China’s dominance in the rare earth metals industry can keep on fueling the VanEck Vectors Rare Earth/Strategic Metals ETF (REMX). A number of the fund’s top holdings are in China, which also gives investors international exposure.

REMX, which is up over 70% in the past year alone, seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® Global Rare Earth/Strategic Metals Index. The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark index.

The index includes companies primarily engaged in a variety of activities that are related to the producing, refining, and recycling of rare earth and strategic metals and minerals.

Speaking of momentum, we can use technical indicators to confirm whether the uptrend may still have legs. With a relative strength index (RSI) indicator, REMX is just above overbought levels, so momentum is indeed strong.

However, a stochastic relative strength index (StochRSI) shows a level of 0.349, which is just above oversold levels. The two opposing indicators could mean REMX still has room to run, or that a drop could take place to test a support level of about $73.

What traders can watch is to see if REMX can breach the high of $79.67 made on January 8. If buyers can break that resistance barrier, more upside could be ahead for this rare earth metals ETF.

China’s Virtual Monopoly

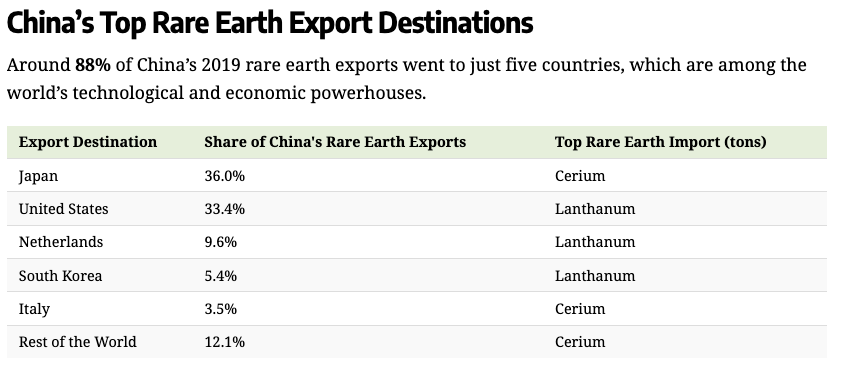

A Visual Capitalist article discussed China’s sheer dominance in the rare earth metals industry. Per the article, “as the world transitions to a cleaner future, the demand for rare earth metals is expected to nearly double by 2030, and countries are in need of a reliable supply chain.”

“China’s virtual monopoly in rare earth metals not only gives it a strategic upper hand over heavily dependent countries like the U.S.—which imports 80% of its rare earths from China—but also makes the supply chain anything but reliable,” the article added further.

For more news and information, visit the Tactical Allocation Channel.

For more news and information, visit the Tactical Allocation Channel.