Traders have to be brimming with optimism with major indexes like the S&P 500 reaching new highs. But can too much of a good thing—optimism in this case—creating a market environment that could upend U.S. equities?

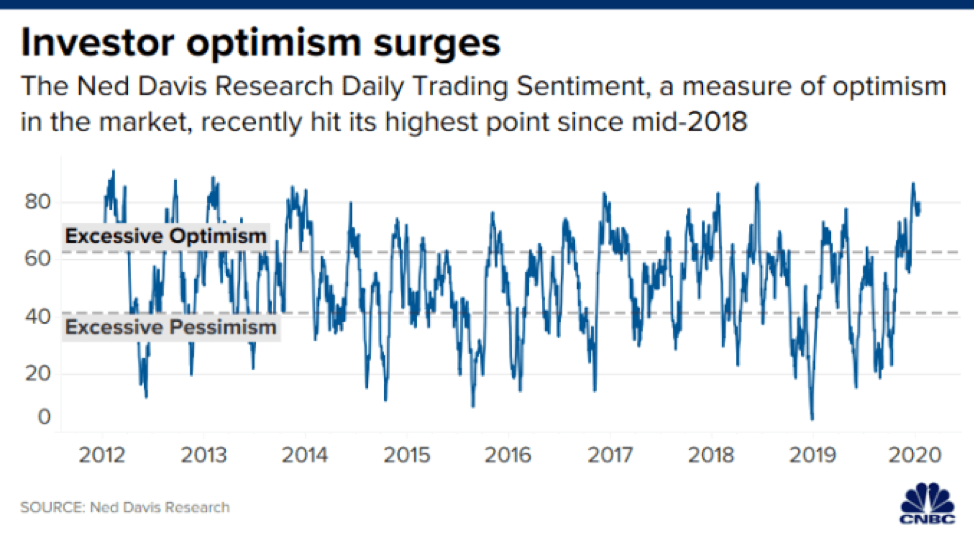

According to the Ned Davis Daily Trading Sentiment Composite, an index that measures the level of optimism or pessimism traders have, currently reads 80. According to the index, this reading shows excessive optimism and its highest level since June 2018.

However, this could just be par for course given that it’s the start of the new year.

“Shorter-term sentiment is extremely optimistic,” Ned Davis, senior investment analyst and founder of Ned Davis Research, said in a note. “Investors tend to be optimistic entering a new year, with lots of inflows to IRA’s and pension plans, but this still shows very high and rising short-term risks.”

“There’s a lot of momentum in the market right now. I think people are looking for something to kind of bring us down a little bit,” said Christian Fromhertz, CEO of The Tribeca Trade Group. “How does that end? We don’t really know.”

Froth might be a good thing for cappuccinos, but when it comes the markets, it could be a telltale sign of a downturn to come. According to some market experts, the excessive optimism could be creating some frothiness.

“Risk wise there is not necessarily any fundamental that could tip things, but I do think sentiment has gotten a bit frothy,” said Liz Ann Sonders, chief investment strategist at Charles Schwab. “That in it of itself doesn’t suggest a problem for the market, but it does establish some vulnerability than if investors were more skeptical.”

Trading the Frothiness

Investors sensing a downturn can play the move via the Direxion FTSE International Over US ETF (NYSEArca: RWIU) to capitalize on international equities will outdoing U.S. equities. RWIU seeks investment results, before fees and expenses, that track the FTSE All-World ex US/Russell 1000 150/50 Net Spread Index, which measures the performance of a portfolio that has 150 percent long exposure to the FTSE All-World ex US Index and 50 percent short exposure to the Russell 1000® Index.

If investors are sensing more strength to come in U.S. equities, they can look at the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI). RWUI seeks investment results that track the Russell 1000®/FTSE All-World ex-US 150/50 Net Spread Index, which measures the performance of a portfolio that has 150% long exposure to the Russell 1000® Index (the “Long Component”) and 50% short exposure to the FTSE All-World ex-US Index (the “Short Component”).

For more market trends, visit ETF Trends.