Once upon a time, in the late ’90s, I ran an actively managed tech fund (with a great team at MetaMarkets). We did great. Until we did just absolutely awful and had to roll up the carpets when the bubble burst. Perhaps one of the most embarrassing parts of that particular failure was how often I was on TV talking about the “New Economy.” But regardless, I learned many lessons, and it drove me to be very skeptical of “this time it’s different” claims, which are often the hallmark of active managers.

The Problem

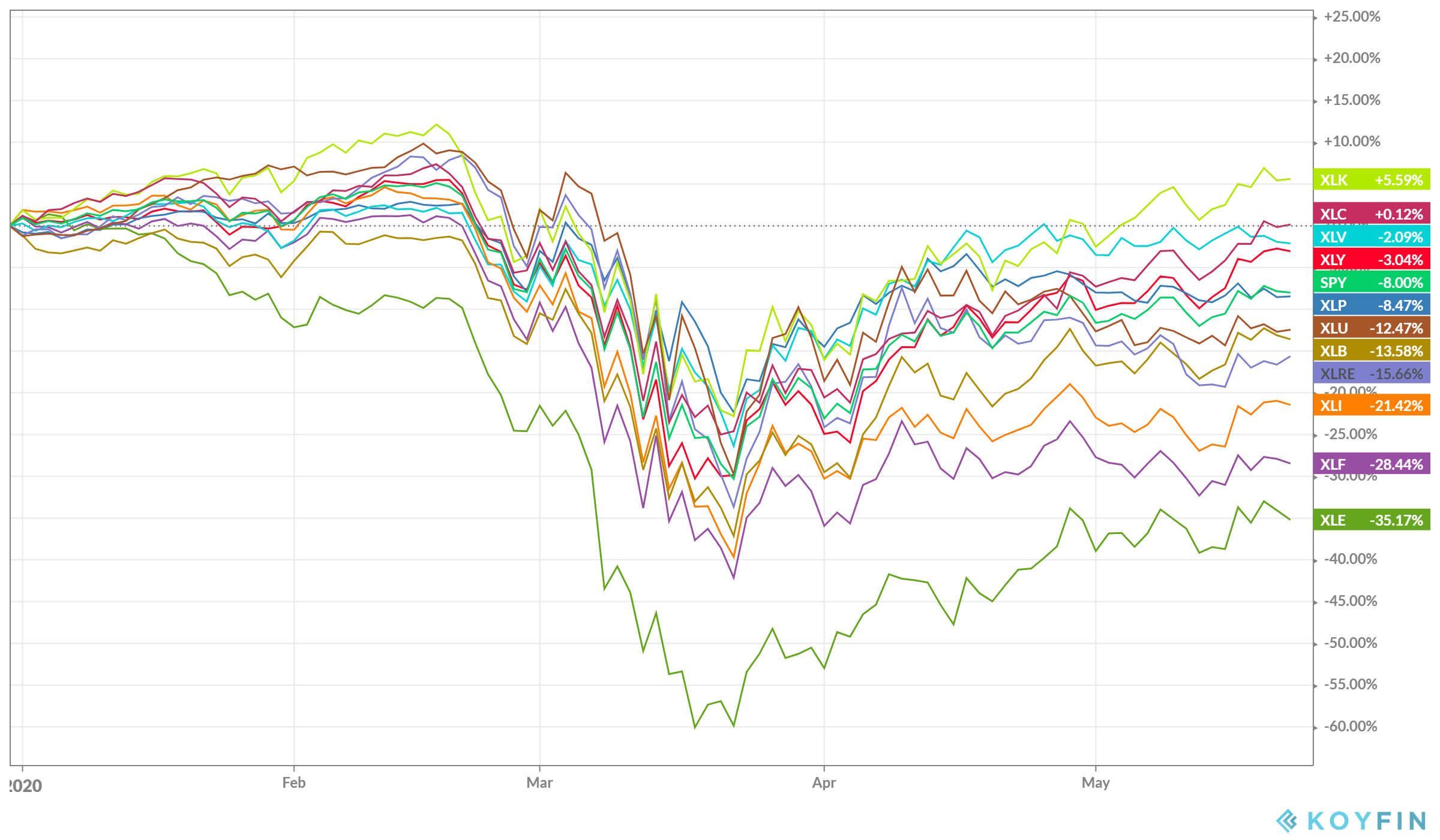

But here’s the thing. This time, boy, it really feels different, doesn’t it? It’s obvious to me that the markets are picking winners and losers — and based on my inbox, many advisors are trying to do that too. They’re not just trying to pick winners for the immediate economic impact, but for a prolonged recovery. And there’s no place that’s more obvious than in sector ETFs. Consider, for example, the returns of the big Select Sector SPDR complex year to date:

That 40% dispersion of returns in just a few months, while not unprecedented, is eye-opening. The core narrative here is pretty apparent: the Work From Home stocks (internet, online shopping, telecom, enablers) are doing great, and more importantly, seem poised to continue to do great even after folks head back to the offices. After all, company after company, from Twitter to Nationwide, has been saying only a fraction of their workforce will return to normal, ever. Healthcare sure seems essential too. On the other hand, investors are indicating they don’t think the Energy business is a long term or short term winner, and financials aren’t much better in a zero-interest rate environment. And money’s flown in, with the complex above pulling in over $15 billion in new assets this year so far.

But honestly, this all seems a bit obvious and, at the same time, poorly implemented with broad sector funds. Sure, XLK has Apple and Intel and Paypal in it, but it also has a load of hardware companies like Applied Materials and AMD and Analog Devices, for whom I think the story is much less noticeable. XLV has Abbot Labs and Amgen, but it also has insurers and providers like UnitedHealth and Anthem, again, for whom the story seems less obvious.

