In Direxion Investments’ latest Relative Weight Spotlight, investors looked to add more international exposure as ETFs from abroad took in more capital in the month of October. Additionally, value and cyclical sectors were also strong performers.

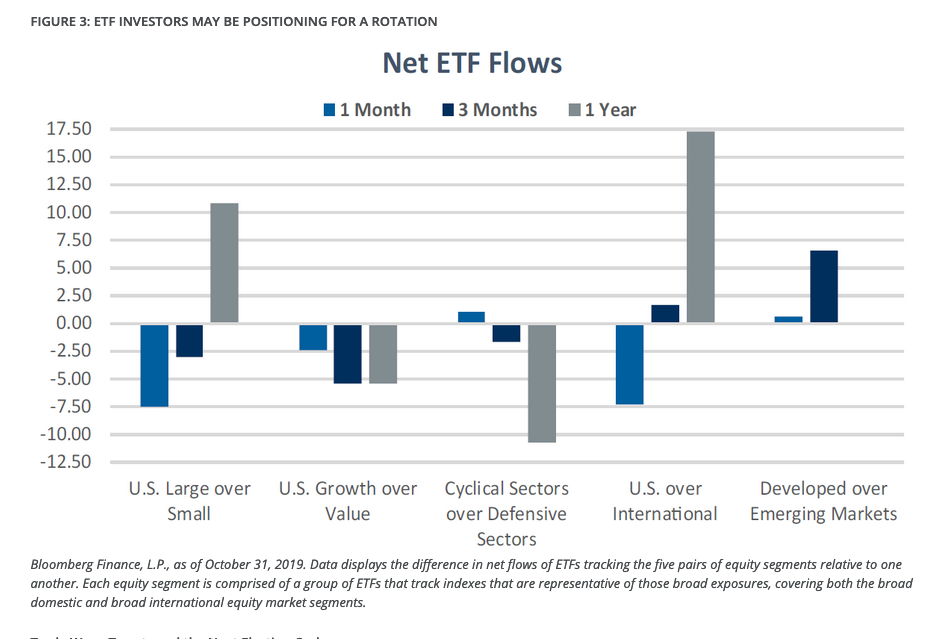

“Notably, ETF investors continue to play defense in the aggregate as fixed income ETFs continue to take in the lion’s share of flows compared to equity ETFs,” the post said. “However, they are showing some signs of positioning for a reversal. For example, after outperforming for two months, investors added more capital to international developed markets compared to U.S. exposures. Specifically, internationally-focused ETFs took in $2.16 billion last month, while investors redeemed $5.13 billion from U.S. ETFs.”

If investors believe that international markets will outperform U.S. domestic markets, the Direxion FTSE International Over US ETF (NYSEArca: RWIU) provides a means to not only see international markets perform well, but a way to capitalize on their outperformance compared to the U.S. markets.

Direxion also noted a shift back to value in the ongoing growth versus value battle, as well as more interest in cyclical sectors.

“While growth reasserted its dominance over value last month from a performance perspective, value ETFs took in $2.42 billion more than growth ETFs last month alone, bringing the difference over the last three months to $5.38 billion,” the post added.

“Another potential sign of reversal toward reflationary assets is that cyclical sector ETFs had $1.08 billion greater inflows than defensive sectors, which contrasts with the $10.78 billion in favor of defensives over the last twelve months.”

For investors looking for continued upside in U.S. cyclical sectors over defensive sectors, the Direxion MSCI Cyclicals Over Defensives ETF (NYSEArca: RWCD) offers them the ability to benefit not only from cyclical sectors potentially performing well, but from their outperformance compared to defensive sectors.

Whichever camp an investor’s confirmation bias happens to be at the time of analysis, he or she can play the Direxion Russell 1000 Growth Over Value ETF (NYSEArca: RWGV) and the Direxion Russell 1000 Value Over Growth ETF (NYSEArca: RWVG). For investors looking for continued upside in growth-oriented equities over value-oriented equities, RWGV offers them the ability to benefit not only from growth opportunities potentially performing well, but from their outperformance compared to value.

Conversely, if investors believe that value-oriented equities will outperform growth-oriented equities, RWVG provides a means to not only see value opportunities perform well, but as a way to capitalize on their outperformance compared to growth.

For more relative market trends, visit our Relative Value Channel.