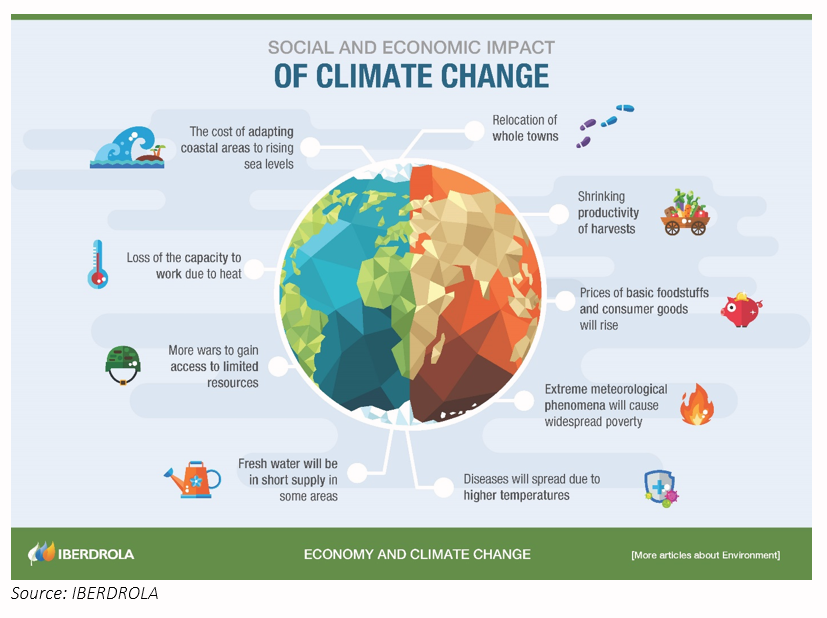

On Wednesday, January 20, less than three months after officially leaving, the U.S. rejoined the Paris Agreement. Though it is not a perfect solution to fight climate change, the 2015 Paris Agreement is a monumental accomplishment. The coalition of nearly 200 countries is aligned on a shared vision of aggressively curbing greenhouse gas (GHG) emissions to prevent irreversible damage on ecosystems worldwide and a shortage of food and water.

The U.S.’ decision in 2017 to leave the Paris Agreement was divisive because it had numerous large supporters, including U.S. states, local municipalities, and Fortune 500 corporations — many of which aggressively stepped up to fill the void. Corporations have sent particularly strong messages and formed alliances to display common climate change alignment. The We Mean Business Coalition, for example, has 1,500 companies with a combined market weight of $25 trillion that have pledged to be carbon neutral, or “Net Zero,” by 2050.

Why by 2050? The Intergovernmental Panel on Climate Change (IPCC) has asserted that the world needs to be carbon neutral by 2050 to limit global warming to 1.5°C relative pre-Industrial Revolution levels (circa 1750). Any further warming would have dire effects on societies worldwide. Many emissions claims made by sustainable-minded corporations focus on trying to do whatever possible to achieve this goal.

Unfortunately, it is not so simple. Although it is easy for a company to stake a claim toward being Net Zero by 2050 or an earlier date, the details of how it achieves that goal are somewhat complicated. Investors will need to delve into the finer points of these climate-related goals, focusing not just on the goals themselves, but more importantly, how they are achieved.

Why 1.5°C Matters

The idea of corporations addressing their environmental impact and its effects on climate change is not a new concept. As early as 1975, companies like SC Johnson were making calculated decisions to ban chlorofluorocarbons (CFCs) from their products to help prevent further damage of the ozone layer, which protects the earth. However, although the corporate focus on climate change may have appeared very gradual over the years, the 2018 IPCC Report signaled a real sense of urgency that action needed to be immediate. Due to the GHG emissions from human activities, the IPCC report noted that Earth had already warmed 1.0°C above pre-industrial levels and was on a path to reach 1.5°C between 2030 and 2052 if GHG emissions continued at current rates.

The environmental impact of 1.5°C versus 2.0°C. Rising sea levels, elevated ocean temperatures, damage on biodiversity and ecosystems, and negative effects on food and water supplies – these can be mitigated to the point where society can adapt with only a 1.5°C rise, provided actions are made now to follow an immediate emissions reduction glidepath.

What is “Net Zero”?

