By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

At Stringer Asset Management, we generally classify emerging market equities and bonds among the asset classes that we consider tactical holdings, as opposed to long-term strategic allocations. We think that there are times to own and times to not own tactical assets, such as high yield bonds, commodities, and emerging markets. We consider other asset classes that we are comfortable holding for the long-term as Strategic, such as domestic equities and diversified bonds.

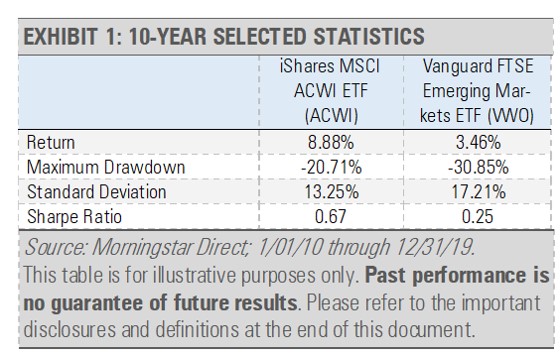

For example, we consider broad equity exposure, as represented by the MSCI All Country World Index ETF (ACWI), to be strategic. Meanwhile, we think that narrow, higher risk areas, such as the Vanguard FTSE Emerging Markets ETF (VWO), as tactical. Over the long-term, these tactical areas often have greater downside risk (maximum drawdown), higher volatility risk (standard deviation), and lower risk-adjusted returns (Sharpe Ratio) than broader strategic investments.

However, there are times when areas like VWO could make great short-term investments, generally being owned for 6-18 months. For emerging markets, we think that these investment opportunities are most prevalent when global economic growth is accelerating, and inflation is building.

Many emerging market economies are manufacturing and/or commodity production oriented. Rising leading economic indicators overall and manufacturing PMI new orders would suggest accelerating global economic growth of the kind that can favor emerging market economies and stock markets. As the following graph illustrates, an acceleration in the pace of global economic growth seems unlikely at this time.

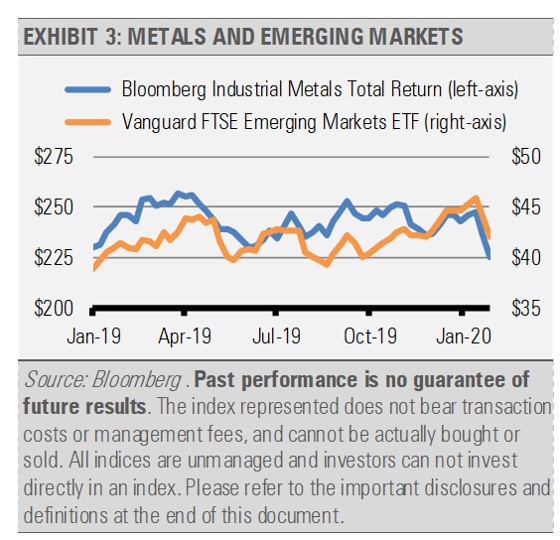

Additionally, higher industrial metals prices can provide support for emerging market equity markets as they reflect greater demand for economically sensitive materials, such as copper and iron ore. Many emerging market economies are heavily weighted to commodity production and emerging market equity prices often move in tandem with industrial metals prices as the following graph shows.

As the previous graph illustrates, emerging market equity prices diverged from industrial metals prices beginning in early November. Without an uptick in economic activity, the weakening of industrial metals prices suggested to us that emerging market equity prices were more likely to weaken rather than industrial metals prices would rally. When prices are vulnerable, any negative shock can send markets tumbling.

Though industrial metals prices may now be oversold, as the Coronavirus risk spreads to threaten the pace of economic growth, we think that emerging market equity prices could fall further before finally finding a bottom as these risks ultimately recede.

Stringer Asset Management is a Memphis, Tennessee third-party investment manager and ETF strategist. Contact Stringer Asset Management at 901-800-2956 or at [email protected]. For a complete list of relevant disclosures, please click here.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

Index Definitions:

Bloomberg Industrial Metals Subindex Total Return – Formerly known as Dow Jones-UBS Industrial Metals Subindex Total Return (DJUBINTR), the index is a commodity group subindex of the Bloomberg CITR. The index is composed of longer-dated futures contracts on aluminum, copper, nickel and zinc. It reflects the return on fully collateralized futures positions and is quoted in USD.

The views expressed herein are exclusively those of Stringer Asset Management LLC (SAM), and are not meant as investment advice and are subject to change. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. All opinions expressed herein are subject to change without notice. This material does not constitute any representation as to the suitability or appropriateness of any security, financial product or instrument. SAM is not making any comment as to the suitability of any funds mentioned, or any investment product for use in any portfolio. There is no guarantee that investment in any program or strategy discussed herein will be profitable or will not incur loss. This information is prepared for general information only. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that security values may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not a guide to future performance.