By BOOX Research

- VHT tracks a basket of 402 Health Care sector stocks.

- We contrast VHT to the larger and more actively traded XLV ETF with data showing the Vanguard fund outperforming over various time periods this past decade.

- VHT yields 1.9%.

The Vanguard Health Care ETF (NYSE: VHT) is an exchange traded fund designed to track the performance of the ‘MSCI US Investable Market Index/Health Care 25/50 Index’, a U.S. equities-focused sector-specific benchmark. VHT with $11.2 billion in total assets under management is a low-cost option for investors to gain exposure to underlying trends in Health Care. This article covers why we think VHT is a better choice compared to the larger and more actively traded Health Care Select Sector SPDR ETF (NYSE: XLV) considering a more positive performance history and higher current yield.

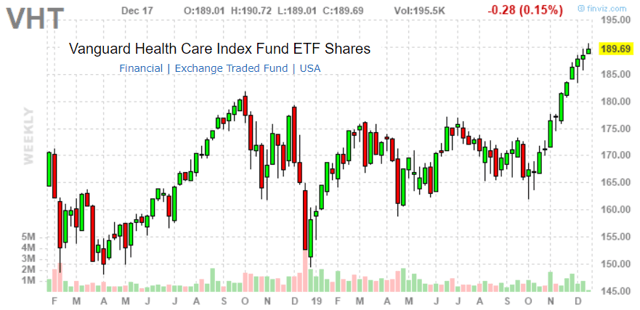

(Source: Finviz.com)

A Better Option Over XLV

What we like about the Vanguard Health Care ETF is that this offers wide diversification within the sector across 402 equity holdings. This is in contrast to the Health Care Select Sector SPDR ETF (XLV) which is more concentrated considering a strategy of tracking just the 60 Health Care sector stocks that are currently components of the S&P 500.

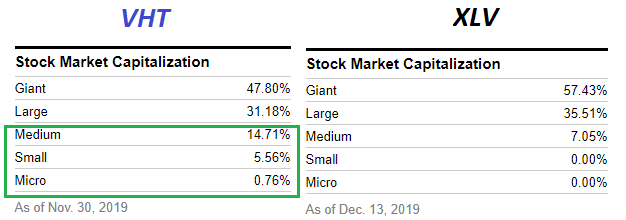

(Source: Vanguard)

In this regard, XLV is focused more on the “large and giant-cap” leaders of the sector while VHT includes exposure to more medium and small-cap companies. VHT is less concentrated with its top 5 holdings representing 28% of the weighting compared to 33% in XLV. VHT’s exposure to medium and small cap stocks represent 20.3% compared to 7.05% in just medium cap stocks in XLV.

This dynamic has led to higher returns for VHT over the past decade that has definitively outperformed XLV and in our view simply has a better strategy over the long term capturing the broader sector. Data shows that VHT is up 20.6% year to date in 2019, ahead of the 19.25% gain by XLV on a total return basis. Over the past 10 years the lead becomes more evident with VHT returning 306.2% compared to 284.5% for XLV.