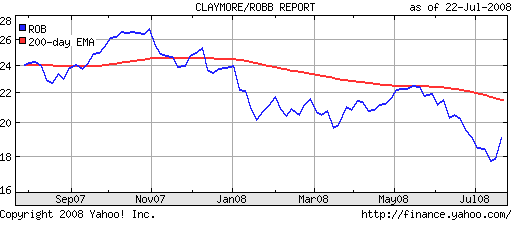

Despite the Claymore/Robb Report Global Luxury (ROB) exchange traded fund (ETF) seeing negative returns, one component of this fund is creating a good buzz. Vintage champagne has outperformed most investments over the past year and is rather heavily weighted in this ETF.

LVMH, which makes Moet & Chandon and Veuve Clicquot Ponsardin is 4.7% of ROB, while Pernod Ricard, maker of Perrier-Jouet, is 4.6% of the fund.

Champagne’s staggering performance is mostly because of the fact that more newly rich people are drinking it, such as Russian and Chinese entrepreneurs. However, sales are holding up well even in slower western markets. As Stephen Beard reports for Marketplace Public Radio, more and more investors have been drawn to vintage champagne, which push prices even higher.

With the term “champagne” used to characterize many kinds of sparkling white wines in many western markets, a true champagne is only produced in the Champagne region of France. The value of a true vintage champagne is enhanced in a competitive market with generic imitators.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.