By Oleum Research

- Despite higher natural gas demand, BOIL prices remain subdued, because of ample U.S. gas reserves and historic high production.

- Yet, hedge fund commitments improved over the week and bulls are back into the depressed natural gas market.

- The weather pattern is unsupportive in the short term, but by the end of the year, a strong cold wave should support the molecule and its proxy BOIL.

Thesis

Since our last take on the ProShares Ultra Bloomberg Natural Gas (BOIL), our bearish recommendation has materialized and BOIL declined 33.8% to $8.87 per share.

This steep decrease has been because of a confluence of factors, amongst which are high natural gas reserves and weaker-than-normal December temperatures.

Looking ahead, our view on BOIL has changed since our last publication, as Nymex front-month futures reached an important resistance level that woke up natural gas bullish speculative interest.

In this context, we are now reverting our view on BOIL and believe that the flammable commodity is oversold for this time of the year. While our recommendation might not emerge in the short term, given warmer-than-usual weather patterns expected for the Christmas week, by the start of January we are expecting Nymex front-month futures to edge higher.

Despite higher-than-average natural gas demand, oversupply keeps gas futures and BOIL shares under pressure

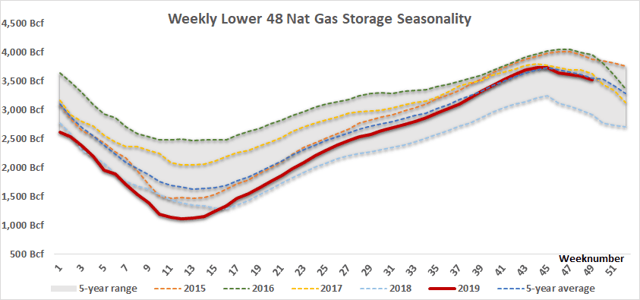

Since the beginning of the withdrawal season, demand for the flammable commodity has been restrained, even if the heating season began with intense cold. Yet, the gas storage picture is within normal levels, establishing slightly below the 5-year average, down 0.8% or 28.4 Bcf, but is in much better shape than last year, up 20.7% or 604 Bcf. Thus, Nymex gas futures are less likely to spike, given the absence of storage uncertainty this year.

Source: EIA, Oleum Research

Output continues to break record-highs. U.S. natural gas production advanced at a rapid pace over the year, as dry and marketed production lifted respectively, 8.6% (YoY) to 96.3 Bcf/d and 10.4% (YoY) to 109.4 Bcf/d.