To limit warming to that critical 1.5°C figure, 2050 is the date upon which the world must reach carbon neutrality, or Net Zero. While it is impossible to limit GHG emissions to zero, fortunately there are activities that can mitigate or balance emissions that do occur. Reforestation, for example, could be a critical component in curbing global warming, as trees through photosynthesis absorb CO2 (one of the GHGs); in addition, they also aid nearby soil to absorb it as well. This activity is known as a carbon offset (discussed later) because it is “offsetting” emissions from another source.

Stakeholders, including companies, are actively searching for ways to both limit emissions as well as find projects that can mitigate their contributions to global warming. If a company claims that it can reach Net Zero by a particular date, it is asserting that it has a path to a business model that will not contribute any further to global warming.

This notion seems simple enough, and companies across the globe are jumping on board. We are seeing thousands of businesses join various alliances all pledging their support to be Net Zero by 2050 or earlier. Companies like Microsoft have gone so far as to pledge being carbon negative by 2030, and by 2050, the company plans to mitigate every ounce of GHG emissions it has made since its inception. Even Shell, the third-largest oil and gas company in the world, signed on to be Net Zero.

At the very least, these types of claims should give anyone pause, and to gauge the seriousness of a company’s claims, one should consider the following questions:

- How is a company measuring and reporting on its emissions relative to its Net Zero Goals?

- What actions are a company taking to become Net Zero and are the forecasted results realistic?

- To what extent and how is a company using offsets?

- What near-term and intermediate-term emissions reduction targets does a company pledge?

Only after addressing these questions can we really understand how companies are contributing to either helping or curbing global warming.

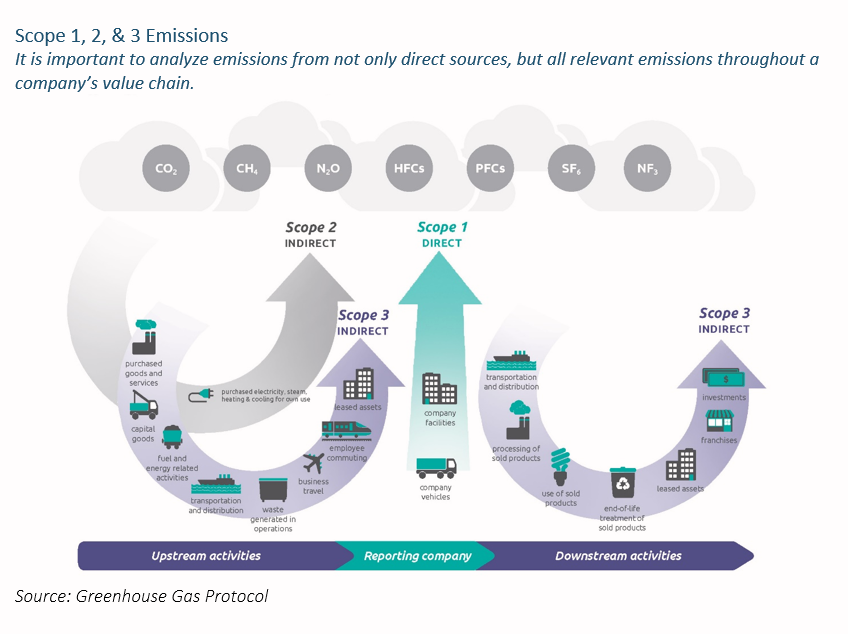

The Three Types of Emissions

There are three types of emissions – appropriately named Scope 1, Scope 2, and Scope 3. Some companies are going to have a large percentage of direct emissions, such the utility company that has a coal-fired powerplant; or the transportation company that has a large fleet of vehicles. These are known as Scope 1 emissions. Other companies have a large proportion of indirect emissions related to their consumption of power, such as a manufacturing company that needs a lot of electricity to power its factories. These are known as Scope 2 emissions.

Historically, we have seen companies do a pretty good job of addressing and analyzing both Scope 1 and Scope 2 emissions. However, there is another set of indirect emissions, known as Scope 3 emissions, that have often been overlooked by many companies in the discussion of climate change. Scope 3 emissions are all the remaining emissions in the value chain that a company is responsible for. They include everything from the emissions that a company’s product generates throughout its lifetime (such as an automobile) to those related to the corporate travel of its employees.

