For the better part of 2020, the market has been ruled less by hard numbers and more by speculation about what the hard numbers may look like once the pandemic is “over” and things get back to “normal.”

Much of this speculation has fallen on constantly changing statistics on the spread of COVID-19. It’s been a grim calculus, with share prices rising and falling as mortality rates spike or subside, such as the 5-7% sell-off among major indexes back in June as cases surged in the U.S., and the most recent volatility.

But the main catalyst for optimism or despair in the market over the past few months has been focused on the holy grail of reclaiming what is perceived to be control over the pandemic: a vaccine for SARS-CoV-2. Already, analysts and traders are forecasting how the market will react if and when a vaccine is approved in the coming months. This behavior can offer a good insight into the market eventualities that might occur in the uncertain path toward fighting back COVID-19.

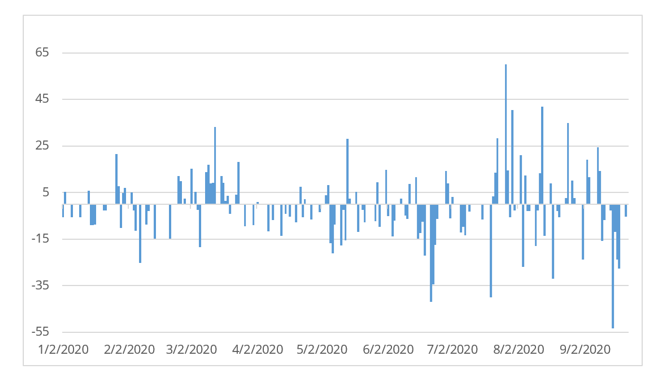

LABU Daily Fund Flows

Source: Bloomberg. Chart data as of September 14, 2020.

Yet even with the expedited approval timeline set out by the FDA and other global pharma regulators, the path to an effective and tolerable vaccine has already proven to be a bumpy one. AstraZeneca recently halted global Phase 2 and 3 trials after the emergence of a mysterious illness among its trial participants, though the stock’s price action has remained generally stable. Meanwhile, other biotechs like Novavax have seen their fortunes rise and fall dramatically through the year, at one point seeing nearly 4,000% growth YTD.

While analysts have debated whether the surge in prices represents a bubble in the biotech industry or if the high valuations simply reflect the value of a potentially $30 billion vaccine market, there still remains a good amount of time between now and a final approved vaccine (or vaccines). The most optimistic projections from executives with Moderna and Pfizer have Phase 3 trial results coming out sometime in October. While that might represent a new catalyst for the industry, there’s no telling what the results will indicate for the leading vaccine candidates or the industry as a whole.

The U.S. Director of the National Institute of Allergy and Infectious Diseases Dr. Anthony Fauci has said he doesn’t expect a vaccine to reach patients until early 2021, at the soonest. But even in that timeline there remain questions of efficacy and tolerability questions that will weigh on the approval process and could spell opportunity or catastrophe for the many small biotech firms racing for a vaccine.

Add to that the practical and logistical hurdles of targeting and distributing any vaccine on a national and global scale, as well as the lingering economic fallout of the pandemic on those that lost their jobs, homes, or health over the course of 2020, and it becomes clear that a vaccine will not be a magic wand that erases the problems exposed by the pandemic.

For longer term investors, that means the work from home and connected consumer space may continue to be the theme to ride well into 2020. The Direxion Work From Home ETF (WFH) and Connected Consumer ETF (CCON) offer ways to gain precise exposure to that theme. In fact WFH has already benefited from over $100 million in flows since just late June.

Riding Out the Pandemic Recession

The previously mentioned logistical hurdles remain the crux of the problem in the sprint for a vaccine. The global economy will remain in limbo for at least as long as it takes for an effective vaccine to show results in containing the virus.

This uncertainty is already clear in the earnings guidance on offer from a large swath of the market. Morgan Stanley recently revealed that 74% of companies included in the Russell 1000 Large Cap Index have withdrawn or declined to provide fiscal guidance as a result of the pandemic.

