Commodity exchange traded funds (ETFs) are surging higher driven by the commitment by the financial administrators from the Group of 20 Nations to stabilize the currency markets by avoiding competitive currency devaluations.

In a statement released at the conclusion of their two-day meeting in South Korea on Saturday, it was reported that they would “move toward more market-determined exchange rate systems that reflect underlying economic fundamentals and refrain from competitive devaluation of currencies.” In response to this announcementm traders are selling dollars which is pushing commodity prices higher in early trading – the dollar is at a 15-year low against the yen. CurrencyShares Japanese Yen (NYSEArca: FXY) is up more than 1%. [The Rush to Foreign Currency ETFs.]

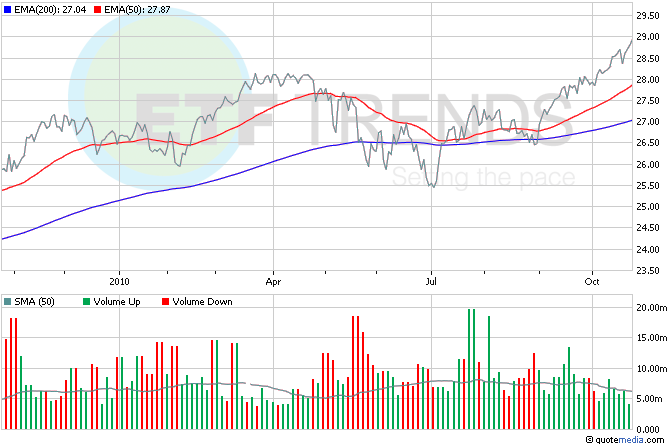

Consumer staple ETFs are up in early morning trading led by Office Depot Inc. (NYSE: ODP) which is up big today by more than 10%. The company announced that it expects a third-quarter profit instead of a quarterly loss estimated by some analysts. RadioShack Corp. (NYSE: RSH) is another retailer that topped analysts estimates by reporting a 23% increase in third-quarter income compared to the year earlier. Consumer Staples Select Sector SPDR (NYSEArca: XLP) is up 0.6% in trading today. [Retail ETFs Hold Strong.]

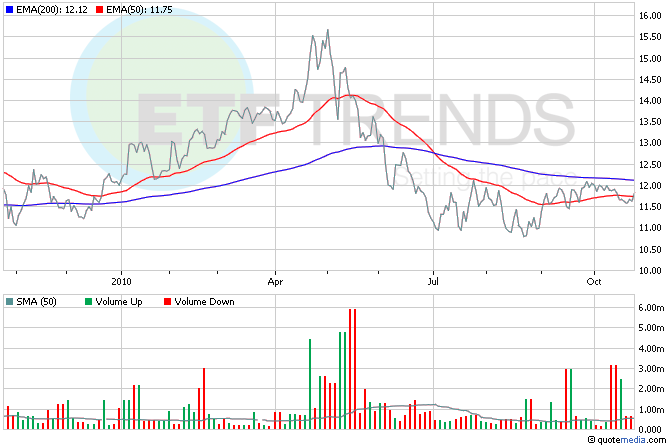

Existing home sales surged 10% in September, but few are cheering the numbers. They’re down 19% from a year earlier and sales are not moving at a rate deemed “healthy.” iShares Dow Jones U.S. Home Construction (NYSEArca: ITB) is up nearly 2% this morning. [Homebuilder ETFs Wait on Recovery.]

Read the disclaimer; Tom Lydon is a board member of Rydex|SGI.

Gregory A . Clay contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.