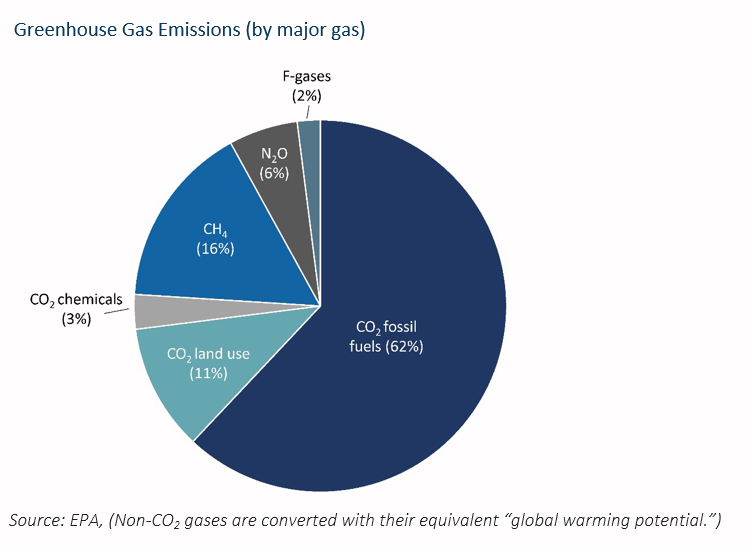

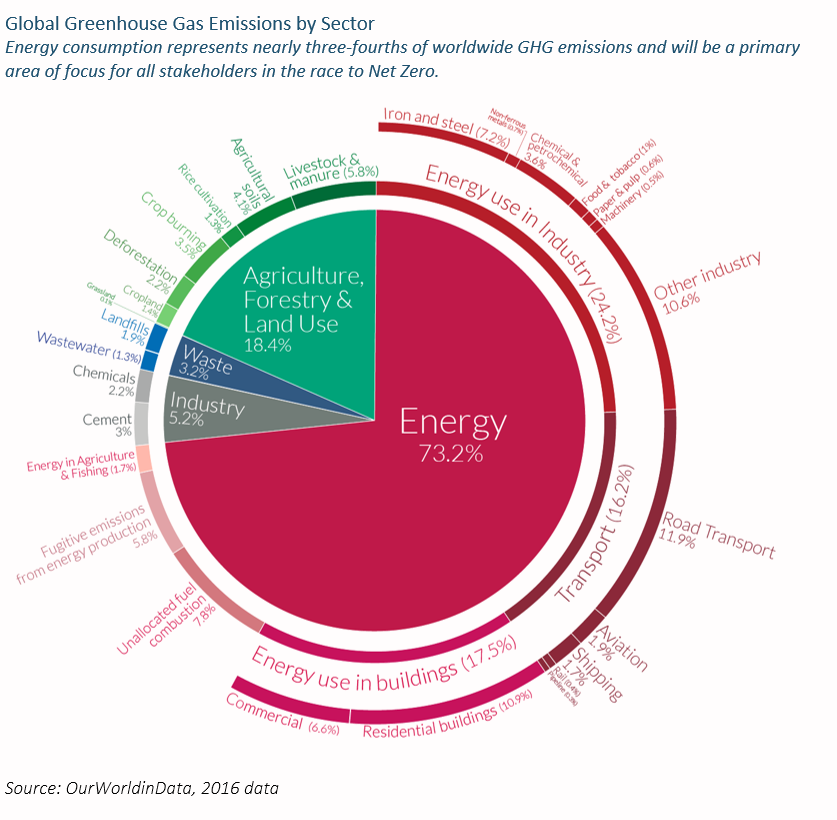

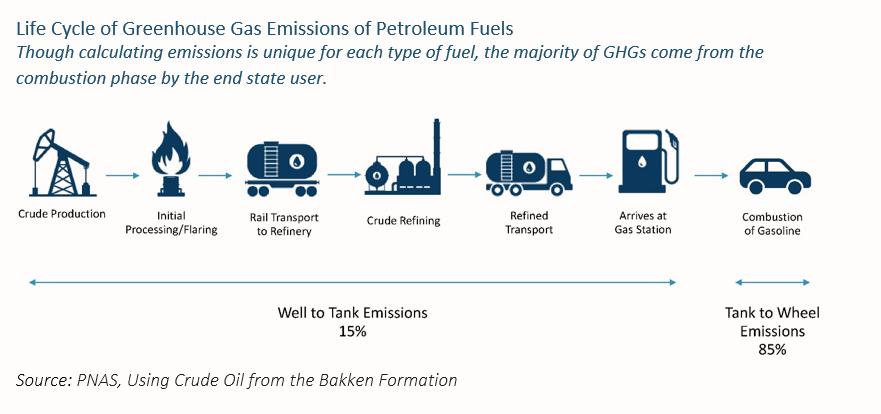

Why are these Scope 3 emissions so important? As an example, even though the oil and gas industry’s extraction and refining activities are energy intensive, some estimates show that over 90% of the industry’s emissions are related to products sold. When international energy leaders, such as Shell, Total, and BP, all make claims of working toward being Net Zero by 2050 but omit most Scope 3 emissions from their calculations, it becomes problematic. Mainly, oil and gas companies focus solely on the direct emissions, and though some indirect emissions are included, the emissions related to their products are largely ignored. This makes the goal of Net Zero difficult to achieve, given that oil and gas are responsible for over half of global GHG emissions in energy consumption worldwide. If a company like Shell claims a Net Zero goal but makes no or few changes to the products it sells to customers, any impact on curbing climate change will be severely limited, no matter how energy efficient the rest of the company’s value chain.

How Can a Company Achieve Net Zero?

To reach a Net Zero Goal, most companies need to find a way to lessen GHG emissions relative to their current levels. How that can be achieved is unique to each industry, but generally each company has four different levers to pull: reduction, innovation, carbon capture, and offsetting. It is vitally important to break up the activities in any Net Zero plan because not all actions are created equal.

Example of Each Net Zero Activity in the Airline Industry

Emissions Reduction

- In 2019 Delta replaced 80 aircraft with planes that were on average 25% more fuel efficient.

New Technology

- In 2019 JetBlue invested in Zunum Aero, an aviation startup focusing on creating hybrid-electric planes.

Carbon Capture

- Last month United Airlines made a large investment in 1PointFive to build an industrial-size plant that can capture carbon and store it underground. * Could be problematic, as they are going to use that CO2 to get more oil out of the ground.

Carbon Offset

- In mid-2020 American Airlines partnered with Cool Effects to voluntarily connect customers with options for participating in offset programs to account for their travel.

Reduction

