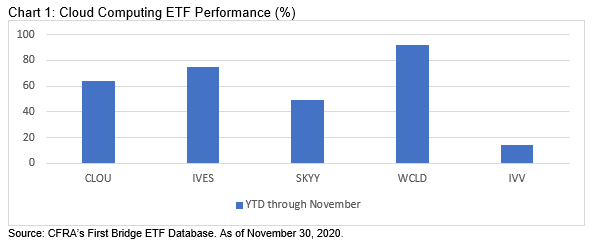

With many Americans working or attending school at home, cloud computing investments have soared. Some of the best performing non-leveraged ETFs in 2020 have cloud in their names, as the stocks inside have climbed higher. Year-to-date through November, WisdomTree Cloud Computing Fund (WCLD) skyrocketed 92%, while peers Wedbush ETFMG Global Cloud Computing Technology ETF (IVES), Global X Cloud Computing ETF (CLOU), and First Trust Cloud Computing (SKYY) rose 75%, 64%, and 49%, respectively. These ETFs are constructed differently according to CFRA Research, as their performance records suggests, but investors will generally find growth companies such as CloudFare (NET) and Zoom Video Communications (ZM) inside. Cloud computing software sales accelerated as companies and consumers turned to internet-based software-as-a-service solutions like videoconferencing.

In addition to buying cloud-related stocks, investors added $3 billion to these four thematic ETFs in the first 11 months of 2020, pushing their combined asset bases to $8.2 billion per First Bridge ETF data. CLOU and WCLD launched in 2019 but each has over $1 billion in assets as investors are not waiting three years, as they often do with mutual funds, before reviewing an ETF. CFRA rates both based on our combination of holdings-level and fund-specific analysis.

Some successful thematic ETF launches in 2020 have benefited from the new normal. CLOU and WCLD are not the only ETFs focused on the long term and with less than a three-year record to appeal to investors. Indeed, some of the more successful launches of 2020 are connected to investment themes that benefit as Americans stay inside for longer.

For example, Global X Telemedicine & Digital Health ETF (EDOC) launched in July 2020, with a focus on companies involved in telemedicine, health care analytics, connected health care devices, and administration digitization such as Agilent Technologies (A) and Tandem Diabetes (TNDM). The ETF already had $490 million in assets as of the end of November.

In June, Direxion Work from Home ETF (WFH) and Roundhill Sports Betting and iGaming ETF (BETZ) came to market, targeting different aspects of a staying inside lifestyle. WFH combines four themes—remote communications, cloud computing, cybersecurity, and online project and document management—in one portfolio, while BETZ owns companies that operate online gambling and sports betting platforms or that provide the infrastructure and technology to those companies. Rather than visiting in-person casinos, many people have shifted to online gaming. Both funds have built their asset bases to more than $150 million in assets as of November.

While CFRA provides ratings on equity and fixed income ETFs, regardless of asset size, many investors either will not consider an ETF or are precluded from doing so if a fund has under $100 million. Once a fund passes this milestone, asset growth can persist. Even as vaccines emerge in 2021, we expect many companies to continue a socially distant approach with their workforce.

Year-to-date through November, these next generation trend ETFs pulled in $29 billion, equal to a whopping 69% of their asset base, according to State Street Global Advisors.

In years past, investors had to buy individual stocks tied to long-term themes in hopes they would pan out. However, the growing supply thematic ETFs the last few years positions the industry for additional asset growth, beyond the popular market-cap weighted equity and fixed income funds that hold most ETF assets. CFRA rates more than 1,800 equity and fixed income ETFs based on a combination of holdings-level analysis and fund attributes, which allows us to begin coverage of many funds within the first three months.

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.