Kicking off the week, ETF Trends CIO and Director of Research Dave Nadig appeared on Yahoo Finance Live with anchor Seana Smith to discuss the biotech industry outlook as the push for Coronavirus treatments continue.

Healthcare ETFs have been drawing more investors’ attention due to increased money flowing into those funds. Given the positive news from drugmaker Moderna today, investors are more excited, as well as the competitors in the mix. The question for Nadig is whether investors should be looking to buy into biotech ETFs.

Nadig explains how those looking to profit on the response to the Coronavirus, a healthcare ETF is not a bad way to go. The challenge, however, is picking the right spot. Many investors are looking to things like the Healthcare Select Sector SPDR Fund (XLV), which has a steady trading flow. The problem is how diversified it is into other things such as insurance and equipment that it hasn’t participated in any of the recent rallies, which has kept its growth-rate flat.

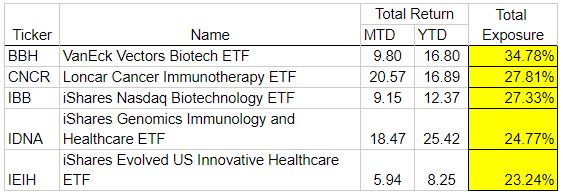

So, for those looking to tap into that core biotech exposure, Nadig notes how the right thing to do is to look for the companies focused on vaccine development and therapeutic specifically for Covid-19. The top pick would be something like VanEck Vectors Biotech ETF (BBH). It has 35% of its exposure in firms that are directly involved in this Covid-19 response, in addition to global exposure.

Watch Dave Nadig Discuss Biotech ETFs

There is also the ARK Genomic Revolutions ETF (ARKG), which is up 40% this year, since its start. Nadig states how this could be a great play due to its investment in a layer down with the real innovations driving some of these discoveries in regards to treatment advances, and core underlying technologies.

Overall, looking at ETF fund flows, in regards to where the most money is being allocated, investors have been looking to see who the “winners and losers” are going to be. As Nadig points out, it’s not necessarily obvious, as there have been huge flows into things like the airlines ETF JETS and energy stocks, which are ways for single investors to attempt to call a bottom and make value plays that aren’t going away but experiencing trouble.

“That’s a core way of thinking about the market. Who are the long-term winners and who are the short-term winners. And that’s really where we’re starting to see that divergence in flows.”

For more market trends, visit ETF Trends.