Both traders and investors who may want to hedge their large cap exposure have been responsible for recent flows into Direxion Daily S&P 500 Bear 1X Shares ETF (SPDN). The abundance of caution from the private sector has made anticipating market reactions difficult. As it stands, most sectors within the S&P 500 are showing a majority of negative returns over the course of the pandemic. While you might not guess that from the index’s performance over that span, the market may soon begin to more clearly reflect the recessionary state of the broader economy.

For instance, despite lagging the broader market through the past six months of growth, healthcare has started to show resilience, with the Direxion Daily Healthcare Bull 3X Shares (CURE) higher by about 22% in that span.

Given that the pandemic will likely be with the world in full-force through the rest of the year, the healthcare sector may see continued life even if the rest of the market begins to waver.

A Vaccine Boom?

The accommodative approach taken by the Federal Reserve has been credited with fueling the massive rush to equities that has put the market back at all-time highs. However, these actions have also led to speculation that, whether or not there is an immediate economic recovery that comes as a result of a vaccine, the market is likely to experience some whiplash from the unprecedented momentum some areas have seen as a result of this intervention.

Not the least of these sectors is information technology, which already experienced a strong sell-off in early September that pushed the Direxion Daily Technology Bear 3X Shares (TECS) higher by 35% in just 10 trading days. Recent analyst notes from both Bank of America and Goldman Sachs anticipate further strife for technology if a vaccine is released and investors rotate money into value sectors that have struggled under the pandemic.

At the same time, if the Fed’s low interest rate policy reverses in the event of a swift, vaccine-driven recovery, it could mean an opportunity for rate-sensitive areas of the market. If the Fed does see it necessary to increase rates, ETFs like the Direxion Daily Financial Bull 3X Shares (FAS) or the inversely leveraged Direxion Daily 20+ Year Treasury Bear 3X Shares (TMV) and Direxion Daily 7-10 Year Treasury Bear 3X Shares (TYO) could be in for a rapid reversal.

Of course, any actions the Fed might take to prevent inflation might also mean an increase in mortgage rates, which could bring pain to a homebuilding industry that has managed to remain mostly unscathed even as home prices hit staggering highs in a historically tight market.

Given the unprecedented circumstances the modern market has been confronted with, there are any number of possibilities that might emerge over the next few months and even years. While a vaccine, whenever it may come, will certainly spur traders and investors to re-evaluate their position in the market, the long-term effects of this pandemic will undoubtedly define the way we think about the economy for the foreseeable future.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For the most recent month-end performance go to Direxion.com Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns.

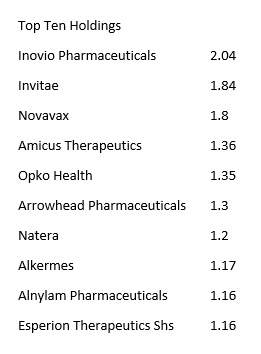

LABU as of 06/30/2020

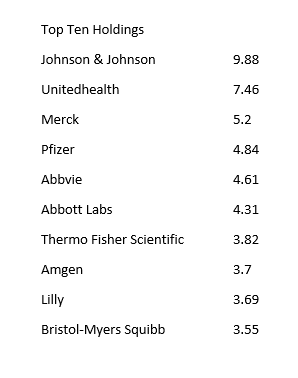

CURE as of 06/30/2020

Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

These leveraged ETFs seek investment results that are 300% of the return of its benchmark index for a single day. Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investment.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-301-9214 or visit our website at direxioni.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Market Disruptions Resulting from COVID-19. The outbreak of COVID-19 has negatively affected the worldwide economy, individual countries, individual companies and the market in general. The future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to the Funds.

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Shares Risks: An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are non-diversified and include risks associated with concentration that results from an ETF’s investments in a particular industry or sector which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The ETFs do not attempt to, and should not be expected to, provide returns which are a multiple of the return of their respective index for periods other than a single day. For other risks including leverage, correlation, daily compounding, market volatility and risks specific to an industry or sector, please read the prospectus.

HealthCare Sector Risk: The profitability of companies in the healthcare sector may be affected by extensive, costly and uncertain government regulation, restrictions on government reimbursement for medical expenses, rising costs of medical products and services, pricing pressure, an increased emphasis on outpatient services, limited number of products, industry innovation, change