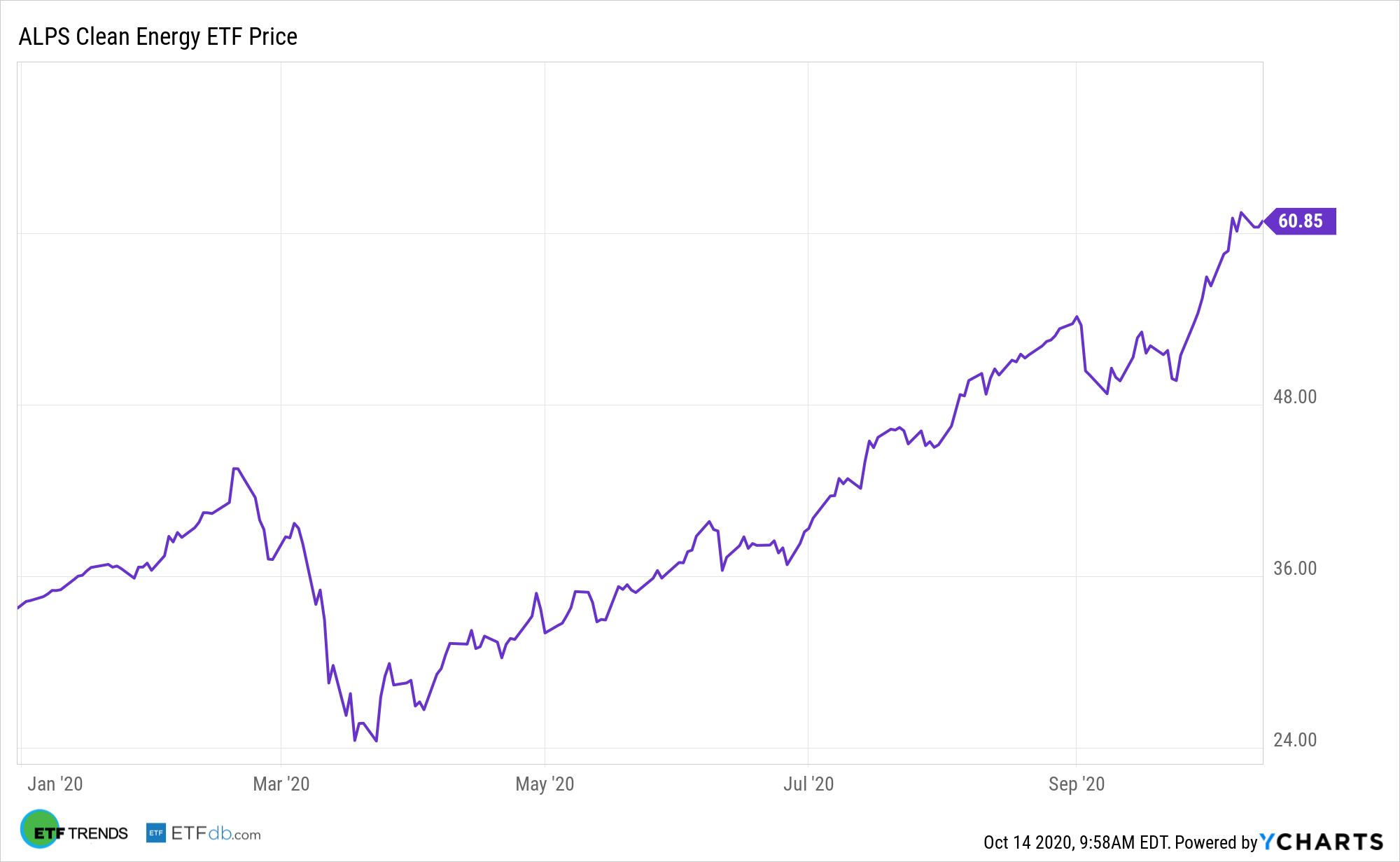

Renewable energy exchange traded funds, including the ALPS Clean Energy ETF (ACES), could be primed for post-election upside, but investors shouldn’t view these ETFs solely through a domestic lens.

In its efforts to curb the world’s worst pollution, China is an increasingly prominent player on the global renewable energy stage and that’s a significant catalyst for ACES going forward.

“The scope of Xi’s (Jinping) ambition, in a country that still gets two-thirds of its power from coal, is breathtaking. Follow-up documents from a Tsinghua University think tank estimate China will have to spend $15 trillion on green transformation, increasing solar power six times and wind more than three times,” reports Craig Mellow for Barron’s.

ACES follows the CIBC Atlas Clean Energy Index. That benchmark is comprised of U.S. and Canada-based companies that primarily operate in the clean energy sector. Constituents are companies focused on renewables and other clean technologies that enable the evolution of a more sustainable energy sector.

ACES Gets Help from Abroad

Boosting the long-term cases for ACES are data confirming solar and wind installation prices will continue declining in the coming decade. Renewables prices could increase due to the coronavirus, according to some market observers, but the consensus appears to be that the spike will be short-lived if it arrives at all.

With many China-based renewable energy stocks already hot this year, investors may find the basket approach offered by ACES less risky.

“Buying the relevant Chinese stocks is another question, however. A lot of good news is already baked in, especially for solar producers, after recent price surges. Shares of industry leader JinkoSolar (JKS) have nearly doubled this year, and No. 2 JA Solar Technology (002459.China) more than tripled, on expectations of a global green reboot after Covid-19 and a potential election victory for environmentally minded U.S. Democrat,” according to Barron’s.

Renewable energy or clean energy ETFs that track industries like wind and solar farms are attracting more interest among investors seeking low-risk opportunities during this volatile period. Similar to what happened during the 2008 financial crisis, investors turned to renewable wind and solar farms as a safe-harbor investment with attractive yields. Wind and solar farms have long-term contracts to sell their electrical output to utilities and companies with good credit ratings for long periods, which makes their returns stable and relatively low risk.

ACES’ components provide the products and services that enable the evolution of a more sustainable energy sector. The green energy companies are engaged in renewable energy sources, including solar power, wind power, hydroelectricity, geothermal energy, biomass, biofuels, and tidal/wave energy; clean technologies, including electric vehicles, energy storage, lithium, fuel cell, LED, smart grid, and energy efficiency technologies; and other emerging clean energy activities and technologies.

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.