As the anticipation of a COVID-19 vaccine grows, positivity is giving the capital markets a boost, but as sellers start to do their profit-taking the markets should dip, adding another dose of volatility to an already interesting year. If traders like this high correlation to the movement of the major indexes, they might want to tap into their sensitive side using high beta funds with leverage like the Daily S&P 500® High Beta Bull (HIBL).

HIBL seeks daily investment results, before fees and expenses, of 300% of the daily performance of the S&P 500® High Beta Index. The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments that track the index and other financial instruments that provide daily leveraged exposure to the index or to ETFs that track the index.

The index provider selects 100 securities to include in the index from the S&P 500® Index that have the highest sensitivity to market movements, or “beta” over the past 12 months as determined by the index provider. If you’re familiar with Direxion’s leveraged funds, you may already know they provide the ability for traders to:

- Magnify short-term perspective with daily 3X leverage;

- Go where there’s opportunity, with bull and bear funds for both sides of the trade; and

- Stay agile with liquidity to trade through rapidly changing markets

High beta fund aren’t for the weak at heart, so Investopedia gives a quick primer:

“High beta index companies exhibit greater sensitivity than the broader market. Sensitivity is measured by the beta of an individual stock. A beta of 1 indicates the asset moves in line with the market. Anything less than 1 represents an asset less volatile than the market, while greater than 1 suggests a more volatile asset,” Investopedia noted. “For example, a beta of 1.2 means the asset is 20% more volatile than the market. Conversely, a beta of 0.70 is theoretically 30% less volatile than the market. Beta is measured against a widely followed index such as the S&P 500 Index.”

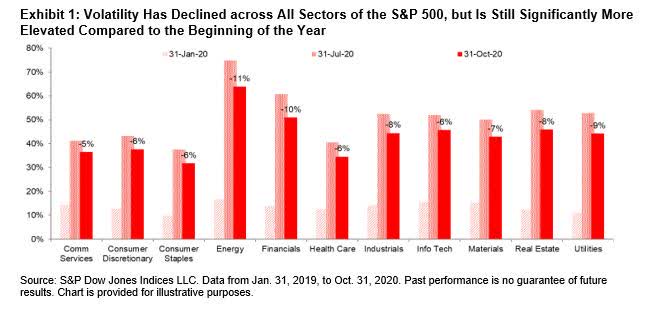

An article by Fei Mei Chan in Seeking Alpha also noted the rise in volatility, which novice traders should take note of before giving high beta funds a try:

“So far, 2020 has brought us a global pandemic, a coordinated global economic shutdown, and, in the U.S., a notably contentious election. So it’s no surprise that volatility has been, and remains, elevated. Despite all this, equities have fared reasonably (some would say surprisingly) well, with the S&P 500® climbing 13% through Nov. 19 since the end of 2019,” Chan noted.

For more news and information, visit the Leveraged & Inverse Channel.