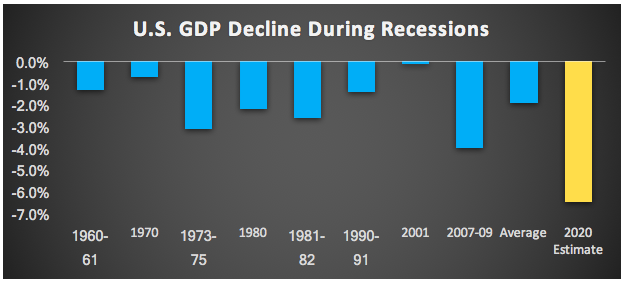

1. The shutdown of the global economy due to COVID-19 has resulted in a deep recession. The intensity of the slowdown is the worst since the Great Depression, and questions remain as to the pace of the recovery.

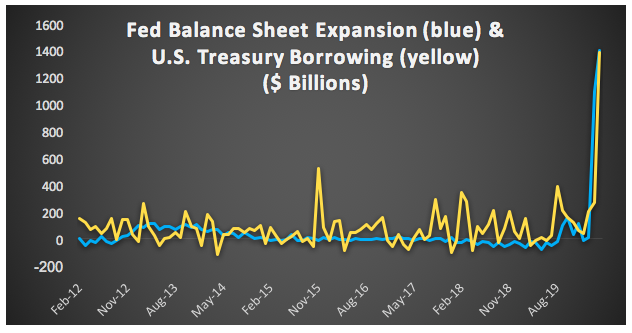

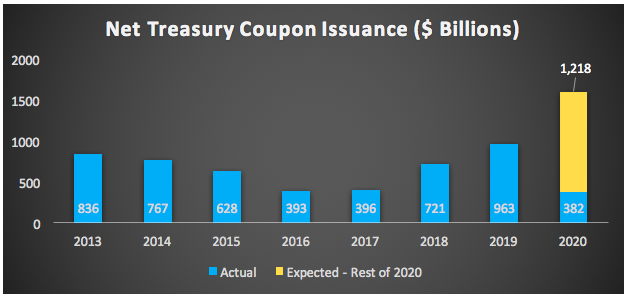

2. Fiscal and monetary stimulus are serving as the main driver of markets. The Fed has conducted over $1.5 trillion of bond purchases and has yet to utilize much of its crisis lending facilities, while U.S. government spending has also stepped up, which will result in record Treasury supply for the rest of the year.

3. Fixed income supply is running at a historic pace. There has been a deluge of fixed income supply as corporations and the U.S. borrow a record amount. Most corporate issuance has taken place, and most bond supply through the balance of 2020 will come from U.S. Treasuries.

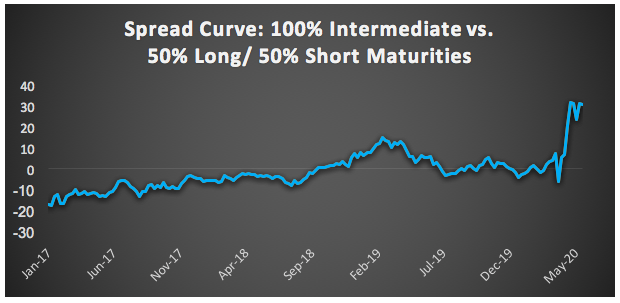

4. Post-crisis, intermediate corporate bonds present attractive relative value versus short and long-maturity corporates. There has been anticipated demand from the Fed for shorter-maturity corporates, while foreign investors have been focused on the long end, which we believe has contributed to the cheapening of intermediate corporates. A barbell versus bullet comparison of the credit curve highlights the relative value of the intermediate corporate sector.

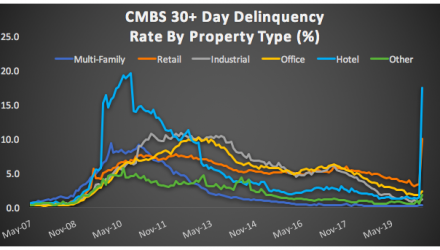

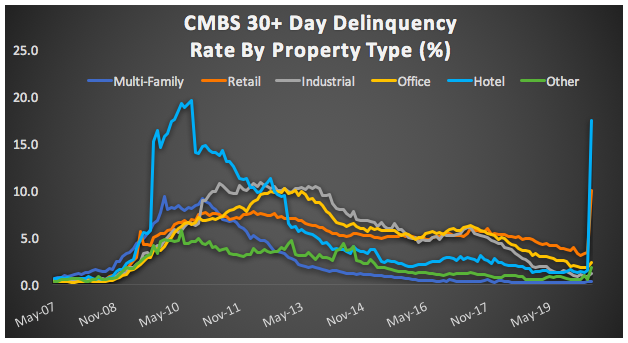

5. In commercial real estate, retail and hotel properties are under extreme pressure while other property types remain stable. We believe that industrial properties and data centers, particularly those that are tied to ecommerce, should fare well coming out of the current environment.

This article was contributed by the team at Sage Advisory, a participant in the ETF Strategist Channel.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.