Emissions reduction is a solid choice for any company to take because it is usually easy for all stakeholders to assess potential benefits and evaluate ongoing results. As an example, Amazon recently promised to buy its fleet 100,000 electric vehicles (EVs) from Rivian by 2030, as part of its 2040 Net Zero Goal. It is relatively easy to calculate the emission benefits of switching from a current vehicle to a new EV, and investors can track the progress along the way as they purchase more vehicles. The only downside is that for some industries, reduction can only take you so far. EQT, the largest natural gas driller in the United States, is considering the use of electric devices in the gas extraction process to reduce Scope 1 emissions for an eventual Net Zero Goal. However, there is no way for EQT to reduce the Scope 3 emissions associated with the usage of their natural gas, limiting the company’s ability to truly mitigate its carbon footprint. So, reduction cannot always be a panacea for many companies in their current form, and they must look for other ways to mitigate climate impact.

Innovation

The area that stands to have the most profound impact on climate change is innovation. If the American economy operates in its current form, no amount of reduction will be able to help the country do its part in limiting global warming to 1.5°C. New technology needs to be a part of the overall strategy, and stakeholders, including both the government and companies, will have to commit resources toward research and development (R&D) to achieve any goal. This could be research spent on advanced power sources, such as nuclear fusion, or continued development to lower costs of a product, like algae-based biofuels. Companies have been rewarded in the past for spending on innovation, and the race to find avenues to help with climate change will be no different. Southern Company, a utility provider, plans to reach “Net Zero by 2050” by leveraging renewable natural gas, advanced nuclear power, and hydrogen as energy sources.

The problem with tying a Net Zero goal to innovation is the potential for the technology to be unsuccessful. Regulatory challenges, safety concerns, or speed of development would be just a few roadblocks that might get in the way of Southern Company’s vision. A Clean Energy Innovation report from the International Energy Agency (IEA) concluded that 35% of the CO2 emissions reduction required to meet the Paris Agreement’s 2C goal hinged on early prototype or development stage (e.g., hydrogen power turbines). Furthermore, another 40% of emissions required rely on “early adoption” technology, such as heat pumps or EVs. Prototype technology may never manifest itself, and costs for early adoption technology may not come down to predicted levels to enable widespread use, so where companies focus research and development expenditures is clearly a very important discussion for Net Zero.

