The search for added yield and income can take investors to some unique asset classes, including business development companies (BDCs). Often high-yielding, BDCs are accessible in the form of an exchange traded fund with the Market Vectors BDC Income ETF (NYSEArca: BIZD).

BIZD gets down to business by seeking to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® US Business Development Companies Index. The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark index.

BDCs offer attractive income opportunities since they are required to pay out 90% of income in form of dividends, a structure similar to what income investors find with real estate investment trusts (REITs).

“Business Development Companies (BDCs) are one alternative income source investors may consider when looking to enhance yield in their portfolio,” writes VanEck analyst Coulter Regal. “BDCs issue common stock and generate income by lending to, and investing in, private companies that tend to be rated below investment grade or unrated and are generally difficult to access. This private credit nature of BDCs, paired with their pass through tax treatment, has historically provided high income potential to investors with yields often near double digits.”

BDCs Stepping in for Banks

BIZD components help fund small $5 million to $100 million businesses. Ever since the financial crisis, regulators have clamped down on traditional lenders and made it harder for businesses to access public capital, which has forced smaller business to take loans from BDCs.

BDCs act as an alternative to bank loan debt, helping smaller companies grow. They profit off of the investments, which in turn help investors gain exposure to the growth and income potential of these privately-held companies. In an expanding economic environment, BDCs should also benefit from stronger domestic businesses and low interest rates.

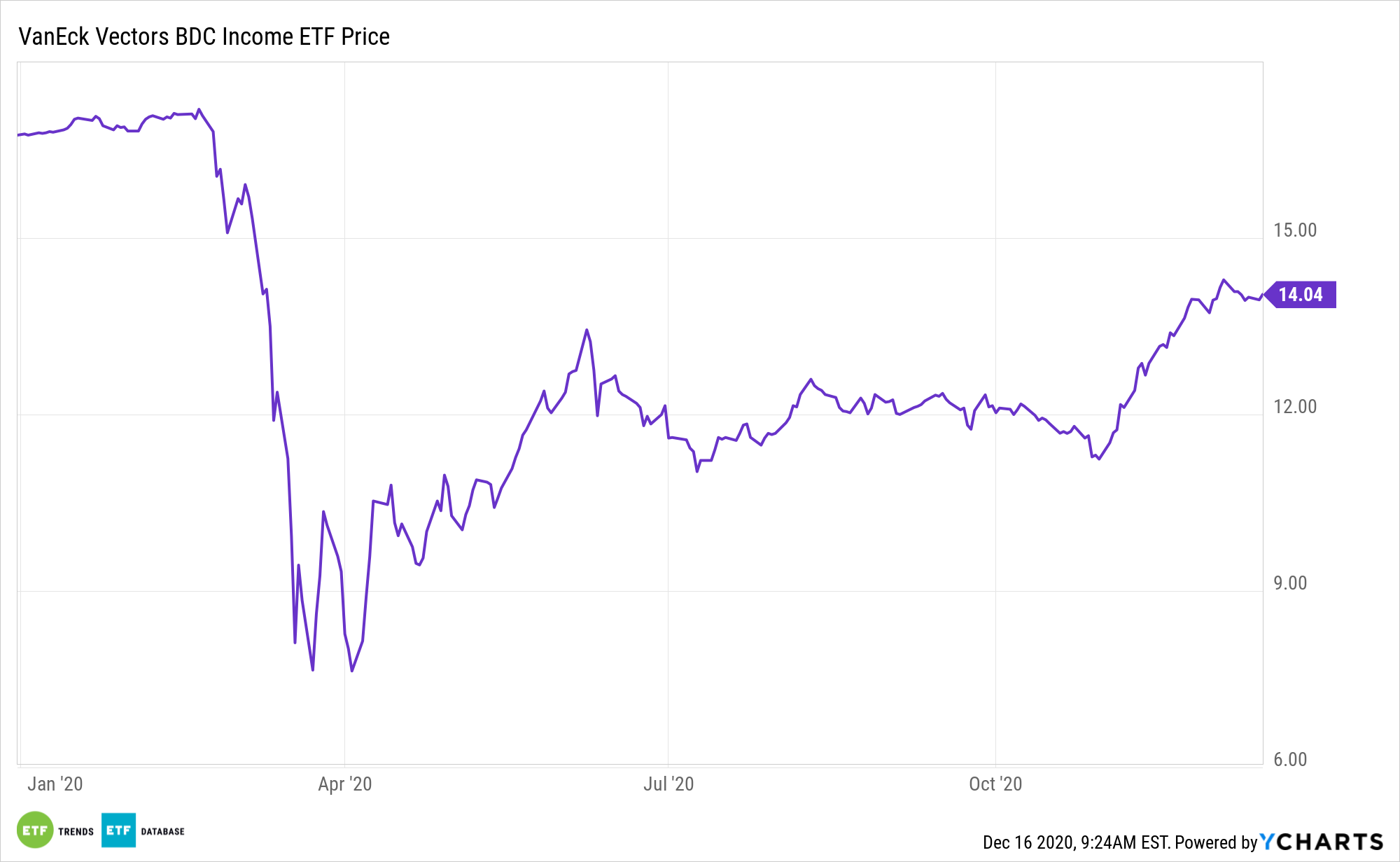

“The yield on the benchmark 10 Year U.S. Treasury spiked in early November, but has since traded down, ending the month flat compared to October,” notes Regal. “Most other income categories saw rising prices and declining yields, as spreads narrowed during the month, with the U.S. election results and positive vaccine news spurring optimism for economic growth. With this recent optimism, there is some growing expectation that rates could begin to rise again. However, we believe any substantial increases are unlikely, meaning the search for yield may still continue for many income investors in the near term.”

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.