The Covid-19 pandemic couldn’t stop the global ETF market in 2020, as the industry took in $7.6 trillion. Traders feeding off the bullish sentiment in the ETF space can use leveraged funds like the Direxion Daily S&P 500® Bull 3X Shares ETF (SPXL) to capitalize on the industry’s growth in 2021.

“Data from TrackInsight, provider of TrackInsight™ Global View, shows the global ETF market finished 2020 at a record high of $7.6 Trillion across 6,518 ETFs,” a Nasdaq article said. “A combination of strong equity market performance coupled with accelerating investor inflows contributed to the new record.”

In capitalizing on that strong equity market performance, the S&P 500 is a great place to start. The benchmark index gained 12% the last three months. Traders looking to amplify their returns can get in with SPXL.

SPXL, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments, such as swap agreements, and securities of the index, ETFs) that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

Within the same 3-month time frame, SPXL is up almost 40% and providing about thrice the return of the S&P 500.

ETFs Passed 2020 with Flying Colors

The Covid-19 pandemic certainly threw a wrench into the capital markets’ plans of building off 2019, but the ETF space was only temporarily affected. 2021 will only see the ETF space grow as providers scramble to offer products that differentiate themselves from the masses.

“ETFs faced an acid test in 2020 and passed with flying colors. The tremendous growth we have witnessed demonstrates how ETFs have successfully convinced investors of the benefits of a liquid, tradable and transparent product – especially during volatile markets,” said Anaelle Ubaldino, Head of ETF Research and Investment Advisory at TrackInsight.

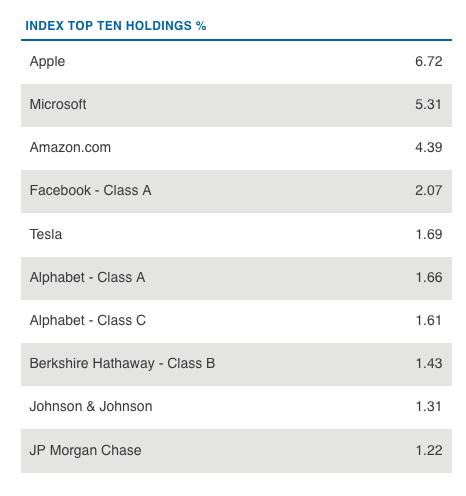

Looking at SPXL’s top holdings, investors will see familiar names within the S&P 500. The holdings include Apple, Microsoft, and Amazon.

The relative strength index (RSI) can be used in tandem with the stochastic relative strength index (StochRSI) to confirm momentum. The RSI reading is just below overbought levels at 67.77, while the StochRSI reading also confirms strong momentum at 0.814.

As the global economy continues to heal following a vaccine rollout, look for SPXL to continue its upward trajectory after its 50-day moving average crossed over the 200-day moving average in late August.

For more news and information, visit the Leveraged & Inverse Channel.