Carbon Capture

If reduction and innovation cannot get us all the way to Net Zero, are there any other ways for companies to reach their goals? Carbon capture, utilization, and storage (CCUS) is an area that has gained traction, especially within the United States, as a method to curb global warming. In this strategy, CO2 is captured from the emissions of either a fossil-fuel power plant or an industrial site (e.g., steel plant), then transported to an underground geological reservoir, such as a former oil field, for permanent storage. Although there are various capturing technologies, and the concept has been around for decades, to date there are only about 51 large-scale sites either operational or in development worldwide (including 10 within the United States). The potential for impact is huge, as a single CCUS site, such as the one at the Occidental Petroleum’s Century Natural Gas Plant in Pecos, Texas, can capture over 27 million tons of CO2 a year, the equivalent of taking 5.4 million cars off the road.

Despite the obvious potential to utilize CCUS technology, the problem ends up being cost. For some industries, such as natural gas processing or petrochemicals, CCUS can be an inexpensive CO2 mitigation measure, according to the consultant BCG. However, in other areas, like coal and natural gas power production, the cost to capture CO2 becomes so expensive that it may make sense to just switch to a renewable power source if Net Zero is desired. But CCUS will likely be a solid Net Zero option for some areas like oil and natural gas exploration. Chevron is betting it will, as the company recently invested $16 billion in Carbon Clean Solutions to develop portable carbon capture technology for oil fields and other industrial facilities.

Even companies outside the fossil fuel realm are trying to use CCUS as part of their Net Zero ambitions. United Airlines plans to account for 10% of its annual carbon emissions through project 1PointFive, a joint venture with Occidental Petroleum Corporation, to create a direct air capture industrial facility (which basically sucks CO2 out of the air), the first of its kind in the United States. Just like with any new technology, it may take years to discern whether facilities like this one are a viable avenue in the fight against climate change.

Offsetting

United’s venture with 1PointFive highlights the notion that some companies are not going to be able to reduce or innovate their way to a Net Zero goal. This is where the idea of offsetting comes in, where companies spend on projects or initiatives to balance out their GHG emissions. Examples of offsetting projects include planting trees in a local community, donating money to a non-profit to help replace open-fire stoves in Guatemala, or creating a sustainable dairy farm in South Africa (Nestle’s new endeavor).

On the surface, all these examples will have distinct, measurable impact on curbing global warming; in practice, however, offsetting has many problems. Due to its popularity, offsetting has essentially become its own industry, with layers of stakeholders that include projects, resellers, and buyers. In addition to the complex nature of the offset world, one must take pause and discern if there are any potential pitfalls to an offset project.

Amazon’s bold initiative to reduce its massive carbon footprint to Net Zero by 2040 is quite impressive and includes a $100 million contribution to the Right Now Climate Fund. One of the projects of this fund includes an effort to pay forest owners across the Appalachian Mountains to utilize their land in ways to capture more CO2 from the air. To be effective, owners must keep the forest healthy with larger trees and cannot cut any trees down for paper products. Though these lands will be preserved, experts are concerned that this will just lead to deforestation elsewhere. This problem is known as leakage and is one of multiple potential problems in the offset world.

Other concerns with offsetting include how long the project will provide GHG emission reduction (“permanence”/ “duration”) and whether a project would have occurred in absence of offset money (“additionality”). And, if every corporation tries to lean too heavily on offsets, eventually there will be very few high-quality offset projects that remain. Because of all these potential pitfalls that limit the impact of any offset project, investors should prefer companies that are seeking to reduce GHG emissions internally before seeking to leverage carbon offset projects.

The Importance of Near-Term and Intermediate Targets

The IPCC’s assertion that the world needs to be Net Zero by 2050 to limit warming to 1.5°C has an emissions reduction glidepath factored into its calculation. If emissions are not reduced from current levels immediately and continuously lowered on a year-to-year basis, the timeline where the 1.5°C level is reached will be accelerated. So, it is imperative that corporations are constantly assessing their path toward Net Zero and overall GHG emissions reductions. Assessment should be an annual or biennial process, especially for companies where the ability to lower GHG emissions might be difficult (e.g., airlines), giving stakeholders the ability to discuss alternate pathways to achieve Net Zero.

