After a loss of 6.59% in 2018, the S&P 500 is back with vengeance in 2019 as it sets to close out a record year. That said, cyclical equities have been strong performers, which could portend to strength in 2020 if caution is thrown out the window and a stronger-than-expected risk-on sentiment prevails in the new year.

“After a 23% gain for the S&P 500 in 2019, many investors are rightfully cautious about more upside for stocks in 2020,” wrote Wayne Duggan U.S. News & World Report. “However, Goldman Sachs analyst David Kostin recently said the recent outperformance of cyclical stocks relative to defensive stocks suggests the market is pricing in U.S. economic growth acceleration in 2020. Kostin says investors who want to improve their risk-reward profile heading into the end of the year can focus on stocks with high economic sensitivity and depressed valuations.”

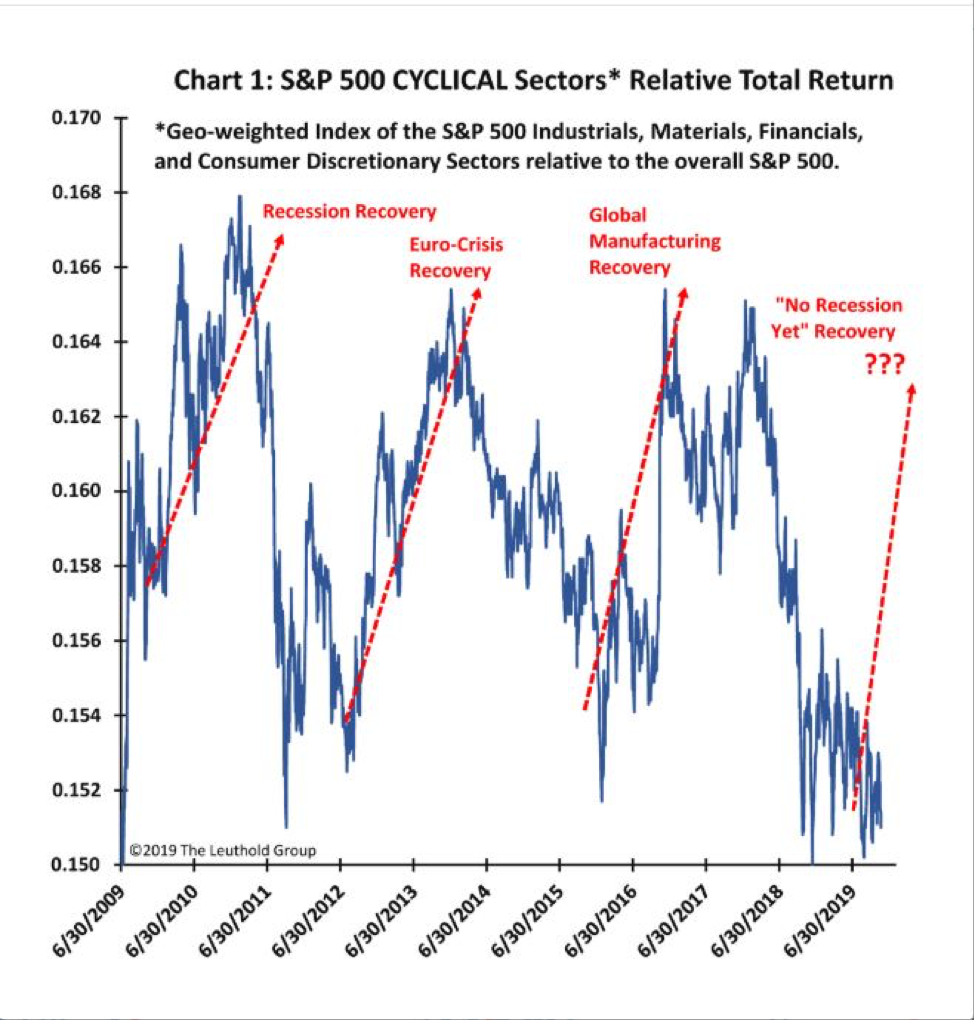

“Cyclical stocks can be difficult to buy,” said Jim Paulsen, chief market strategist at Leuthold Group. “You usually can’t wait until they show decent price momentum because, by then, their leadership is probably nearing an end.”

“Moreover, the best time to buy economically sensitive stocks is typically when their fundamentals (e.g., earnings or sales growth) are less than stellar,” he added. “Unlike growth stocks, if the fundamentals of a cyclical company are obviously great, it is usually a good time to sell. For similar reasons, conventional valuation gauges are also problematic. Often, the best time to tilt toward cyclicals is when fundamentals are questionable and, therefore, relative valuations are high.”

For investors looking for continued upside in U.S. cyclical sectors over defensive sectors, the Direxion MSCI Cyclicals Over Defensives ETF (NYSEArca: RWCD) offers them the ability to benefit not only from cyclical sectors potentially performing well, but from their outperformance compared to defensive sectors. The fund offers investors the ability to trade the macro trend as opposed to individual stocks that comprise cyclical equities.

RWCD seeks investment results that track the MSCI USA Cyclical Sectors – USA Defensive Sectors 150/50 Return Spread Index. The fund, under normal circumstances, invests at least 80% of its net assets in securities that comprise the Long Component of the index or shares of ETFs on the Long Component of the index. The index measures the performance of a portfolio that has 150% long exposure to the MSCI USA Cyclical Sectors Index and 50% short exposure to the MSCI USA Defensive Sectors Index.

For more market trends, visit ETF Trends.