The global economy is slowly recovering despite the resurgence in coronavirus cases that threatens the fragile recovery process. In this type of environment, exchange traded fund investors should pick and choose their battles.

“The return of the coronavirus across Europe and the Americas represents an important risk factor for the global economic recovery. We contemplated this risk back in the spring and outlined a baseline scenario of a meaningful second wave of COVID-19 infections across the northern hemisphere upon the return of colder temperatures. The probability of a double-dip recession in Q4 2020 is certainly increasing across multiple regions, but it does not need to translate into the same economic and financial shock experienced with the first wave. A combination of ample monetary and fiscal policy support, together with economic adjustments and measures implemented over the past seven months, is likely to reduce the uncertainty associated with this second wave compared to the first,” Alessio de Longis, a Senior Portfolio Manager for the Invesco Investment Solutions team at Invesco, said in a research note.

Looking at equity market opportunities, de Longis noted that Invesco holds large tilts in favor of emerging markets compared to developed markets due to favorable cyclical conditions, improving risk appetite, attractive local asset valuations, and an expensive U.S. dollar.

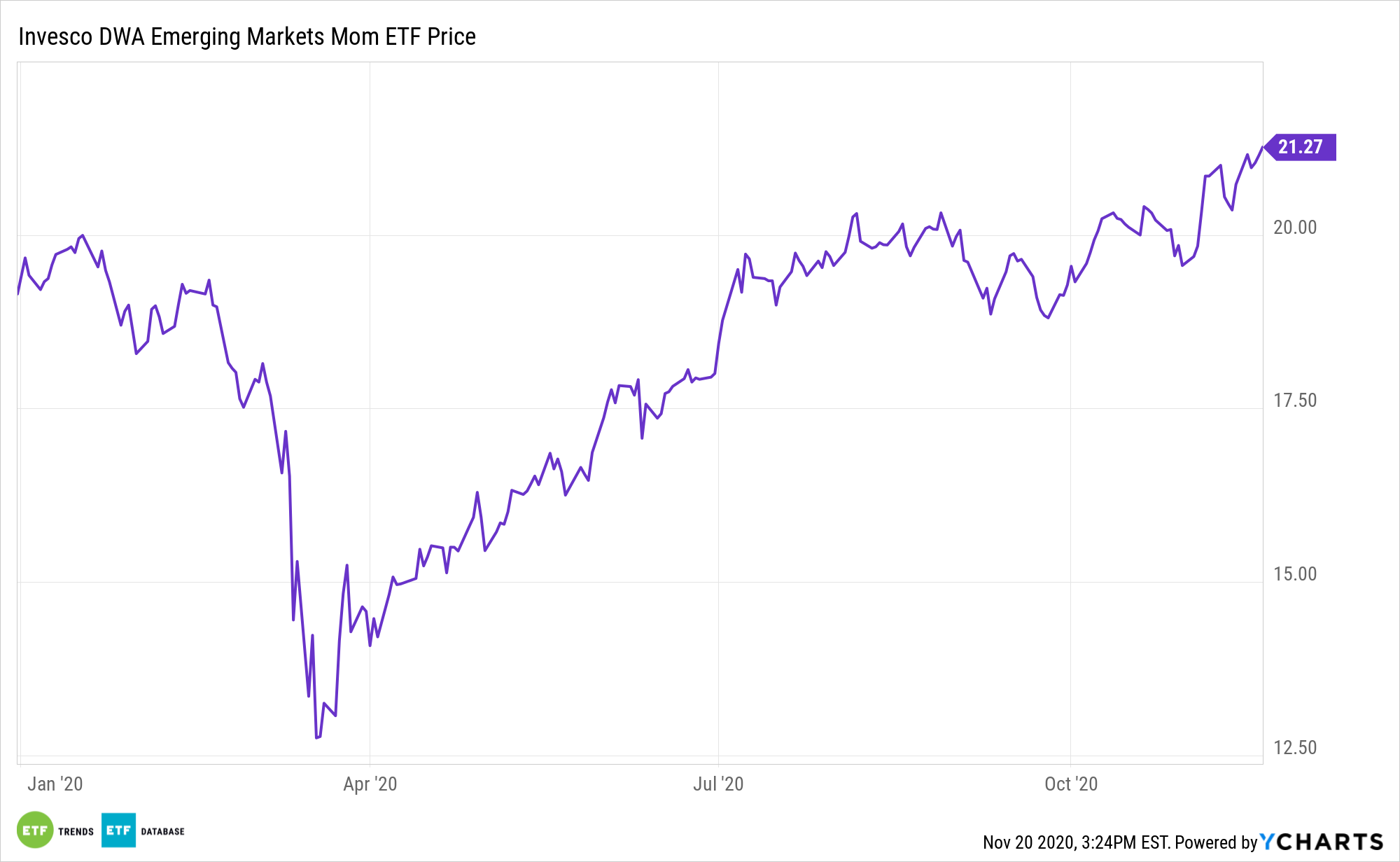

ETF investors can also target the emerging markets through ETFs like the Invesco DWA Emerging Markets Momentum ETF (PIE). PIE is based on the Dorsey Wright Emerging Markets Technical Leaders Index, which includes approximately 100 companies from the Nasdaq Emerging Markets Index that possess powerful relative strength characteristics and are domiciled in emerging market countries including, but not limited to Brazil, Chile, China, India, Indonesia, Philippines, South Africa, Thailand, and Turkey.

Additionally, the Invesco FTSE RAFI Emerging Markets ETF (PXH) provides exposure to the investment results of the FTSE RAFIT Emerging Index, which is designed to track the performance of the largest emerging market equities, selected based on the following four fundamental measures of firm size: book value, cash flow, sales, and dividends. The equities with the highest fundamental strength are weighted according to their fundamental scores.

For more news, information, and strategy, visit the Innovative ETFs Channel.