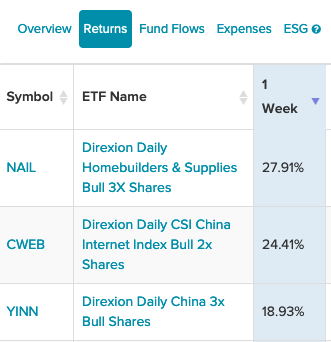

Low interest rates and strong demand are feeding into strength for home builders. The Direxion Daily Homebuilders and Supplies Bull 3X Shares (NAIL) was Direxion’s strongest leveraged performer the past week, gaining almost 30%.

NAIL looks to deliver triple the daily returns of the Dow Jones U.S. Select Home Construction Index. Strength in home builders has been apparent as of late, as NAIL has gained 65% within the past six months.

NAIL is still trying to get to pre-pandemic levels from last year, but it’s got momentum on its side. The relative strength index (RSI) is showing a 72.68, which is at overbought levels in its six-month chart.

An additional indicator, the moving average convergence divergence (MACD), is showing the exponential moving average (EMA) above the signal. This further confirms the strong momentum.

Its previous high in the six-month chart, $64.71, will be a key level to watch in the coming weeks. That resistance level could be tested, especially after the golden cross, where the 50-day moving average moved past the 200-day moving average on September 22. 2020.

Low Confidence, But Strong Demand

The rise in NAIL comes after National Association of Home Builders’ monthly confidence index dropped three points to a reading of 83 in January. According to a Realtor.com article, “a combination of factors drove the decline in confidence among builders.”

“Demand for newly-built homes is still strong. Interest rates remain near historic lows, and there’s a shortage of homes for sale that is pushing more buyers into the market for new homes,” the article added. “Builders’ concerns mostly relate to issues on the supply side.”

“A shortage of buildable lots is making it difficult to meet strong demand and rising material prices are far outpacing increases in home prices, which in turn is harming housing affordability,” Robert Dietz, chief economist for the National Association of Home Builders, said in the report.

The pandemic has certainly changed the landscape of real estate with a lesser need for office space due to social distancing measures. More employees are using their homes as their offices now, which could be helping to spur the demand for more homes.

In addition, builders are changing the way they do business amid the new normal of social distancing.

“Developers have become adept and experienced at selling homes virtually, but rocketing COVID cases and deaths aren’t good for confidence,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

For more news and information, visit the Leveraged & Inverse Channel.