A new study has revealed an evolving trend towards more extensive use of liquid alternative ETFs by institutional investors in specific situations.

In a study commissioned by IndexIQ, Greenwich Associates recently interviewed senior fund managers at large U.S. institutions to determine how those investment professionals are currently employing alternative asset classes and ETFs in their portfolios.

For more than 20 years, institutional investors have been adding alternative asset classes to their portfolios in an effort to diversify exposures and increase long-term investment returns, according to Andrew McCollum, Managing Director, Greenwich Associates.

“More recently, institutions have been adopting exchange-traded funds (ETFs) as a jack-of-all-trades tool that’s versatile enough to provide short-term liquidity for manager transitions and other tactical tasks, while also providing an effective vehicle for taking on long-term strategic investment exposures,” McCollum said. “The intersection of these trends could ultimately bring about a transformation of alternative investments in institutional portfolios.”

Greenwich Associates projects that institutional investments in liquid alternative ETFs will more than double in the next 12 months from $47 billion to $114 billion.

The study noted that nearly 20% of institutions not currently investing in liquid alternative ETFs say they will consider using them in the year ahead; Roughly 1 in 10 current investors plan to increase allocations to liquid alternative ETFs in the next year.

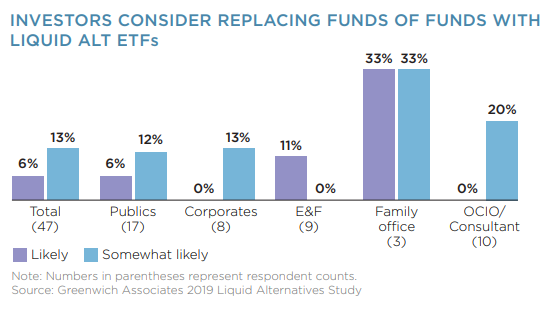

McCollum said this growth is driven by institutions’ use and interest in using liquid alt ETFs for a variety of tactical and strategic applications – such as transition management, core replacement, replacement for cash bonds, or strategic diversification – as well as interest in replacing fund-of-fund allocations.

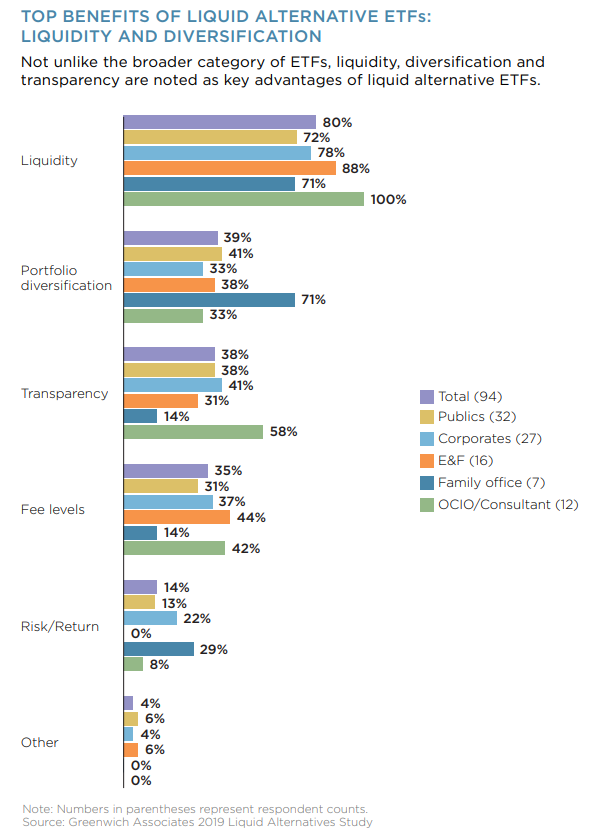

“Compared to their illiquid counterparts, liquid alt ETFs provide greater liquidity, transparency, diversification, and cost efficiency benefits,” he said. “The growth in liquid alt ETFs could even accelerate beyond these projections if asset managers intensify efforts to educate institutional investors about the benefits and potential applications.”

Other key takeaways from the study include relatively low costs, liquidity, transparency and diversification are cited as the main benefits of liquid alternative ETFs. Among the main implementation cases, transition management, fund of funds replacement and core allocations are cited as the most common uses for liquid alternative ETFs.

Greenwich Associates suggests that liquid alternative ETFs, while still in their very early stages in the institutional marketplace, are projected to follow a similar trajectory of adoption as ETFs and liquid alternatives and are poised for long-term growth within institutional portfolios.

McCollum said the report will help other institutional investors – as well as sophisticated financial advisors – better understand how their peers are using liquid alt ETFs in their portfolios.

“Greenwich Associates has been tracking institutional use of ETFs for the past decade,” he said. “During this time, we have seen institutions embrace (first) equity and (later) fixed income ETFs for a variety of applications. The adoption pattern we observe with liquid alt ETFs is very similar to what we saw in these other asset classes. As a result, it is very possible that liquid alt ETFs are still in the very early stages of adoption in institutional portfolios with more growth on the horizon.”

To learn more about the growth of liquid alternative ETFs within the institutional space, download the full Greenwich Associates Institutional Liquid Alt ETF report.