The focus on better-than-expected earnings and profit results reported by companies in recent days appears to be moving the markets and exchange traded funds (ETFs) up again in early trading.

Further adding to the upward push is the U.S. Labor Department’s report that jobless claims fell 23,000 last week to 452,0000. A reported poll of economists had expected initial claims to fall to 450,000. It’s a step in the right direction, but make no mistake: joblessness is still elevated.

Among the positive earnings the markets saw this morning:

- Stock of McDonald’s (NYSE: MD) is surging up more than 2% in early trading after the fast-food giant said third-quarter revenue and profit exceeded the prior year and beat analysts’ projections. PowerShares Dynamic Food & Beverage (NYSEArca: PBJ) is up nearly 1%; McDonald’s is 5% of the ETF. [Fast Food ETFs: Where the Consumers Are.]

- Shares of Peoria, IL based construction equipment maker Caterpillar (NYSE: CAT) are down approximately 1% today, though the company reported third-quarter revenue and profit that soared above the year-prior and exceeded estimates. SPDR Dow Jones Industrial Average (NYSEArca: DIA) is up about 0.6%; Caterpillar is 5.4% of the ETF.

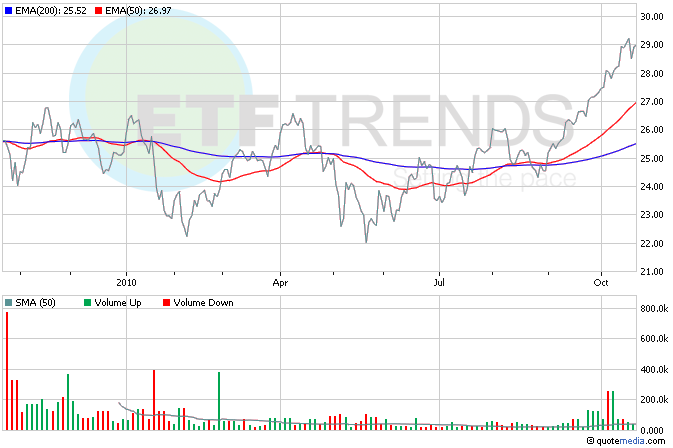

China’s economic growth cooled in the third-quarter but did exceed expectations. China’s National Bureau of Statistics reported the economy grew 9.6% in the third-quarter compared to last year. The country is attempting to slow growth to a more manageable level to keep a lid on inflation. Guggenheim China All-Cap (NYSEArca: YAO) is up 0.6% so far this morning; it’s up 14.6% in the last three months. [ETF Spotlight on Chindia ETF.]

Gregory A. Clay contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.