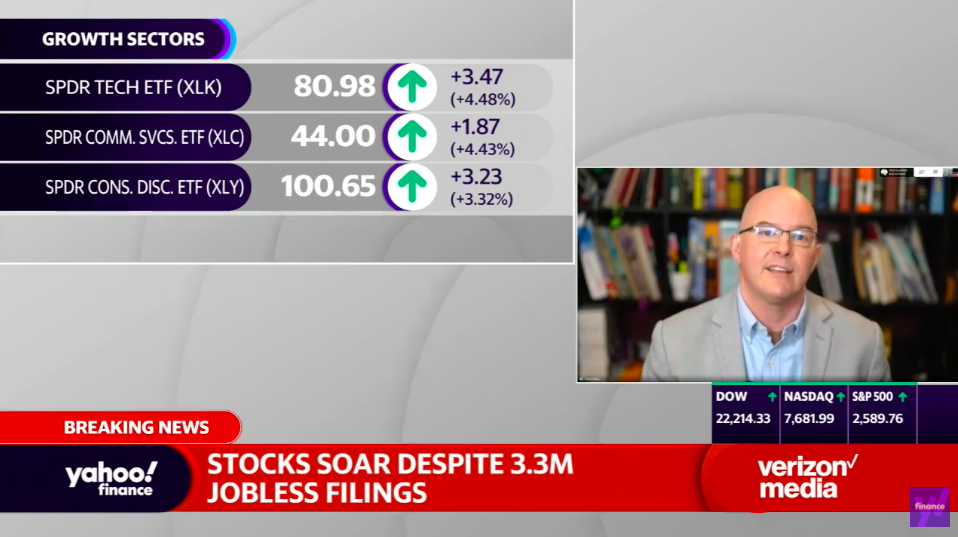

With everything going on with rising treasury yields, looking at the Bond ETF market has proven to be an exciting area to keep up with. Following the historic jump regarding jobless claims, it does help to see what else is happening. Dave Nadig, CIO and Director of Research for ETF Trends, hopped on Yahoo Finance, on Thursday, with Seana Smith to go over this recent market action.

Getting into the bond market, there has been a lot of ETF trading at big discounts relative to their asset value. When looking at fixed income, Nadig points out the disconnect in the live market for bonds, which has essentially become an ETF market. There’s also the prices that get assigned in asset value, which often have little to do with recent trading. This, in essence, creates a lag.

So, when getting these sharp downward moves in the bond market, the net asset value took days to respond, which created the appearance of a real disconnect. However, it was actually the ETFs becoming price discovery for bonds that weren’t trading for funds that couldn’t have gotten a bid on at all. So now, after a few days, the discounts are collapsing, amid some recovery in the underlying ETF trading, while the net asset values come down to reality where the cash bond market is.

How Should Investors Act?

With the Fed being so aggressive, there can be a question of how investors should act. Nagid notes some unprecedented actions in place. He states how the Fed has announced they’re not only going to come into the market and buy corporate bonds, but also buy ETFs investing in corporate bonds.

This applied to BlackRock, who would be heading this program. That brings in LQD, the liquid bond fund, which went from trading at a discount to a premium immediately.

“We’ve seen $2 billion flow into that fund in just the last two days,” Nadig adds.

So, people could be hoping that because the Fed is going to be a bottomless buyer of corporate debt, that it’s a great place to be. It’s an opportunity for someone to take the debt off their hands.

Shifting gears to the demand for gold, and how it’s not becoming as safe a bet as people expected, Nadig believes people may have had unrealistic expectations. Still, gold is up 8% or so this year, while the market is down 22%. It may be hard to see this in the midst of a crisis. However, there is proof of diversification still working. As it stands, it’s doing its job, even while other areas of the market are sitting as hard to predict.

Watch Dave Nadig Discuss The Bond Market on Yahoo Finance Here

For more market trends, visit ETF Trends.