Financial exchange traded funds (ETFs) were tops today after Federal Reserve Chairman Ben Bernanke gave assurances to the sector.

He said the central bank may keep its lending facilities open to a broader group of financial firms longer than had been planned. Traditionally, only commercial banks were allowed to access the discount window, but in the wake of the Bear Stearns mess earlier this year, the capacity was extended to more firms on Wall Street. Bernanke’s soothing words helped firm up the dollar and send oil lower, reports Steve Schaefer for Forbes.

Bernanke also called on Congress to provide new tools to prevent a domino effect on the broader system if a financial firm is liquidated, as well as increased oversight to keep any firm from becoming “too big to fail.”

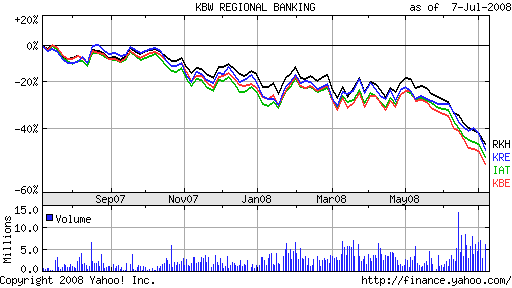

Overall, the markets seemed to like the news and financial ETFs gained for the day while still remaining sharply off for the year:

- KBW Regional Banking (KRE), down 33.1% year-to-date

- KBW Bank (KBE), down 36.5% year-to-date

- iShares Dow Jones U.S. Regional Banks (IAT), down 32% year-to-date

- Merrill Lynch Regional Bank HOLDRS (RKH), down 34.9% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.