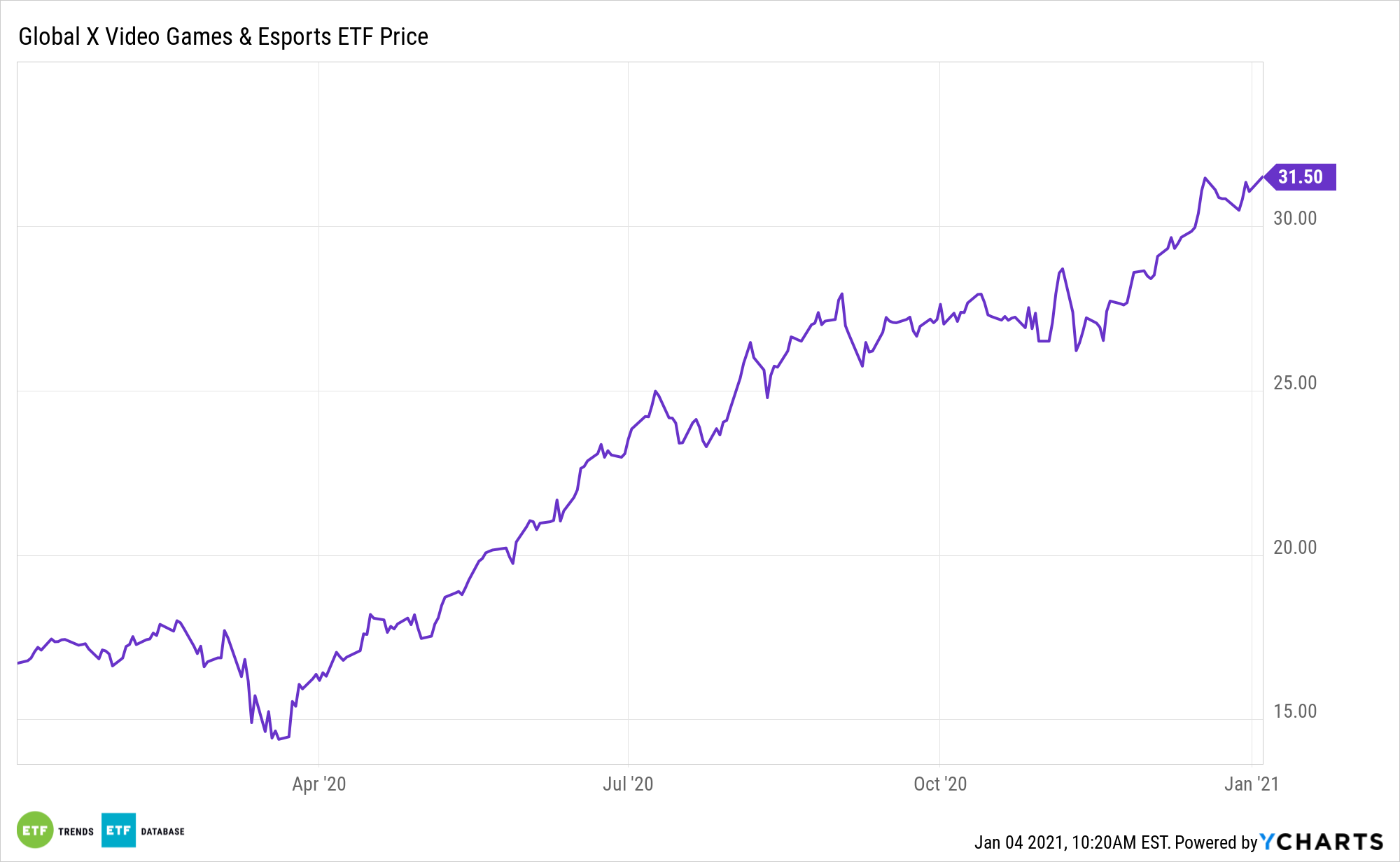

The Global X Video Games & Esports ETF (NASDAQ: HERO) did not disappoint last year. The fund surged nearly 90% while hauling in more than $446 million in new assets.

HERO “seeks to invest in companies that develop or publish video games, facilitate the streaming and distribution of video gaming or esports content, own and operate within competitive esports leagues, or produce hardware used in video games and esports, including augmented and virtual reality,” according to Global X.

Due in part to shelter-in-place orders forced by the coronavirus pandemic, the gaming industry notched stellar growth.

“According to data from the International Data Corporation (per MarketWatch), global gaming revenue is expected to be around $197.7 billion by the end of the year (2020),” reports Tyler Treese for GameSpot. “That’s up roughly 20% from last year, and the significant rise can be contributed to the pandemic, the continued success of the Nintendo Switch, and the console launches for PlayStation 5 and Xbox Series S and X.”

Could Esports Even Overtake Traditional Ones?

Video games and Esports will continue to shine beyond the pandemic. The HERO ETF can also serve as an international diversification tool, as one of the fund’s top 10 holdings (as of December 11) includes Japanese video game developer Capcom. Mobile gaming is yet another emerging catalyst for HERO.

“While console sales are on the rise, the biggest boost in gaming revenue has come from mobile gaming. Smartphone titles have seen an overall revenue boost of nearly 25% and are now up to a projected $87.7 billion. A bulk of that revenue comes from Asia and the Pacific region, as it makes up $56.6 billion,” according to GameSpot.

The explosive growth of esports could even power the space past traditional sports, where revenue generation is now heavily tilted towards enhancing a fan’s multimedia experience. Adding to the HERO case is data confirming just how much gaming spending is soaring.

“This data backs up a report from The NPD Group last month, which says that gaming spending in the US has risen 22% to $44.5 billion during the first 11 months of 2020. Gaming hardware makes up roughly $4 billion of that amount, while over $38 billion comes from software. The most significant rise is the number of consumers playing games as it has risen to 79% of the US,” adds GameSpot.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.