Select equities have already rebounded past their pre-Covid-19 highs and the space could be looking more expensive than necessary. If investors are feeling jittery on inflated equity prices, they may want to give bonds a closer look.

“Shares in American companies are the most expensive they have been in almost 20 years,” wrote James Mackintosh in a Wall Street Journal article. “Bonds from American companies aren’t even as expensive as they were this February. Are corporate bonds offering a bargain that the stock market isn’t?”

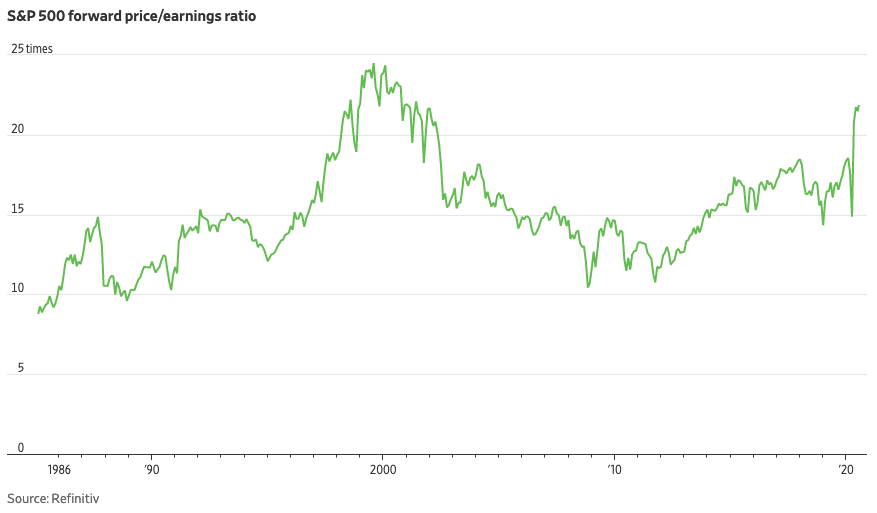

The price-to-earnings ratio chart below paints a technical picture of current PE ratios almost mirroring that of the tech boom in the early 2000s.

“When I think about the S&P, I would consider that a higher quality index than high yield on average so it’s hard to compare one-for-one,” says Thushka Maharaj, global multiasset strategist at JP Morgan Asset Management. “The S&P does look expensive but once you adjust for the tech [valuation]it is more reasonably priced.”

With the central bank stepping in to shore up the bond market, now’s a time to give debt some attention.

“We’re in a golden age of credit,” said Gregory Peters, head of the strategy at PGIM Fixed Income. “In an environment where debt levels are high and there is slow growth as far as the eye can see, dividends are being cut and investment canceled as companies are looking to preserve free cash flow. That’s a bond story, not an equity story.”

Investors looking for core bond exposure can look to the iShares Core U.S. Aggregate Bond ETF (NYSEArca: AGG), which has been the go-to fund for investors.

Fund facts:

- AGG seeks to track the investment results of the Bloomberg Barclays U.S. Aggregate Bond Index.

- The index measures the performance of the total U.S. investment-grade bond market.

- The fund generally invests at least 90% of its net assets in component securities of its underlying index and in investments that have economic characteristics that are substantially identical to the economic characteristics of the component securities of its underlying index.

Reasons to use AGG:

- Broad exposure to U.S. investment-grade bonds

- A low-cost easy way to diversify a portfolio using fixed income

- Use at the core of your portfolio to seek stability and pursue income

Another ETF to consider is the Goldman Sachs Access Investment Grade Corporate Bond ETF (GIGB). GIGB seeks to provide investment results that closely correspond to the performance of the FTSE Goldman Sachs Investment Grade Corporate Bond Index.

The fund seeks to achieve its investment objective by investing at least 80% of its assets (exclusive of collateral held from securities lending) in securities included in its underlying index. The index is a rules-based index that is designed to measure the performance of investment grade, corporate bonds denominated in U.S. dollars that meet certain liquidity and fundamental screening criteria.

For more market trends, visit ETF Trends.