Watch Dave Nadig Discuss How ETFs Have Fared On TD Ameritrade Network

So against every fiber of my normal, passive, buy and hold self, I think this is the case where “big and broad” indexes based on decades-old GICS classifications are the wrong call for folks looking to position a sector rotation strategy for the eventual recovery (while acknowledging that even a sector rotation strategy is a form of active management, and thus, statistically, likely to fail as often as not).

So what are the right calls? Thematic funds and industry funds.

If you’re looking to play the shift in workplace dynamics, consider funds like the O’shares Global Internet Giants ETF (OGIG), or the Global X Cloud Computing ETF (CLOU), or the SPDR FactSet Innovative Tech ETF (XITK). Every one has crushed broad tech this year (OGIG is up over 26%). Of course, timing is always everything in active trading, so who knows whether the current valuations hold, but at least the narrative makes sense, instead of buying chip companies with deep Chinese supply lines.

If you’re looking at healthcare, ask yourself why? Is it because you think that the firms who develop treatments and vaccines for Covid-19 will rocket on the news? Then why not invest in an ETF that owns the most of those particular companies. You can find the list of those firms pretty easily, and then just cross ref the ETF holdings:

| Ticker | Name | % Covid-19 Stocks |

| BBH | VanEck Vectors Biotech ETF | 34.78% |

| CNCR | Loncar Cancer Immunotherapy ETF | 27.82% |

| IBB | iShares Nasdaq Biotechnology ETF | 25.45% |

| IEIH | iShares Evolved US Innovative Healthcare ETF | 22.05% |

| IDNA | iShares Genomics Immunology and Healthcare ETF | 21.27% |

| IHE | iShares US Pharmaceuticals ETF | 20.96% |

| PPH | VanEck Vectors Pharmaceutical ETF | 18.95% |

| XLV | Health Care Select Sector SPDR Fund | 17.05% |

BBH is the clear winner here, and you have to runway down the list before finding XLV.

The Point

I’m really the last one who’s going to suggest investors chase performance and trade around headlines. That’s not investing, it’s speculating. But given the volume of questions I’ve had around these two particular themes, I think it’s fair to say it: if you’re going to make “bets” here, at least think it all the way through.

For more market trends, visit ETF Trends.