Getting quality exposure to monthly dividends doesn’t have to come with a high expense ratio. The Global X S&P 500 Quality Dividend ETF (QDIV) offers ETF investors an annual dividend rate of about 3% with a low 0.20% expense ratio.

The fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the S&P 500® Quality High Dividend Index. The fund invests at least 80% of its total assets in the securities of the underlying index.

The underlying index is designed to provide exposure to U.S. equity securities included in the S&P 500® Index that exhibit high quality and dividend yield characteristics, as determined by Standard & Poor’s Financial Services LLC, the provider of the underlying index.

QDIV gives investors:

- Quality Focus: QDIV invests in companies that score in the top 200 of the S&P 500 based on a variety of quality metrics including return-on-equity, accruals, and financial leverage.

- High Income Potential: To qualify for QDIV, a company must score in the top 200 of the S&P 500 in dividend yield.

- Monthly Distributions: QDIV makes distributions on a monthly basis.

If monthly dividends weren’t enough, QDIV is up 22% the last six months as it returns to its pre-pandemic levels. The fund is up a healthy 4% thus far in 2021.

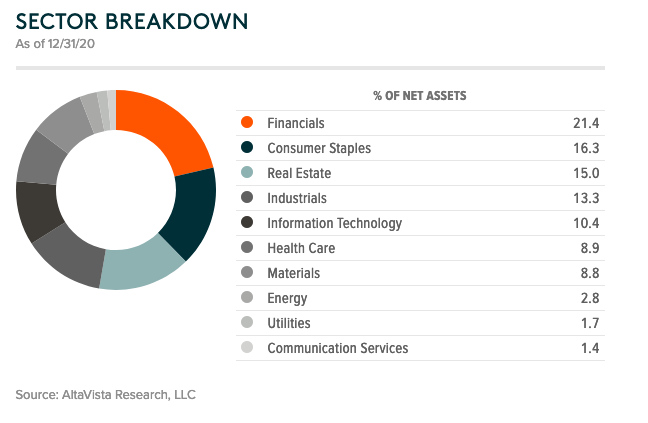

Looking at its top holdings, investors can see a heavy emphasis on financials, followed by consumer staples and real estate. The fund’s top holding is in NRG Energy Inc, but tops out at just 1.79% of net assets. QDIV is never too heavily allocated toward any one stock.

Economic Recovery Will Drive Fixed Income

With yields still low, the fixed income environment in 2021 will largely depend on an economic recovery. As a ThinkAdvisor article writes, “the performance of the U.S. fixed income market in 2021, like most financial markets, will depend largely on the extent of the economic recovery, which in turn, depends on the trajectory of the coronavirus pandemic and the distribution and uptake of vaccines that can stem its spread.”

“The Federal Reserve said as much in its latest policy statement: ‘The path of the economy will depend significantly on the course of the virus,'” the article stated further. “The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.'”

For more news and information, visit the Thematic Investing Channel.