ETF provider DWS offers a plethora of products that enable investors want to get tactical with their portfolios. When it comes to their current top-performing funds, three stand out among a very distinguished crowd.

It appears that investors are once again diving back into the risk pool with emerging markets. While China might be deemed a the safest bet, other funds are also churning out strong performances in the new year.

Broad China Equities Exposure

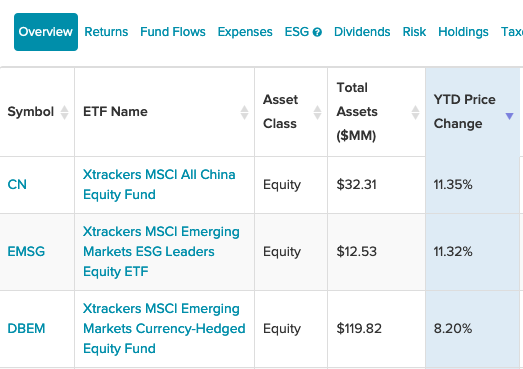

At the top of the list is the Xtrackers MSCI All China Equity ETF (CN), which is up 11.35% year-to-date. CN seeks investment results that correspond to the performance, before fees and expenses, of the MSCI China All Shares Index.

The fund will normally invest at least 80% of its total assets in securities of issuers that comprise either directly or indirectly the underlying index or securities with economic characteristics similar to those included in the underlying index. The underlying index is designed to capture large- and mid-capitalization representation across all China securities listed in Hong Kong, Shanghai, and Shenzhen.

CN’s net expense ratio comes in at at 0.50%, while the fund is up almost 50% within the past year.

An Appetite for EM

More investors are returning to emerging markets after tiptoeing those EM assets during the pandemic. The Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF (EMSG), which gives investors emerging markets and environmental, social, and governance (ESG) exposure at a low 0.20% expense ratio, is up 11.32% so far this year.

EMSG seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI Emerging Markets ESG Leaders Index. The fund will invest at least 80% of its total assets (but typically far more) in component securities of the underlying index.

The fund is up 32% the past year.

Rounding out the top three is the Xtrackers MSCI Emerging Markets Hedged Equity ETF (DBEM). DBEM seeks investment results that correspond generally to the performance of the MSCI EM US Dollar Hedged Index.

The fund, using a “passive” or indexing investment approach, seeks investment results that correspond generally to the performance of the underlying index, which is designed to track emerging market performance while mitigating exposure to fluctuations between the value of the U.S. dollar and the currencies of the countries included in the underlying index. The fund’s net expense ratio is 0.66%. DBEM is up over 26% within the past year.

For more news and information, visit the Smart Beta Channel.