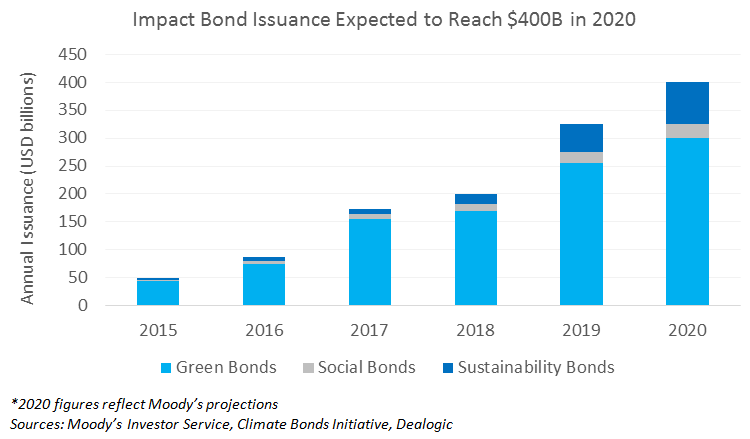

As ESG strategies prove their mettle in the current market environment, investors are turning to bonds that fund sustainable solutions. These “impact bonds” include green bonds, social bonds, and sustainability bonds. They allow investors to have a positive impact by providing organizations with capital that is proceeds-driven. Impact bond AUM is on the rise and is likely to continue growing as these bonds become increasingly transparent in how their proceeds are used for sustainable projects.

- Green Bonds focus on addressing environmental challenges, such as CO2 emissions and deforestation.

- Social Bonds seek to address societal issues, such as gender inequality and access to medical care.

- Sustainability Bonds simultaneously address both social and environmental issues.

Green bonds make up the largest segment of impact bond issuance. Financial market data provider Refinitiv reports that green bonds’ share of the global bond market tripled from 0.6% in 2015 to 2.2% in 2019. Total issuance reached $255 billion in 2019, and it was expected to continue to grow in 2020.

How do we hold impact bond issuers accountable?

The key to holding impact bond issuers accountable is verifiability. Is the bond issuer basing its use of funds on a public framework, offering independent assurance, and will investors will be updated on the progress in deploying the proceeds? The International Capital Market Association (ICMA) and the Climate Bond Initiative (CBI) are organizations that can certify and/or review impact bonds. The ICMA administers the Green Bond Principles, Social Bond Principles, and Sustainability Bond Guidelines, which are commonly used in frameworks. The CBI is a non-profit aimed at mobilizing the bond market toward fighting climate change by defining and identifying bonds that promote a low carbon economy.

How do we ensure proceeds are properly allocated?

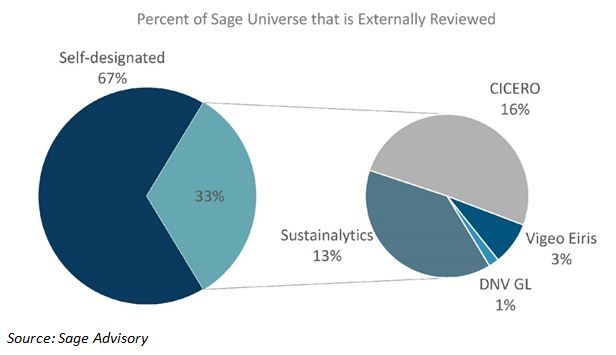

A common critique of the green bond designation is that some issuers may label a bond “green” but not actually use the proceeds for such purposes, a process known as “greenwashing.” One check on this behavior is the hiring of second-party, or external, verification providers to ensure that an issuer meets its stated obligations under the offering documents and articulates them in a sufficiently binding and explicit manner. Not all green bonds are created equal. By subjecting their offerings to independent evaluation, issuers can provide investors with more confidence that they are getting what they paid for.

What is next for impact bonds?

The growth in impact bonds witnessed over the past several years has created opportunities for investors to tap into a new market segment, which is expected to continue growing even as the dynamics change due to events such as the current pandemic. Impact bonds seek to address several issues that the world is facing today, such as climate change. Approached with care and due diligence, impact bond investments are one way to ensure an investor’s potential impact and competitive market returns.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

This article was contributed by the team at Sage Advisory, a participant in the ETF Strategist Channel.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.