Best practice currently seems to be implementing a hard 2030 intermediate goal using a baseline emissions level from a recent reporting period. As an example, General Mills committed to reducing Scope 1 and Scope 2 GHG emissions by 42%, and Scope 3 by at least 30%, all by 2030, using FY 2020 as a base year. Without an intermediate goal, one should highly question a company’s commitment to the Net Zero cause, and investors need to press these companies to showcase the path of emissions reduction, not just the end goal.

Conclusion

All stakeholders have a lot of work to do to limit global warming, but it is exciting to see that U.S. corporations are signaling they are up to the task. Although it may be easier for some companies to follow a path toward Net Zero, it will generally be a challenging one, which will certainly be further shaped by the Biden Administration. Focused efforts on GHG reduction, a commitment to a green energy infrastructure, and large expenditures on research and development need to be focal points for both government and corporate America for the United States to do its part in the fight against climate change. Investors need to be an integral part of the discussion, too, and challenge companies to follow through with their claims, or urge them to set reduction targets if they have not already. Additionally, investors need to ensure that every company is reporting on all emissions throughout the value chain, as well as making sure they limit GHG emissions offsetting and hold them accountable if they are not doing so. Time is not on our side; every moment of inaction by any stakeholder (including companies) only accelerates the timeline to when the world reaches the critical 1.5°C warming level.

Originally published by Sage Advisory

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Sources

- Rott, Nathan. Biden Moves to Have U.S Rejoin Climate Accord. January 20, 2021.

- Secretary-General welcomes US return to Paris Agreement on Climate Change. UN News. Jan 20, 2021.

- The Race to Zero: We Mean Business Coalition. We Mean Business Coalition. January 15, 2021.

- The Paris Agreement. United Nations Climate Change. January 15, 2021.

- Taking CFCs Out of Aerosols. SC Johnson. January 16, 2021.

- Masson-Delmotte, V. et al. IPCC, 2018: Summary for Policymakers. October 8, 2018.

- Smith, Brad. Microsoft will be carbon negative by 2030. January 16, 2021.

- Francis, Thomas. Net Zero by 2050? “Sooner the better”. November 2, 2020.

- CDP Technical Note. Carbon Disclosure Project.

- Kusnetz, Nicholas. What Does Net Zero Emissions Mean for Big Oil? Not What You’d Think. Inside Climate News. July 16, 2020.

- Companies Taking Action. Science Based Targets. January 16, 2021.

- CDP: About Us. Carbon Disclosure Project. January 16, 2021.

- Meisenzahl, Mary. Amazon just revealed its first electric delivery van of a planned 100,000-strong EV fleet- see how it was designed. Business Insider. October 8, 2021.

- Freitas, Gerson Jr. and Naureen Malik. Top US Gas Driller Weighs First Step Towards Net Zero Emissions. November 11, 2020.

- Southern Company Corporate Responsibility: Climate. Southern Company. January 17, 2020.

- Henderson, Chris. Investing in Innovation is Key to Net-zero Emissions. Center for Climate and Energy Solutions. July 28, 2020.

- Gonzales, V, et al. Carbon Capture and Storage 101. Resources for the Future. May 6, 2020.

- Varanasi, Anuradha. You Asked: Does Carbon Capture Technology Actually Work? Columbia Earth Institute. September 27, 2019.

- Dewar, Alex and Bas Sudmeijer. The Business Case for Carbon Capture. September 24, 2019.

- Chapa, Sergio. Chevron Invests in Carbon Capture Technology Company. Houston Chronicle. February 18, 2020.

- Rucinski, Tracy. United Airlines Invests in Carbon-Capture Project to be 100% Green by 2050. December 10, 2020.

- Guatemala Stove Project. Guatemala Stove Project. January 16, 2021.

- Developing Nestlé’s First Net Zero Dairy Farm in South Africa. Nestlé. December 4, 2020.

- Temple, James. How Amazon’s Offsets could Exaggerate its Progress Toward “Net Zero” emissions. MIT Technology Review. November 2, 2020.

- Companies Taking Action. Science-Based Targets. January 17, 2021.