While the capital markets saw retail traders piling into GameStop last week, not all the action was relegated to the video game provider. Direxion Investments saw heightened inflows in their leveraged and sectoral funds.

At the top of the heap was a focus on semiconductors. A heavier reliance on technology is driving a need for chips to process data. Short-term investors in leveraged funds have been capitalizing on the chip trade.

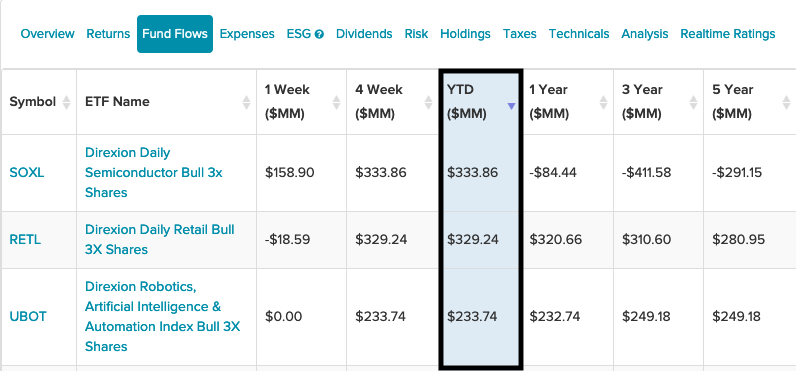

Direxion Daily Semiconductor Bull 3X ETF (NYSEArca: SOXL): for traders seeking a leveraged trade, SOXL seeks daily investment results, before fees and expenses, of 300% of the daily performance of the PHLX Semiconductor Sector Index. The fund, under normal circumstances, invests at least 80% of its net assets in financial instruments, such as swap agreements, and securities of the index, ETFs that track the index, and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index. The index measures the performance of domestic companies engaged in the design, distribution, manufacture, and sale of semiconductors.

Direxion Daily Retail Bull 3X ETF (RETL): RETL seeks daily investment results of 300% of the daily performance of the S&P Retail Select Industry Index. RETL invests in securities found within the index, which is a modified equal-weighted index that measures the performance of the stocks comprising the S&P Total Market Index. The fund has successfully been able to parry the effects of the pandemic since the sell-offs in March, giving bullish retail traders much to cheer about to end 2020.

As of January 29, the aforementioned GameStop frenzy was responsible for RETL’s run higher the past week. The stock comprises about 12% of the fund.

Robotics & AI Bull 3X ETF (UBOT): seeks daily investment results equal to 300 percent of the daily performance of the Indxx Global Robotics and Artificial Intelligence Thematic Index, which is designed to provide exposure to exchange-listed companies in developed markets that are expected to benefit from the adoption and utilization of robotics and/or artificial intelligence.

Overall, all three funds provide traders with the ability to

- Magnify short term perspective with daily 3X leverage;

- Go where there’s opportunity, with bull and bear funds for both sides of the trade; and

- Stay agile, with liquidity to trade through rapidly changing markets

For more news and information, visit the Leveraged & Inverse Channel.